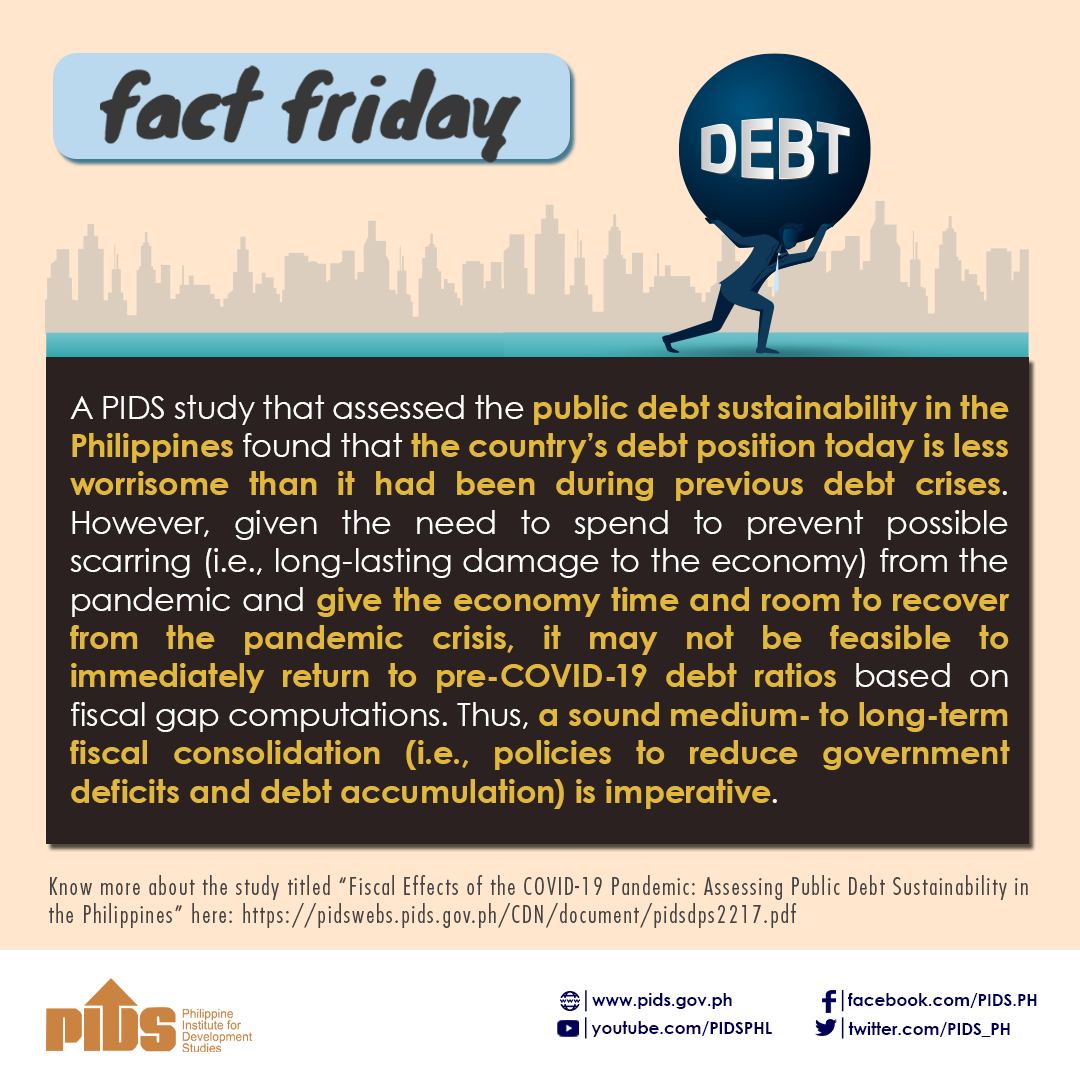

MANILA, Philippines — The government’s rising debt pile is still tolerable in proportion to the country’s growth level, state-run think tank Philippine Institute for Development Studies (PIDS) said.

In a briefing yesterday, PIDS research fellows noted that the sustained focus on the improvement of infrastructure and social programs would boost the economy and strengthen the government’s payments capacity for these loans.

The Department of Budget and Management (DBM) reported that national government debt is expected to reach P7.85 trillion by the end of 2019 and P8.77 trillion by the end of 2020 as the government spends aggressively for infrastructure and social programs.

“Since we are growing at five percent to six percent, I think we can tolerate increases in government debt,” said PIDS senior research fellow Roehlano Briones. “I think economic managers are keeping it within reasonable limits.”

The Department of Finance has said the government would remain prudent in its borrowing plans moving forward and is committed to cap the fiscal deficit at 3.2 percent of gross domestic product (GDP) from 2019 to 2022.

The government has also committed to borrow funds for projects that have a higher rate of return than the actual borrowing cost.

The country’s debt-to-GDP ratio can be expected to remain at around 41 percent by the end of the year.

PIDS president Celia Reyes said the country continues to need a lot of resources to address infrastructure woes that is preventing the country from meeting its economic growth potential.

“What’s also important is how this debt is being used. We actually need a lot of resources to be able to participate in global value chains, to take part in this new globalization,” she said.

“The fact that the government is focusing on infrastructure, we expect that this would generate revenues that would allow us to pay these loans,” she added.

PIDS yesterday held a forum with the theme “Navigating the New Globalization: Local Actions for Global Challenges” that touched on external challenges faced by the country such as rising protectionism, worsening inequality trends and trade wars.

During the forum, resource persons maintained that there is a need to address weaknesses in market access via market and product diversification and the removal of uncertainties in the business environment so the country can attract more foreign direct investments.

They also pointed out the need to pass the Corporate Income Tax and Incentive Rationalization Act (CITIRA) Bill to eliminate uncertainties in the business environment so the country can at least attract more investments even if it cannot match the competitiveness of some of its ASEAN neighbors such as Vietnam and Thailand.