THE CENTRAL BANK is using a sandbox approach to support the growth of digital financial players in the “new normal” amid the coronavirus pandemic, said Bangko Sentral ng Pilipinas (BSP) Assistant Governor Iluminada T. Sicat.

“The BSP is approaching the digital transformation initiative through a sandbox approach or the test and run approach where we adopt a flexible, open and enabling regulatory stance rather than stifling potential, supporting our advocacies for a secure, robust, resilient and more inclusive financial system,” Ms. Sicat said in an online forum hosted by the Philippine Institute of Development Studies.

Ms. Sicat said the BSP’s digital drive is focusing on infrastructure, digital ID, open banking as well as digital skills as they believe consumers will lean more towards online transactions amid the pandemic.

She cited data from the BSP Center for Learning and Inclusion Advocacy which showed ATM or automated teller machine transactions posted a 24% decline in volume and a 13% drop in value during the 76 days of lockdown from March to May. Likewise, she said check transactions slumped 67% by volume and by 62% by value.

Another area set to gain traction in terms of digitization is QR Ph, as Ms. Sicat said 12 more BSP-supervised financial institutions will launch the payment facility this year, aside from the 16 already using it.

The official noted there has been a surge in transactions made through the E-Gov Pay Facility, as these increased 618% and 799% in June 2020 compared to when it launched in November 2019.

The Bureau of Internal Revenue saw the most transactions made through the facility, followed by the Philippine National Police, the Environment Management Bureau and the Overseas Workers Welfare Administration, Ms. Sicat said.

“The surge in E-Gov Pay transactions reflect deepening public awareness of this digital facility as a safe and efficient means of payment for taxes, licenses, permits, and other obligations to the government,” she said.

“Without the vaccine, we expect the increasing trend in digital transfer transactions to continue even as lockdown measures ease,” she said.

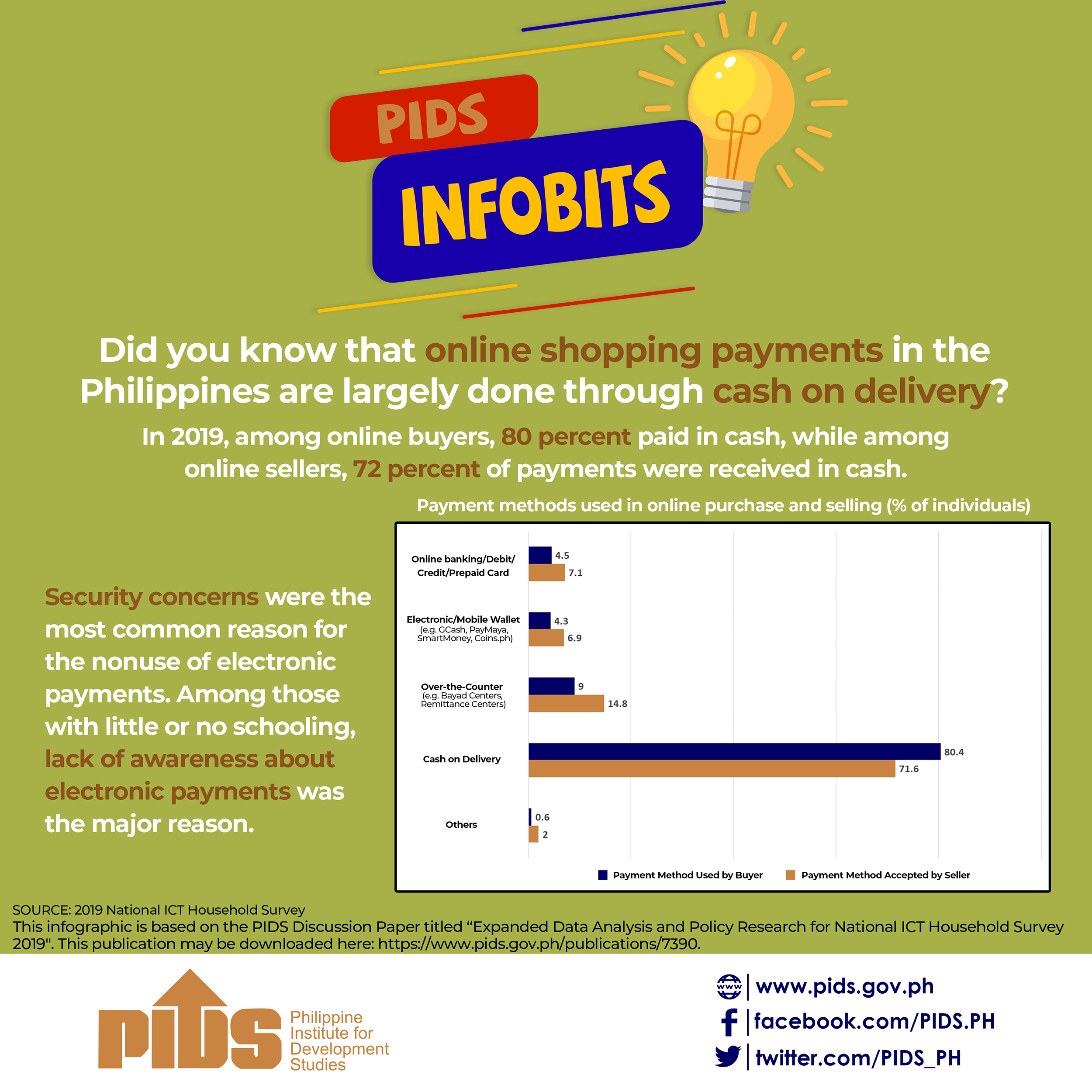

The volume of e-payments increased to comprise 10% of total transactions in 2018 from just 1% in 2013, according to a United Nations-based Better than Cash Alliance report. By value, digital transactions also rose to make up 20% of the total from the 8% in 2013.

The central bank targets to have 50% of transactions done digitally by 2023.

BSP uses sandbox approach to boost electronic payments