There have been significant increases in budget allocations for public health programs since the Sin Tax Reform Act of 2012 was enacted, but this did not necessarily lead to improved outcomes and spending capacity, a report published by the Philippine Institute for Development Studies (PIDS) said.

According to the policy note, Efficiency and effectiveness of earmarking for public health in the Philippines, the programs’ annual allocations are not properly spent based on their implementation plans.

The report said implementing agencies should be more strategic in requesting, allocating and utilizing funds to address service coverage gaps.

The policy note further said the criteria for implementing public health programs should be revisited to improve equity and ensure that poverty incidence is considered in determining program access and assistance to areas with high at-risk subpopulations.

“The quality of program performance indicators also varies widely and thus must be reviewed to draw conclusions on the effectiveness of earmarking to achieve target outcomes,” the report said.

The Sin Tax Reform Act of 2012 was established for tobacco and alcohol excise tax reforms, to support revenue generation for public health spending, and reduce tobacco smoking, alcohol use and risk factors associated with noncommunicable diseases.

It was later amended and repealed to include sugar-sweetened beverages, heated tobacco products and vapor products.

The report mentioned that the sin tax laws are revenue earmarks that highlight the increase in fiscal space for health as a political priority, funding health programs and initiating the transition of the Philippine health agenda to universal health care.

The policy note said public health appropriations significantly increased after the passage of the law in 2012, as reflected in the Department of Health budget in 2014. Overall appropriations increased by P35.207 billion per year, on average, from 2014 to 2020.

“Trends in individual health program budgets in the general appropriations show that one budget supplements the other (sin tax revenues and national government counterpart), evidenced by inconsistent inter-year growth between both budget sources. It should be made clear that earmarked funding sources through sin taxes are supplementary to the main provisions of the national government for public health programs,” the report said.

Most funds from the Sin Tax Reform Act are used consistently to finance the membership of indigents in PhilHealth, a hallmark to achieve universal access to health care, according to the policy note.

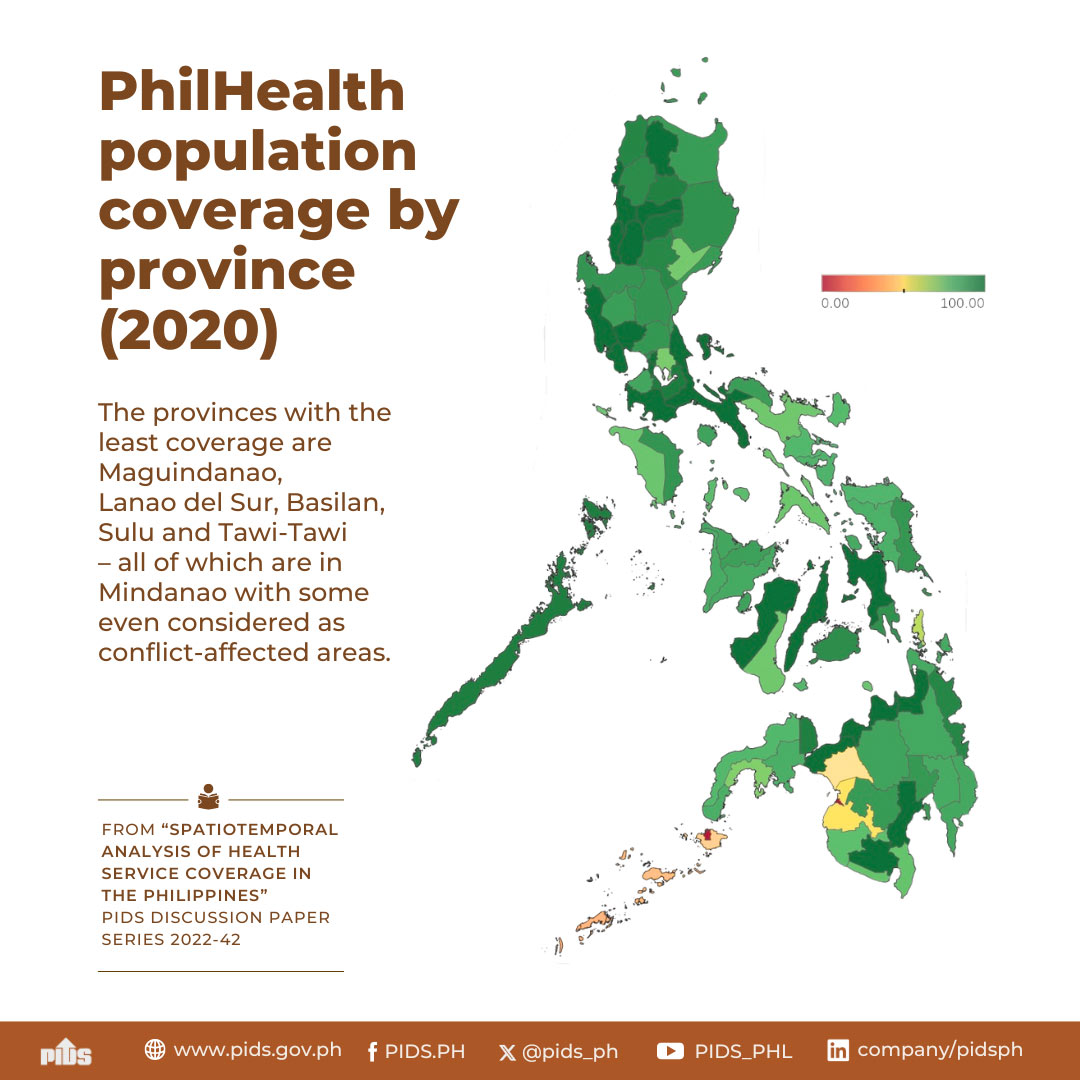

“However, sponsored PhilHealth membership is weakly associated with poverty incidence.

Therefore, there is a need to strictly implement appropriate parameters to include the National Household Targeting System for Poverty Reduction in the program to reach actual indigents as beneficiaries,” the report said.

All programs must include poverty incidence in their criteria and administrative processes when allocating funds, projects and activities to ensure that assistance is provided in areas with high at-risk subpopulations, thus increasing access and equity, it added.