More financial technology (fintech) firms have become alternative lenders to micro, small and medium enterprises (MSMEs), including those engaged in agriculture, amid banks’ continued hesitancy to provide such loans.

Bangko Sentral ng Pilipinas (BSP) Monetary Board member Romeo Bernardo last Friday said, “Fintech companies are doing a lot in these areas. They have become alternatives to providing credit, especially to members of the informal sector who may not want to go to the bank formally dressed.”

Bernardo, who was in the Institute of Corporate Directors’ induction of Officers ceremony at the Dusit Thani in Makati City said funds from fintech firms can support the BSP’s fund distribution to government agricultural agencies that come from penalties paid by banks for not complying with the Agri-Agra Reform Credit Act of 2009.

The law requires banks to allot 25 percent of their loanable funds to agriculture and fisheries. From this, 10 percent must support agrarian reform beneficiaries.

“The money that goes to the Central Bank does not go to the Central Bank; only 10 percent is retained and most goes to the Department of Agriculture and the Department of Agrarian Reform so they can do their credit programs,” Bernardo said.

Loans to agricultural workers increasing

The BSP official said loans to agricultural workers have been increasing after the law was revised to include all players in the agriculture sector.

“The compliance is very high now compared to before because the new law broadened the definition. It has to include lending to firms that build water systems and others that are part of the food supply value chain,” he said.

According to the BSP, banks increased funding for agriculture and rural development to 192.4 percent of their total funds in the first half of 2024, from 36.4 percent in the same period in 2023.

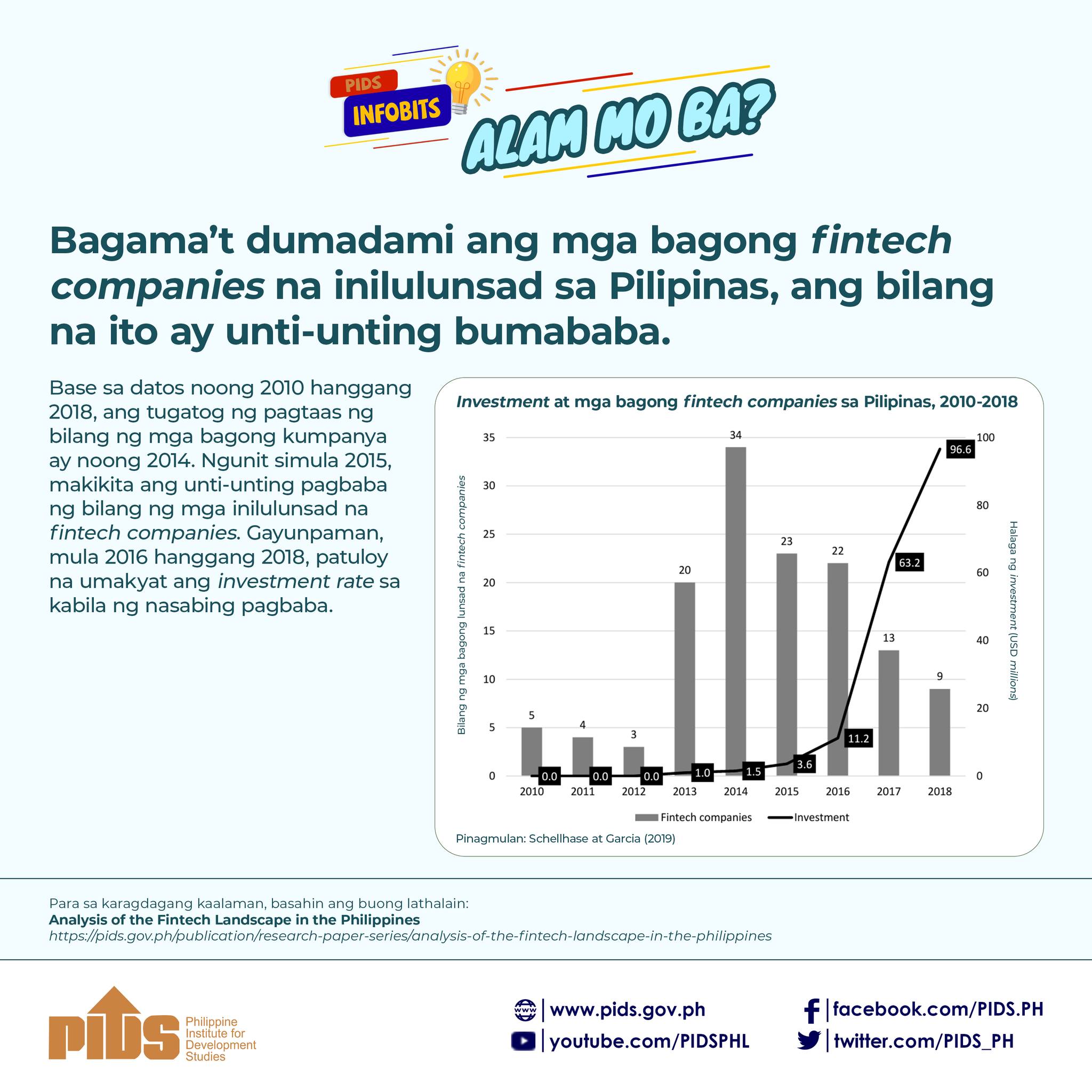

Meanwhile, Fintech Alliance.Ph says fintech firms in the country have surged to 285, with 22 percent offering loans.

Bernardo said the government and the private sector must enhance the collection and analysis of entrepreneurs’ financial data to boost agricultural growth and ultimately slash the country’s poverty rate.

“As long as the environment is not able to lend good loans, banks’ cautious approach is a very reasonable thing. They have responsibilities to depositors,” he said.

Agriculture sector reforms

“We have to look deeply into the reforms needed to develop the agriculture sector, but there are measures being done,” Bernardo continued.

The Philippine Institute for Development Studies reported that the demand for financing from the agriculture sector accounts for 65 percent of the total demand for production activities.

According to the Philippine Statistics Authority, the poverty rate among farmers was the second highest at 30 percent in 2021, after the fisherfolks’ 30.6 percent.