At last, the government has set the ball rolling on the devolution of its functions to local government units (LGUs), after a months-long review of the previous administration’s preparatory groundwork for the decentralization project.

On Dec. 21, President Marcos issued a set of instructions to agencies to evaluate the impact of genuine local autonomy on cities, provinces, towns, and barangays, and to draw up a list of basic services that these LGUs can offer without draining their coffers.

It’s evident that the President and his advisers are treading lightly on this massive undertaking to turn LGUs into “self-reliant communities,” as the authors of the Local Government Code envisioned 32 years ago.

And well they should.

That our bureaucrats are opting for more prudence than haste is an encouraging sign for the success of this decades-long endeavor. At stake, after all, is the delivery of critical services, such as health, agriculture, environmental management, local infrastructure, social welfare, and tourism.

Greater responsibility

As it is, many LGUs are too poorly equipped to assume new mandates, willing but unable to absorb the larger share of national revenues to which they are now entitled under the 2018 Mandanas ruling of the Supreme Court.

LGUs had rejoiced when that decision came out five years ago, in anticipation of a much bigger national tax allotment (NTA), previously known as IRA, or internal revenue allotment. The ruling means LGUs’ 40-percent share in the national wealth is no longer limited to taxes collected by the Bureau of Internal Revenue but includes those by the Bureau of Customs and similar agencies.

In 2024, LGUs will receive P871.3 billion in NTA, higher by some P50 billion than their share this year.

But with greater funding comes greater responsibility, and one too heavy to shoulder for many LGUs. In March, Budget Secretary Amenah Pangandaman said some 450 LGUs were ill-prepared to take on their devolved functions for not having enough skill, capacity, or resources. Between then and nine months later, the situation has not changed much, or at all.

Elephant in the room

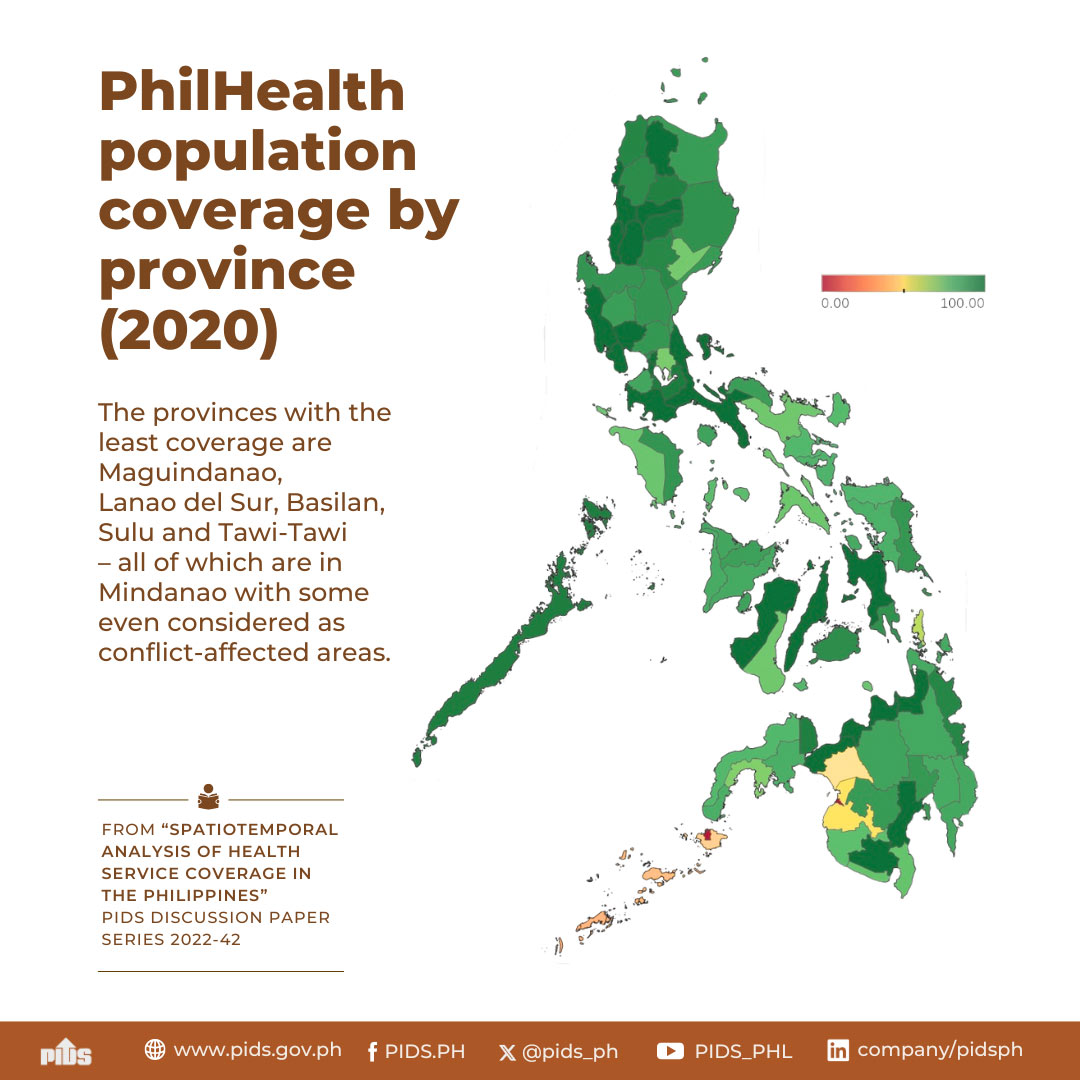

The elephant in the room, of course, is the wide chasm between the wealthiest local governments and the most impoverished ones. Compare the likes of Quezon City and Makati City, whose locally sourced revenues already dwarf their NTA shares, with the municipalities barely scraping by with their own meager portions, only to be saddled with more work than their offices can realistically handle.

In the recent Palace meeting, the President ordered the National Economic Development Authority to analyze what the government could gain from the devolution initiative and create a timeline, while the Department of the Interior and Local Government was asked to list down the functions LGUs should perform based on their devolution transition plans.

Earlier, Mr. Marcos had sought a study on the impact of Executive Order No. 138, issued by then President Rodrigo Duterte in June 2021, which set the stage for full devolution by 2024.

Not one-size-fits all

“The conclusion that we arrived at is that it should not be one-size-fits-all,” Mr. Marcos said in March, warning that a penniless municipality might receive more funds due to the Mandanas ruling but ironically find itself in a “poorer, financial condition.”

The crux of the problem lies not only in funding availability for cash-strapped LGUs but in fiscal management, too.

In a 2022 report, the United Nations Development Programme observed a “significant disparity among LGUs in terms of technical capacity and preparedness” for implementing the Mandanas ruling.

“The larger an LGU’s budget, the lower the rate of budget utilization,” the report said, noting that cities and provinces on average would have about P604 million in unspent funds per year.

In a study published in May, the Philippine Institute for Development Studies agreed that the devolution policy should reflect the “heterogeneity in capacity” among LGUs, instead of imposing uniform rules for all.

Formula for distribution

Under the Local Government Code, the formula for the distribution of national wealth among LGUs is computed according to population (50 percent), land area (25 percent), and equal sharing (25 percent). But this system prioritizes equality, where LGUs are given the same resources regardless of their circumstances, over equity, which addresses the inequalities among them. As a result, the richest cities end up with inflated NTA shares they don’t need, while LGUs that need more are deprived of the opportunity to catch up.

Congress would be well advised to revisit this policy and consider a fairer system that factors in another crucial variable—poverty.

Top of Form

Bottom of Form

Ultimately, the onus is on the government to support struggling LGUs in the devolution process until they reach their highest potential as self-governing political units. The top imperative, always, must be to ensure that the poorest communities aren’t left behind.