LOCAL governments are expected to receive almost a trillion pesos next year as their share of national government's tax revenues.

The Department of Budget and Management (DBM) said that the national tax allotment (NTA) share for local governments is calculated at P959.04 billion as a result of the Mandanas-Garcia ruling which jacked up their budget allocation from what was previously known as internal revenue allotment (IRA).

The amount is P263.54 billion or 37.89 percent more than what LGUs got from this year's IRA.

The Supreme Court has ruled that a local government's "fair share" of income includes all national government taxes, not only those collected by the Bureau of Internal Revenue.

The ruling was named after Batangas Gov. Hermilando Mandanas and Bataan Gov. Enrique Garcia Jr. who were the principal petitioners in the landmark case filed in 2012.

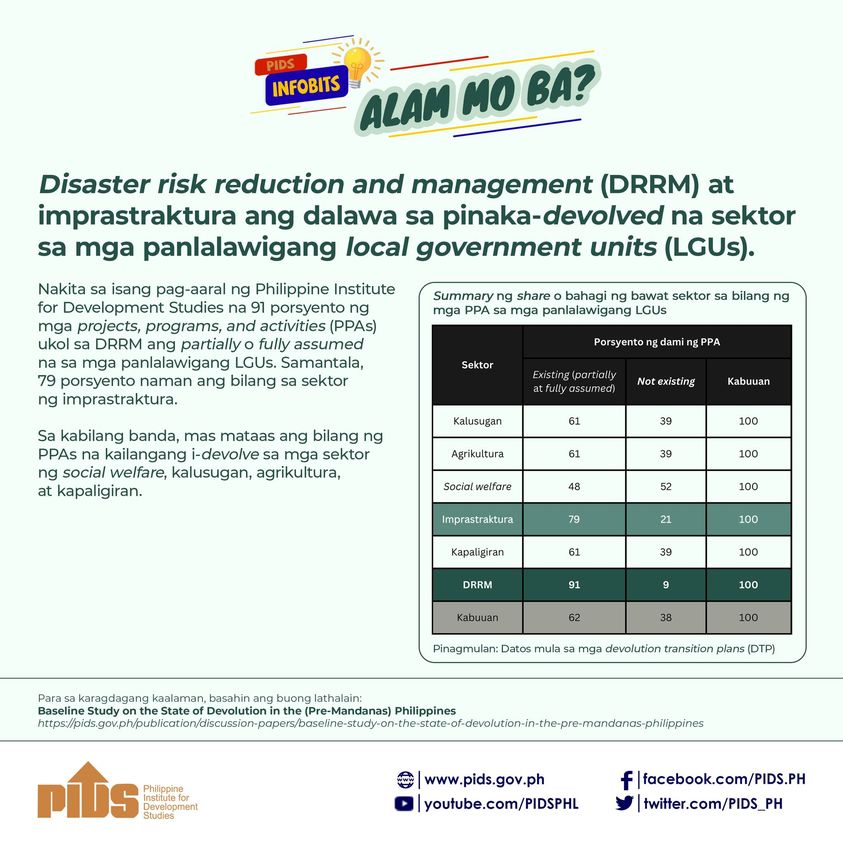

The Mandanas-Garcia ruling was discussed in a paper published by the Philippine Institute for Development Studies (PIDS) authored by Rosario Manasan.

The petitioners argued that certain collections of national internal revenue taxes (NIRTs) by the Bureau of Customs (BoC) — excise taxes, value added taxes, and documentary stamp taxes — have not been included in the base amounts for the computation of the IRA, but that said taxes, even if collected by the BoC, are in fact NIRTs and should thus rightfully form part of the base amount for the computation of the IRA.

Garcia argued that the exclusion of certain taxes and accounts pursuant to or in accordance with special laws was likewise unconstitutional, Mandanas said.

Development projects

According to the Budget department, the NTA will provide funding to 43,649 municipalities. Of the total, 82 provinces will receive P220.57 billion, 146 cities will secure P220.57 billion, 1,488 municipalities will get P326.07 billion, and 41,933 villages, P191.80 billion.

Local governments, on the other hand, were reminded to set aside at least 20 percent of their NTA allocation for development projects.

"Local budget plans and goals shall, as far as practicable, be harmonized with national development plans, goals, and strategies to optimize the utilization of resources, and to avoid duplication in the use of fiscal and physical resources," the DBM noted.

Local governments were also advised to continue to cover Covid-19-related initiatives, programs, projects and activities (PPAs) as needed.

"The Covid-19-related PPAs and expenses that may be funded by the LGUs (local government units) may include those that are related to the prevention of the spread of Covid-19, provision of basic services to the affected population, necessary support to frontline workers, procurement and administration of Covid-19 vaccines, and ancillary supplies and services, subject to the provisions of the Covid-19 Vaccination Program Act of 2021 (Republic Act 11525), and other PPAs related to Covid-19 response and recovery measures," the Budget department stressed.

The PIDS said in a recent discussion paper that the Mandanas-Garcia decision will allow local governments to take on additional devolved tasks.

"To help address the problem of horizontal imbalance, a fiscal equalization called the growth equity fund (GEF) was introduced," it emphasized.

The GEF strives to address challenges such as unequal development, high poverty rate, and discrepancies in local government fiscal capacities.

The GEF, which was established by Executive Order 138 and is included in the proposed 2022 budget by virtue of National Budget Memorandum 140, will provide "assistance to LGUs with the highest poverty incidence, and are financially challenged to level the playing field in the implementation of devolved services," it explained.

According to the PIDS, the GEF may fund basic infrastructure as well as other programs, projects, and activities of poor, disadvantaged, and lagging local governments, including capacity development requirements, to enable them to more effectively and efficiently implement the functions and services devolved to LGUs by relevant laws.

"The GEF is different from previous programs under the LGSF (Local Government Support Fund) umbrella that were in recent years LGU-level specific programs for specific purposes in the case of provinces and cities," it continued.

The fund is managed by the DBM, and local governments will play a critical role in the country's economic recovery, according to the Department of Finance.

Finance Secretary Carlos Dominguez 3rd said that the government wants LGUs to take the lead in grassroots planning, community infrastructure, and the establishment of additional economic links on behalf of their constituents.

"Local government finance, in particular, will even be more important next year as the revenue share of local governments increases dramatically. The local governments will therefore be primarily responsible and accountable for the provision of basic services and facilities fully devolved to them," he said.

Improved revenue collection and resource mobilization strategies, Dominguez added, are required for local governments to achieve full development as self-sufficient communities.

As a result, he said, local governments should continue to strengthen their competencies and improve their absorptive powers. For example, by committing to a complete digital transformation, which aims to increase the efficiency and reliability of frontline agencies, while also ensuring that it can accomplish far more with less money in the long run.

"The local governments must keep pace with this digital transition — starting with local government finance. I strongly urge the local governments to adopt electronic facilities for business registration and renewal, and most importantly for assessment and collection of local taxes, fees, and other charges," the Finance chief noted.

LGUs to get windfall thanks to Mandanas-Garcia ruling