Let local government units (LGUs) achieve fiscal and local autonomy and give them their just share to ensure fiscal viability.

League of Provinces of the Philippines (LPP) Executive Director Sandra Tablan-Paredes emphasized this at a webinar recently organized by the Philippine Institute for Development Studies (PIDS) and the House of Representatives–Congressional Policy and Budget Research Department that featured a PIDS study on LGU fiscal viability.

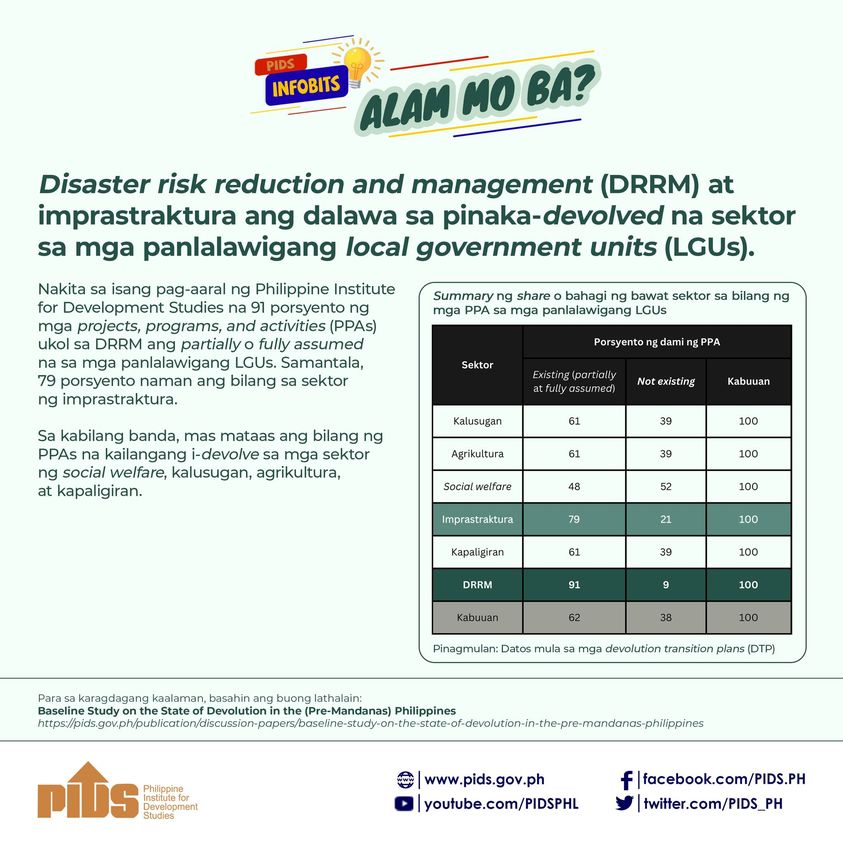

With the implementation of the Mandanas ruling this year, LGUs will receive increased intergovernmental fiscal transfers to deliver devolved basic goods and services to the public.

Tablan-Paredes, a discussant at the webinar, said that the PIDS study highlighted the dependency of provinces and municipalities on the internal revenue allotment and the need to raise local revenues.

“If LGUs are not fiscally viable to deliver basic services, it defeats the very purpose of being an LGU,” she said.

Tablan-Paredes added that there is a need to increase the income requirement for LGU conversion to a higher level. She also mentioned that the LPP and the League of Cities of the Philippines believe it is important to update the LGUs’ income classification first before creating new provinces and cities.

“[We] asked a moratorium for the creation [of new provinces and cities] because it impacts the fiscal viability of existing LGUs,” she said.

Meanwhile, on the PIDS study’s recommendation to encourage amalgamation across LGUs to improve their service delivery, Tablan-Paredes pointed out that “political realities” and lack of “political will” hinder the government from pursuing this. Other challenges she identified include legal limitations given that the 1987 Constitution provides for multi-tier levels of LGUs, the need to strengthen Regional Development Councils and the supervisory powers of provinces, and implement the Universal Health Care Law with its corresponding resource requirements.

Tablan-Paredes provided recommendations to improve the fiscal viability of LGUs.

One is for Congress to revise and update the minimum requirements for converting LGUs to a higher level based on their current revenues by amending the Local Government Code (LGC) of 1991.

She also urged the Department of Finance to update the income classification of provinces, cities, and municipalities pursuant to Executive Order 249, Administrative Order 270, and the Implementing Rules and Regulations of the LGC.

On the part of the LGUs, the LPP executive director shared some of their initiatives to raise local revenues. These include simplifying the structure of local business taxation, improving tax collection efficiency through technology, and updating the schedule of market values for real property.

Lastly, Tablan-Paredes emphasized that there is no “one-size-fits-all” approach in dealing with LGUs.

“Different LGUs have varying circumstances and their own prevailing conditions. They know what is best. They are the frontliners. They are the ones who should be left to make the proper decisions,” she concluded. ###

You may watch the webinar at https://fb.watch/bwgt104QGI/ or https://youtu.be/jMAKYzPcV1g.

For more videos of PIDS events, go to https://www.pids.gov.ph/videos.