Value added tax (VAT) - Matches

Showing 1-7 of 7 items.

Proposals to reform the personal income tax have gained prominence in recent months. To date, personal income tax reform is part and parcel of the pla..

Discussion Papers

Amid rising international crude oil prices that have once again breached the US$100 per barrel mark and sparked calls for a return to government regul..

Policy Notes

With the increase in the VAT rate from 10 to 12 percent effective February 1, 2006 as well as the expansion in the coverage of the VAT-able sectors un..

Economic Issue of the Day

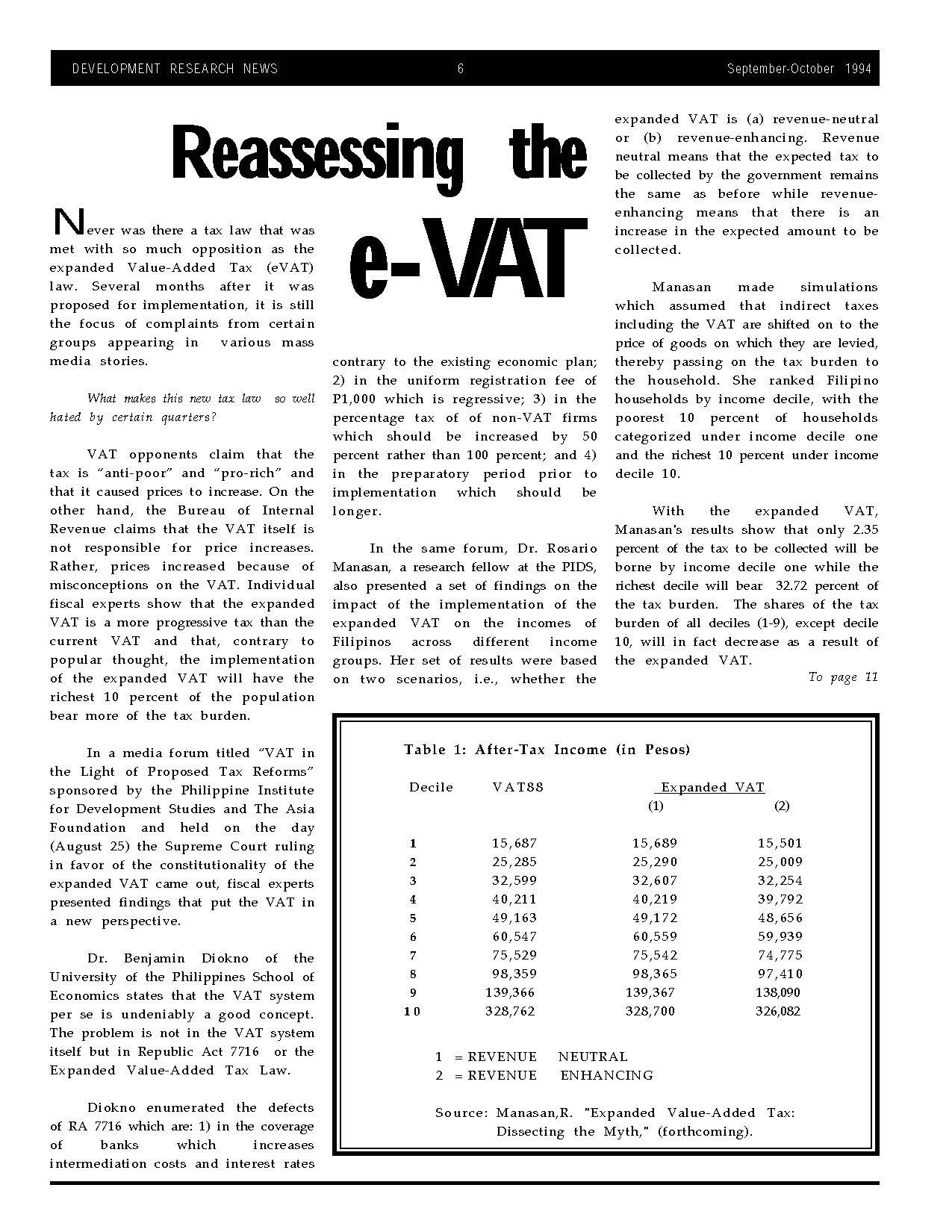

In this article, the author outlines the coverage and structure of the Philippines' value-added tax (VAT) on goods and services and discusses the prob..

Philippine Journal of Development

Various indicators (e.g., VAT-to-GNP ratio, VAT evasion rate) suggest that problems in VAT administration have not only persisted during the 1990s but..

Discussion Papers

One of the ways to improve the administration of the value added tax (VAT) in the Philippines is through the development of industry standards against..

Policy Notes

Showing 1-7 of 7 items.