ENCOURAGING greater private sector participation in government infrastructure projects requires addressing issues in Public Private Partnerships (PPPs) such as contingent liabilities and risk-sharing, according to the National Economic and Development Authority (Neda).

In an interview with the BusinessMirror, Socioeconomic Planning Secretary Arsenio M. Balisacan said the government’s limited fiscal space remains the primary consideration when it comes to undertaking infrastructure projects.

Balisacan said the Marcos administration intends to continue the ongoing projects as well as those that were nearly completed by the Duterte administration. The pipeline, however, will have to be re-evaluated.

“The President has expressed, realizing there are very limited resources, the private sector would have to come in and would have to be enticed, encouraged to participate in infrastructure development. Which means, the PPP would have to be strengthened,” Balisacan said.

By strengthening the PPP framework, Balisacan said, there is a need to address concerns that were raised about this particular mode of financing. These concerns included contingent liabilities and risk sharing issues.

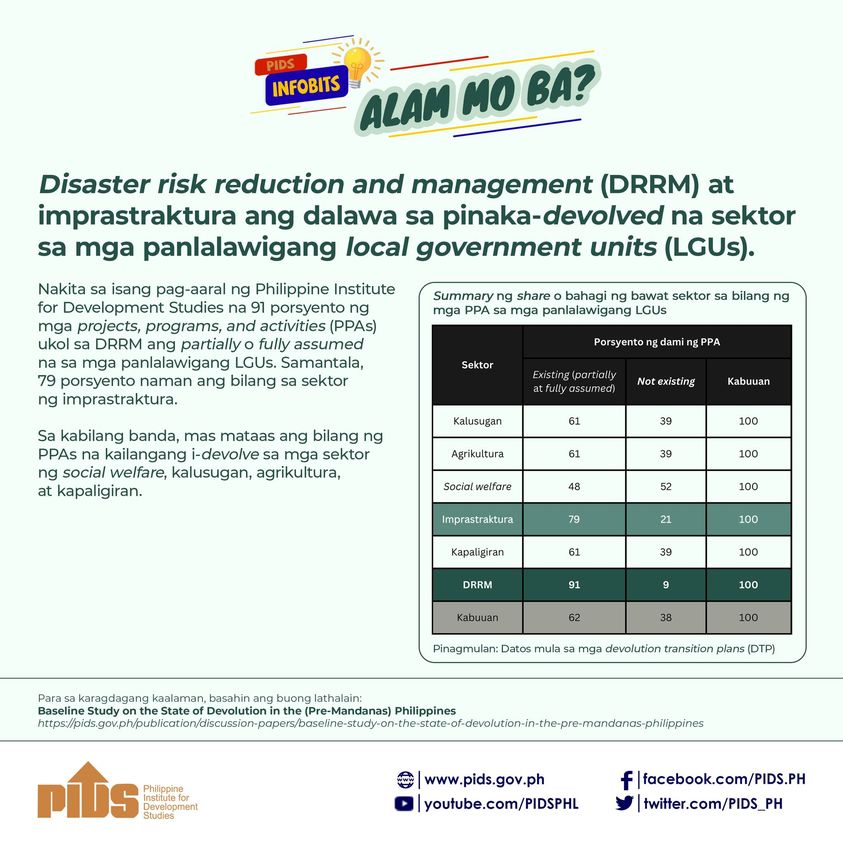

Former Philippine Institute for Development Studies (PIDS) President Gilberto Llanto defined contingent liabilities as obligations shouldered by the national government on behalf of private investors to absorb risks from “insufficient market demand, adverse exchange rate fluctuations, and other negative shocks.”

These, Llanto said, are deemed contingent because they may or may not be shouldered by the government, depending on the occurrence or outcome of the event. However, he said, “contingent liabilities usually arise from the payment of government guarantees.”

Balisacan also said proper risk sharing pertained to the risks borne by the private sector and the government when undertaking PPPs. The PPP was introduced under the second Aquino administration, under which Balisacan first served as Socioeconomic Planning Secretary after the resignation of the late Cayetano W. Paderanga from the post.

“PPP is a relatively new funding mechanism for our infrastructure. That was fairly developed during the PNoy administration and then we were able to launch a number of those PPPs but we also learned lessons from those early projects. And we should be able to enhance, improve the design, the framework of PPPs so we can maximize the benefits from those,” Balisacan explained.

In January, ADB Economic Research and Regional Cooperation Department Advisor Yesim Elhan-Kayalar said developing economies should increase partnerships with the private sector to finance infrastructure programs.

Elhan-Kayalar said this will help economies recover from the pandemic. She said responding to the pandemic has placed a strain on public funds and induced countries to resort to external borrowing to augment their resources.

She said charting a path toward economic recovery will mean financing large-scale public works that would generate sufficient jobs and foster private sector development for both upper and lower middle income countries.

Elhan-Kayalar said this includes financing infrastructure programs in emerging upper middle-income countries such as the P9-trillion Build, Build, Build program in the Philippines.