MANILA, Philippines—The numbers leave no doubt that President Rodrigo Duterte will step down with a record amount of debt but uncertainty hovers over how his successor would be able to repay.

One thing is sure, though. The administration that would succeed Duterte’s when he is gone in 2022 would have to “progressively” increase government capacity to pay the mind-boggling amount of debt incurred by the outgoing president.

This was stressed by the non-profit research group Ibon Foundation as the government debt—largely incurred to pay off COVID expenses—was expected to reach P13.42 trillion by end of 2022 from P11.73 trillion this year.

Set aside questions about whether the borrowed money was spent wisely, but to get a picture of how enormous the amount is, imagine this: A trillion is 1 followed by 12 zeroes. Multiply it by more than 13.

The Philippine debt picture changed drastically through the years. It took 118 years for the country to raise its debt from P20 million in 1898 to P6.1 trillion in 2016, the year Duterte was elected as president. It will take just six years to escalate the debt burden from P6.1 trillion in 2016 to P13.42 trillion in 2022.

Finance officials continued to express confidence that the country would be able to weather the debt challenge because debt-to-GDP ratio would remain in the 60 percent range, which meant debt won’t be out of control.

But Ibon Foundation’s Sonny Africa told INQUIRER.net that as the country faces the gargantuan task of paying off trillions of pesos in debt, the next administration should consider “taxing the rich.”

Why the rich?

Africa said the next president should revise the current administration’s tax-generating methods which “increase reliance on consumption taxes.”

Consumption taxes are those “paid directly or indirectly by consumers” through sales of goods and services—taxes which are “at the expense of poor and low-income Filipinos.”

“Since governments inherited debt from previous administrations, they had to generate revenues. The bad policy choice, however, was they were generating revenues by taxing the poor,” he said.

Africa stressed that the tax collection system skewed against the poor is reflected by two very recent laws—Tax Reform for Acceleration and Inclusion (Train) Act and Corporate Recovery and Tax Incentives for Enterprises (Create) Act.

The tax policy mirrors reliance on indirect consumption taxes which burden the poor while reducing taxes for rich and big corporations, Africa said.

The Train law reduced personal income and estate taxes but experts said it led to increase in the costs of oil, electricity and beverages which has a deleterious impact on the poor.

The Create law reformed corporate income tax and incentives and reduced corporate tax rate from 30 to 25 percent.

But Ibon Foundation said its studies showed that the Create law would lead to P251 billion in foregone revenue—P133.2 billion in 2020 and P117.6 billion in 2021—which could have been spent on a stronger COVID response.

“It is beneficial to increase revenues by taxing billionaires and large corporations because it eases the tax burden on the poor,” Africa said.

Inequality

Africa, executive director of Ibon Foundation, said it was clear that when the share of immense corporations in government finances is reduced, the consumption taxes increase.

According to data from the Bureau of Internal Revenue (BIR), corporate taxes had a 3.5 percent Gross Domestic Product (GDP) share in 2008. It declined to 3 percent in 2019 and 2.8 percent in 2020.

Consumption taxes, including Value Added Tax (VAT) and excise, increased to 3.7 percent in 2019 and 3.6 percent in 2020—higher than the 2.5 percent in 2008.

Africa said the 2017 Train law collected P197.3 billion from oil excise from 2019 to 2020. However, the government lost P14.5 billion as the law lessened estate and donor taxes.

According to Ibon Foundation’s computations, the government, from 2021 to 2023, was expected to lose P372 billion in revenues as the Create law reduces corporate income taxes.

The government will also lose P5.85 billion because of exemptions from VAT, Documentary Stamp Tax and Creditable Withholding Tax through the Financial Institutions and Strategic Transfer (Fist) Act.

Africa said these showed a “disproportionate burden on the poor and a needless gain for the rich, especially in the midst of the COVID-19 crisis.”

Poor and COVID-19

“The principle of generating revenues should be focused on those who have the capacity. Don’t charge the poor who can’t clearly afford it,” he said.

He said the next president should implement a “progressive tax system” as it would be beneficial since it could be used to pay debt while easing the hardship of poor and low-income Filipinos.

Africa said the government should not burden the poor, especially in the midst of the COVID-19 crisis and the reality that there are “extreme income inequalities” and most Filipinos are without savings.

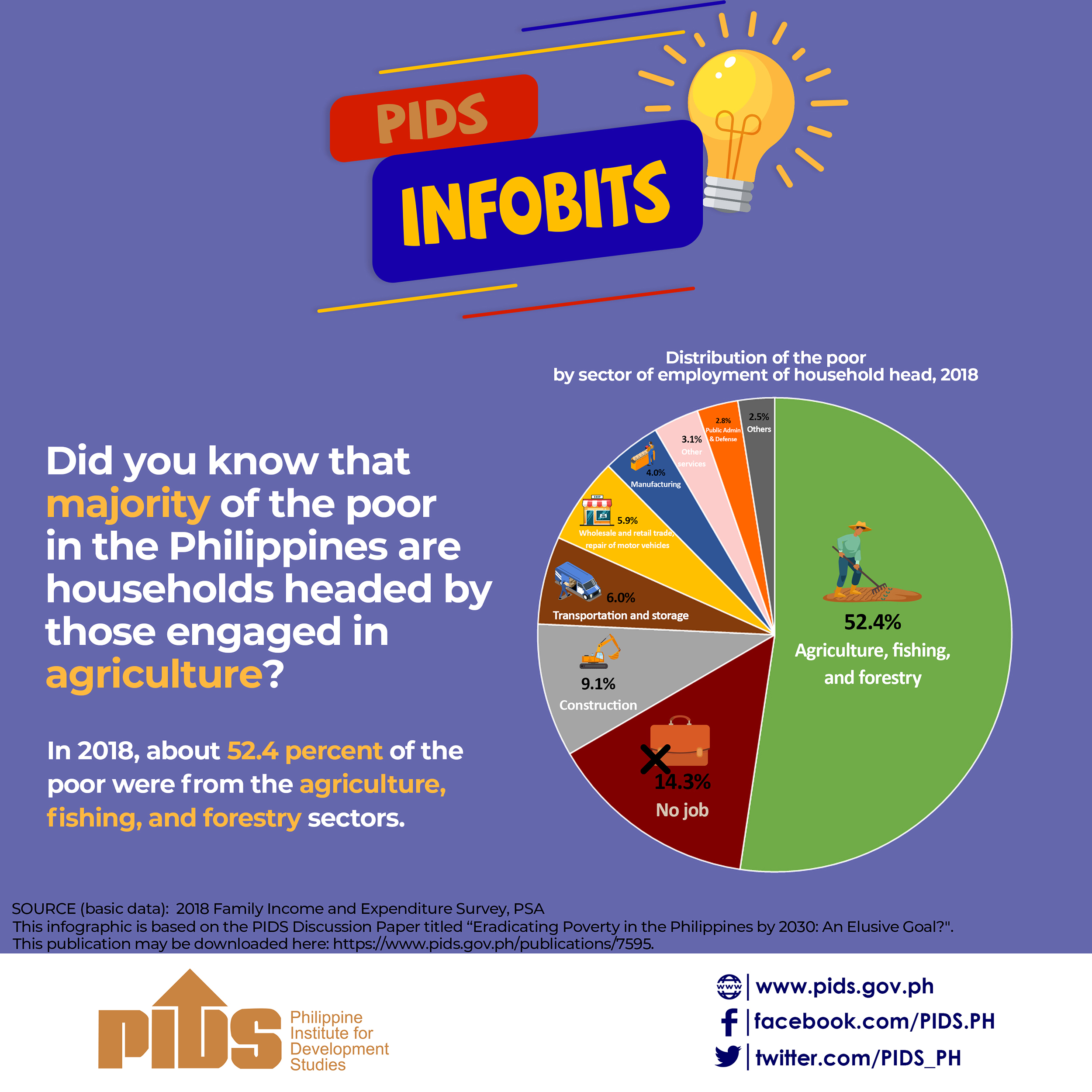

Ibon Foundation, citing data from the Philippine Institute for Development Studies, Philippine Statistics Authority and the BIR, said out of 25 million Filipino families, only 0.6 percent had a monthly income of P219,000 to P10 million.

0.6 percent (143,000 families): P219,000 to P10 million

1.5 percent (358,000 families): P131,000 to P219,000

18.2 percent (4.3 million families): P44,000 to P131,000

32.1 percent (7.6 million families): P22,000 to P44,000

35.4 percent (8.4 million families): P11,000 to P22,000

12.2 percent (2.9 million families): P11,000 and below

It also said that from 2020 to 2021, P13,000 to P32,500 in incomes were lost by the poor while 15.5 million families went hungry in 2020.

“With most Filipinos having little or no assets to speak of, who do you tax?” said Africa.

Data from the Bangko Sentral ng Pilipinas showed that in the third quarter of 2021, 74.8 percent of Filipino households have no savings while only 9.7 percent have deposit accounts.

This is far from the state of the wealthy in the Philippines. Based on data from Forbes and Credit Suisse Global Wealth Databank, 2,919 upper class families had a combined net worth of P8.04 trillion.

The richest two percent, Forbes and Credit Suisse said, have a combined net worth of P20 to P25 trillion which is equal to 40 percent of wealth in the Philippines and the combined wealth of the poorest 80 percent.

Africa said if the government’s way to generate revenues will continue to rely on consumption taxes, the poor, who continued to reel from the COVID-19 catastrophe, will be the ones to pay most of the taxes which will be used to pay the debt.

“For us, that’s not right in a time of crisis,” Africa said, stressing the need for the next president to change the government’s way of generating revenues.

As Duterte leaves with record PH debt, question raised: Will poor pay for it?