Wise, a global digital payments app, introduced the more accessible Philippine Peso Account Details amid the growing number of freelance workers in the country.

The app now allows users to receive compensations and other payments in Philippine peso without service fees and traditional bank accounts.

“At Wise, we are constantly evolving to meet the needs of our Filipino customers. We believe these added capabilities will help users to seamlessly manage their finances and enjoy a convenient payment experience,” Wise Philippines country manager Areson Cuevas said.

Wise, which entered the Philippine market in May 2024, allows users to receive funds denominated in over 40 currencies and link them to bank and card accounts and e-wallets GCash and Maya using InstaPay, a fast electronic payment system monitored by the Bangko Sentral ng Pilipinas.

Freelancers jump 208%

According to the Philippine Institute for Development Studies, firms employing Filipino freelancers registered a 208 growth in revenues from 2018 to 2020.

Researchers said growth drivers included Filipinos’ desire for flexible working hours and work place and wider access to the internet and digital tools.

Freelancers are part of the gig economy who perform task-based or project-based work.

Pangasinan Representative Christopher de Venecia, the author of the Freelance Workers Protection Act bill, said at least 1.5 million Filipinos engage in freelance work.

Business Research Company projects global freelance revenues to grow by nearly 17 percent to $13.92 billion by 2028 from $6.46 billion in 2023.

Using the Wise Card, Filipinos can shop in over 160 countries at mid-market exchange rates.

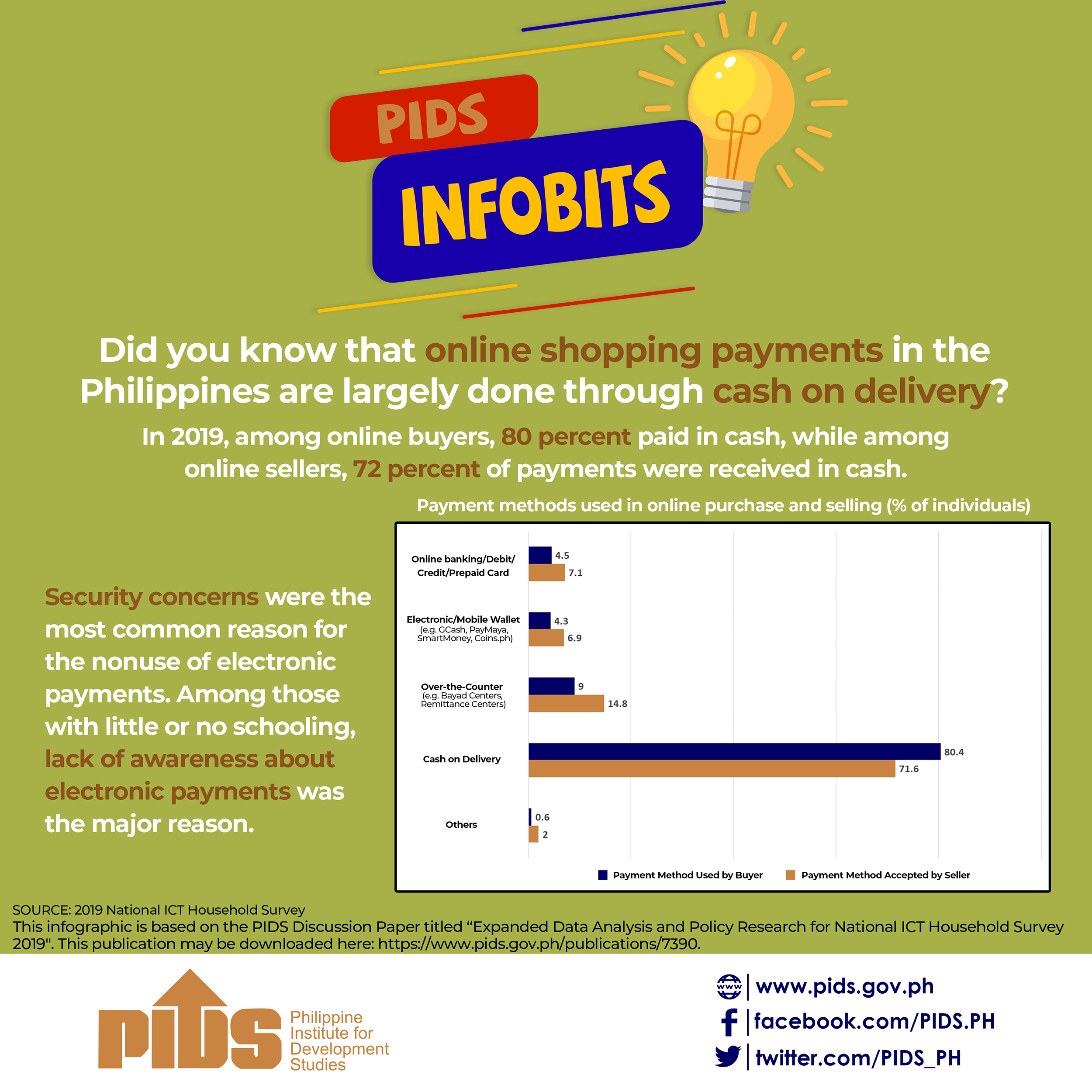

The technology firm shared that nearly 75 percent of Filipinos had been seeking lower services fees and faster transactions for global payments.

Wise reported it expanded its client base to 2.8 million individuals and businesses last year and posted 118.5 billion pounds in cross-border transactions and enabled 1.8 billion pounds in customer savings.