AS The Manila Times is hosting our 2024 Economic Forum today, February 21, it seems an appropriate time to discuss one of the more authoritative economic forecasts published recently, provided by the Philippine Institute of Development Studies (PIDS). While other expert opinions may differ in the exact degree of basic indicators, we find the overall upbeat outlook, along with the several key risks it identifies, quite encouraging and sensible.

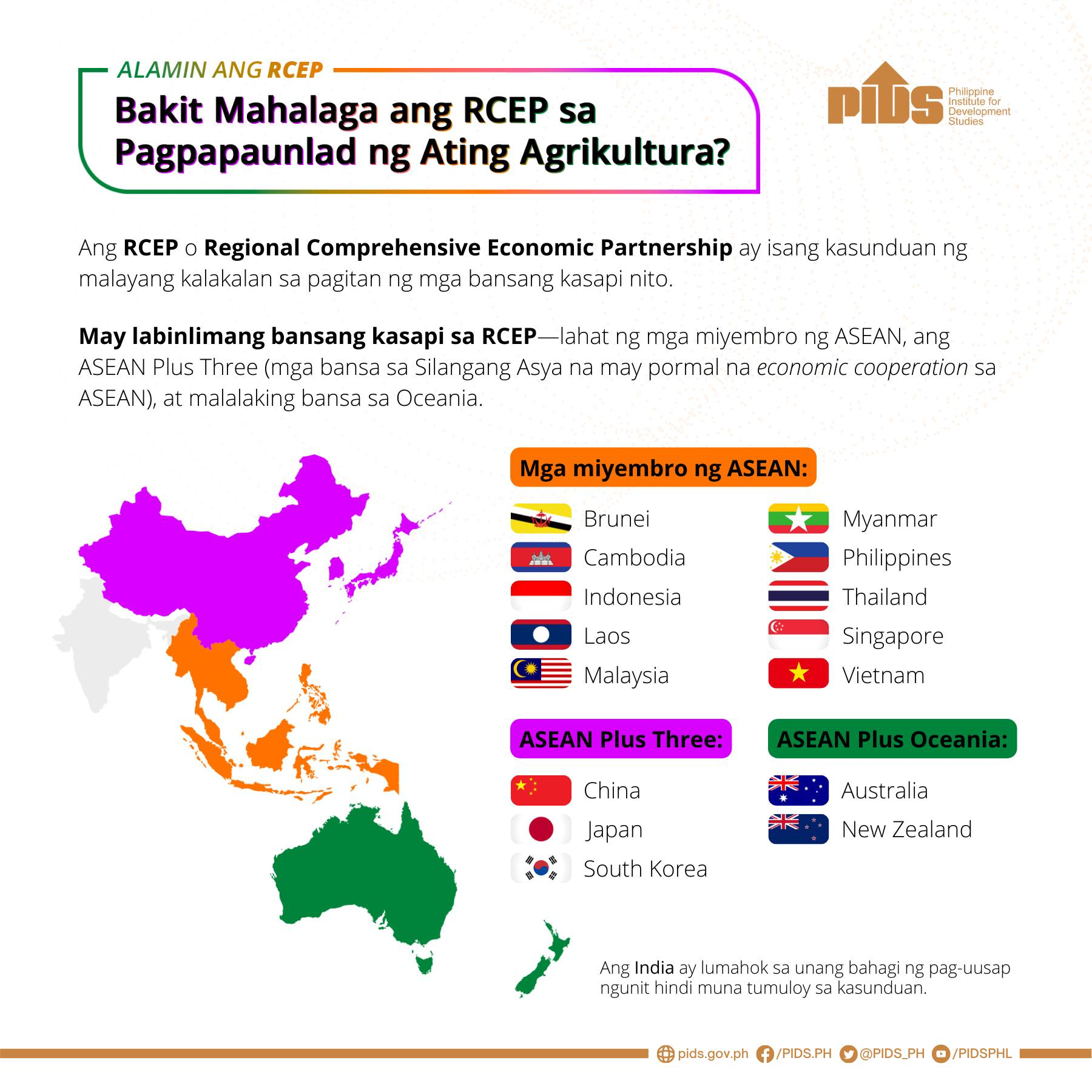

The PIDS forecast is a combination of the institute's own expert economic assessment and a careful analysis of other reliable forecasts, such as those from the World Bank, the International Monetary Fund (IMF) — both of whom are gracing our forum today — the Asean+3 Macroeconomic Research Office (AMRO), the Asian Development Bank (ADB), the "Big 3" credit and macroeconomic research agencies Fitch, Moody's and S & P, and the government's economic team. As the report was put together in December 2023, it includes PIDS' predictions of what last year's final economic numbers would be. Since the actual figures will be available in about another week, we will not concern ourselves with that part of the forecast but rather the forward-looking assessment for 2024, which concentrates on what are arguably the two most important indicators — gross domestic product (GDP) growth and inflation.

For 2024, PIDS has forecast a GDP growth rate of 5.5 percent to 6 percent, with headline inflation moderating to 3 percent for the year. The growth forecast is significantly lower than the Department of Budget and Management's (DBM) target of 6.5 percent to 8 percent, but the inflation estimate does agree with the government's outlook for inflation to return to the 2 percent to 4 percent target range in 2024.

For comparison, the most recent GDP growth forecasts for 2024 from the other sources noted above range from 5.3 percent to 6.6 percent, with a consensus of just over 6 percent, and inflation forecasts ranging from 3.2 percent to 4 percent, or a consensus forecast of slightly more than 3 percent.

There are, of course, some caveats to this outlook, which PIDS notes are taken in spite of "a generally 'gloomy and uncertain' outlook for the world economy." In terms of growth, the economy is mostly insulated from external circumstances since it is largely driven by consumption, which remains healthy thanks to recent job and wage growth and strong remittances. However, inflation is another matter. While policy action last year in the form of interest rate hikes will continue to help keep inflation in check since policy decisions have a lag of four to seven months in terms of their effect, PIDS feels food, energy and other commodity prices are still at risk. This is partly due to the still unrealized impact of El Niño, as well as uncertainty about the state of big rice exporters such as India and Thailand, and partly due to the potential for geopolitical stress to get worse or shift.

PIDS makes three basic recommendations to make the optimistic macroeconomic forecast a reality. First, the researchers urge the government and the BSP to aggressively use all the tools available to keep inflation in check, even if the forecast is rather benign. The implication here is that relaxing controls could leave the government flat-footed and unable to react quickly enough if inflation becomes a problem again due to the risks above.

The second recommendation is for government to get back on track with "stalled fiscal policy reforms." These pertain to issues such as reforming the military and uniformed personnel pension program, revenue management, and debt management. There seems to be a subtext in all this, intended or not, which we believe is worth highlighting again: diverting attention and effort to such a tangential activity as wrangling over proposed changes to the Constitution's economic provisions, changes that have no certain benefit, may not be the best use of the government's time.

Finally, PIDS sounds a strong note of caution on the Maharlika Investment Fund (MIF), politely describing it as "unique" and suggesting it needs a great deal more work to demonstrate that it is reliable and can be productive. Among other things, there is a "need for clear mandate[s] and suitable and transparent performance benchmarks," implying the MIF does not yet have these, and which "may be difficult to establish."