The House Special Committee on Senior Citizens on Tuesday, Sept. 21, approved in principle a bill that would grant senior citizens an exemption from income taxes.

House Bill No. 8832, filed by Senior Citizens’ Party List Representative Rodolfo Ordanes, seeks to further amend the country’s National Internal Revenue Code to exempt persons aged 60 years old and above, who are still working, from the imposition of income tax.

Ordanes also sought to exempt any holiday pay, overtime pay, night shift differential and hazard pay received by senior citizens from the tax.

But during the committee’s hearing, the Bureau of Internal Revenue (BIR) said it cannot support the bill for failing to identify new sources of funds to offset revenue losses resulting from the tax exemption.

“Unless legislation provides for new sources of revenue, it is the policy of the bureau not to encourage legislation that provide additional exemptions, incentives or tax holidays to existing tax payers as they diminish the revenue that national government would have collected,” said lawyer Mary Gretchen Mondragon of the BIR’s law and legislative division.

Aside from the alternative fund source, Mondragon also noted the absence of an income ceiling that would qualify beneficiaries of the proposal. There should be a threshold specifying the income that would be exempt from income tax, she said.

The BIR officer suggested that the threshold be set at minimum wage, so that indigent senior citizens will benefit from the bill.

Mondragon also raised that lawmakers can instead provide the tax incentives to companies to encourage them to hire senior citizens.

“We cannot support the tax exemption per se, but we probably can support the additional deduction provided to companies that will provide employment opportunities to senior citizens,” she told the House panel.

The Philippine Institute for Development Studies (PIDS) also said that granting tax exemption to all senior citizens might violate the principle of “neutrality” in taxation. The research body also noted that existing laws already provide tax exemptions to low-income earners, including low-income senior citizens.

Tax exemption, the PIDS added, does not also guarantee greater savings as Ordanes expected in his bill.

Senior citizens representatives, on the other hand, backed HB No. 8832.

“The seniors have already paid their dues to society and to entire world, so at this time, whatever little income we will earn, should already be exempted from income taxes,” said Philippine Association of Retired Persons (PARP) president Mafeo Vibal.

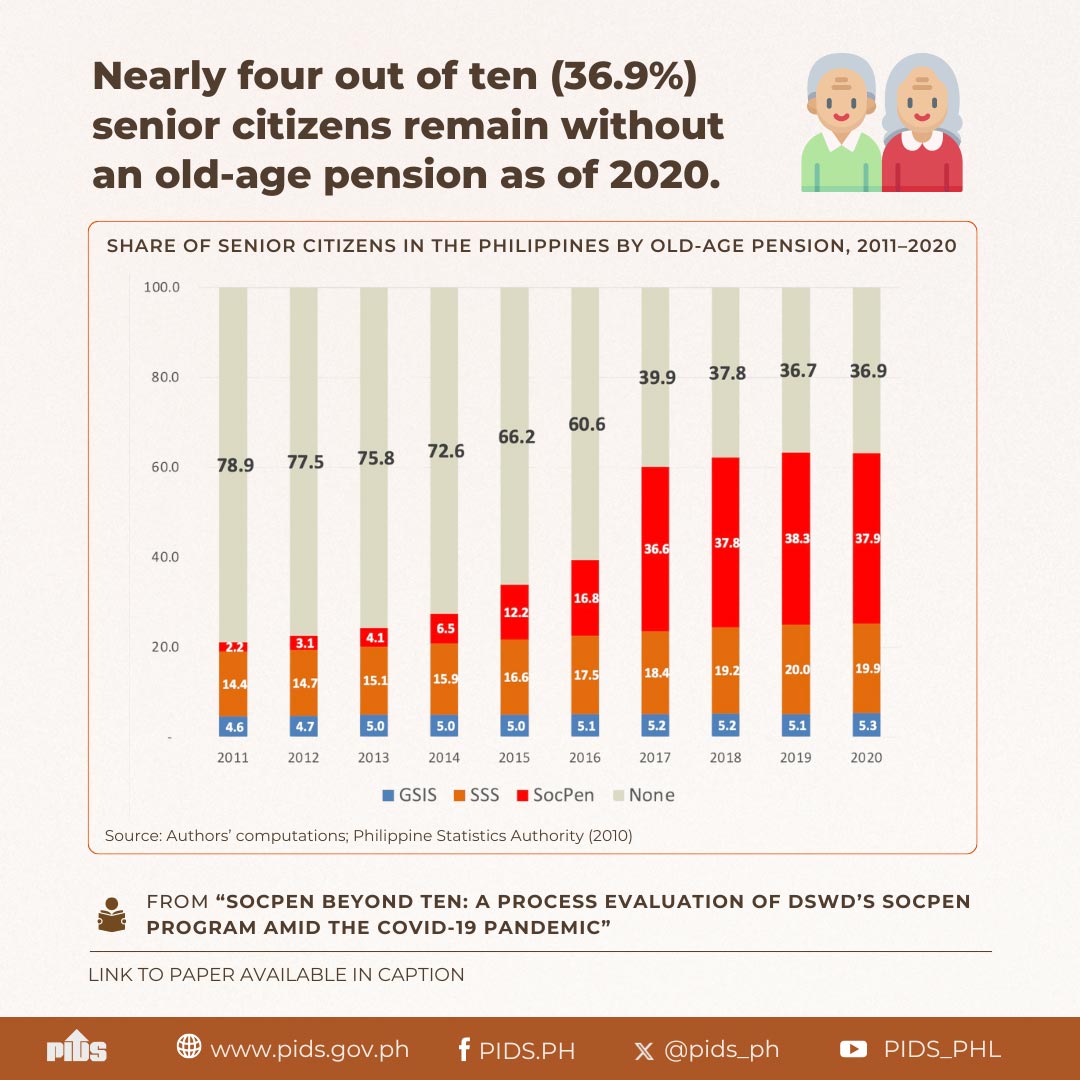

National Anti-Poverty Commission (NAPC) also noted that while some senior citizens “were fortunate enough to receive the fruit of their labors,” thru social pension and other benefits, others “continue to suffer not because they were not persistent, but due to reasons of prioritization during their younger years, including supporting their families.”

The NAPC supported the BIR’s suggestion to set a threshold for the income tax exemption as “it will help the less fortunate in the community.”

The panel will prepare an amended bill to be referred to the House Committee on Ways and Means for further deliberation or revisions.

House panel OKs income tax exemption for senior citizens