IN a recently published paper, the Philippine Institute of Development Studies (PIDS) emphasized the need for the Philippines to pursue a multi-pronged strategy to boost the country's middle class, in line with the long-term goals codified in the AmBisyon Natin 2040 25-year development plan. The focus on the Philippines' growing middle class is sensible, as the country has an aspiration to become an upper-middle-income economy, something that Finance Secretary Ralph Recto has recently said might even be possible within the next year or two.

To strengthen the middle class, the PIDS research focuses on familiar broad priorities, such as promoting social justice, maximizing trade and investments, ensuring a future-ready workforce, and improving digital governance and public service delivery. These are entirely valid objectives and are made no less so by being repeated by policymakers ad infinitum if that is what it takes to keep everyone on a mission to boost the productivity and prosperity of the country. However, these platitudes, even if actualized into real policy and programs, overlook a unique vulnerability of the middle class, which must be addressed.

As in any developing economy, the focus of socioeconomic policy in the Philippines has quite appropriately been on "lifting people out of poverty" through developing various social safety nets; the Department of Social Welfare and Development's (DSWD) Ayuda para sa Kapos ang Kita Program, or AKAP, that we discussed in Tuesday's editorial is a recent example. Others include the expansion of low-income housing and the Universal Health Care (UHC) law. Over the past decade, and particularly in the past couple of years as the country has strived to recover from the Covid-19 pandemic, there has been impressive progress, although there is still much work to be done in eliminating poverty.

Once people are lifted out of low-income status, however, the safety nets disappear, as it is assumed that they have sufficient income to meet their own basic needs. And this is indeed the case for most middle-class households, provided they are not faced with a personal calamity, which could come in the form of an unexpected job loss, a serious medical issue, or even a literal disaster such as a flood or fire that destroys their home.

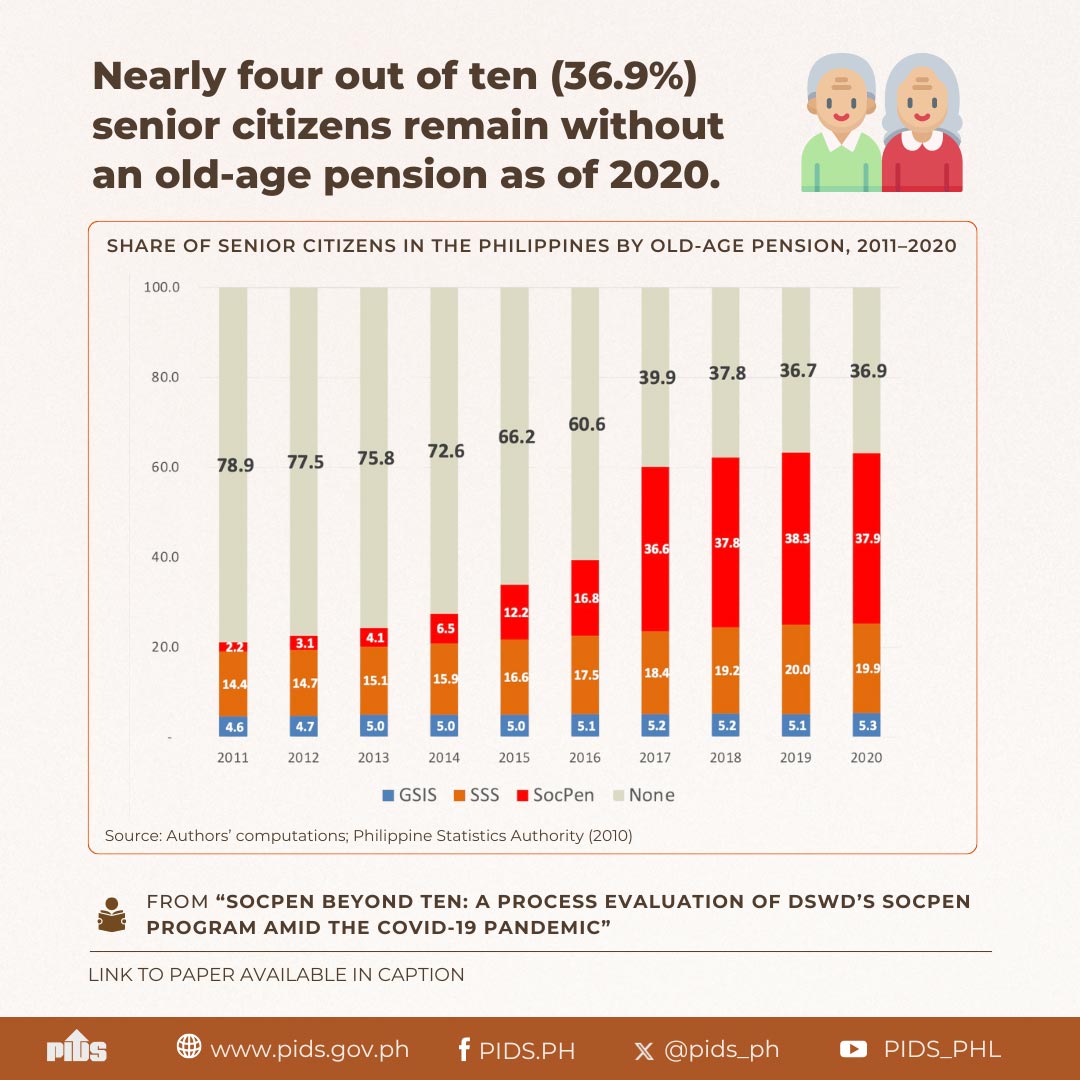

Under the UHC, for example, while most medical expenses are covered by PhilHealth, a significant percentage are not for people whose income level indicates capacity to pay. Even though that percentage may be modest on paper, the costs of a serious illness or injury can add up quickly. Likewise, even retirement, despite being something that can be anticipated, may be calamitous for a middle-class household due to the sharp reduction in monthly income benefits from SSS or GSIS represented for almost everyone.

If the government is serious about building a resilient and sustainable middle class, it will have to account for the need for appropriate safety nets for middle-class families. These are not the same as social nets for impoverished and lower-income citizens, which is a benefit to the government in one sense because middle-class support does not necessarily require significant spending on the government's part but is quite challenging in another respect because it will require private sector participation.

The objective must be to help middle-class households maximize and secure financial status with the resources they have worked hard to earn. Encouraging the expansion of the insurance market is the first step toward this. Examples of what is needed include more accessible and more affordable health insurance, either to supplement UHC coverage or as an alternative to it; expanded unemployment insurance; and more insurance options against property loss.

The second critical need is, on the one hand, expansion and significant improvement of financial literacy education, something that should begin in primary school, and on the other, more access to retirement savings and investment products. One should not have strived for his or her working life to achieve a comfortable and dignified financial status only to be consigned to a lower-class existence by wholly inadequate retirement benefits provided by SSS or GSIS. Giving people choices to make the most of their own resources and teaching them how to make those choices for their own best interests is how you build a middle class and move the entire country beyond the realm of "developing" economies.