ALIGNED with the country’s commitment to the World Health Organization Framework Convention on Tobacco Control, over a decade ago the government established the sin tax law which sought to increase revenue for public health spending and reduce the burden of tobacco smoking and alcohol use.

Sin tax is a tax levied on goods that are neither luxuries nor necessities, and in general considered to be harmful to society. The most common of these goods are alcohol and tobacco.

So how are we faring in the utilization of revenues from the Sin Tax Reform Act of 2012 (Republic Act 10351)?

Perhaps the government should revisit policies and processes under this law to ensure that six tax revenues are used efficiently, equitably and effectively for health programs.

Some of the main reforms of RA 10351 include substantial increases in excise tax rates, an annual increase rate in excise tax, and earmarking of revenues to support progress toward universal health coverage. Around 85 percent of incremental tax revenues collected from excise tobacco and alcohol taxes are earmarked for the health sector. This funds the Department of Health’s (DOH) programs and activities and premiums for PhilHealth.

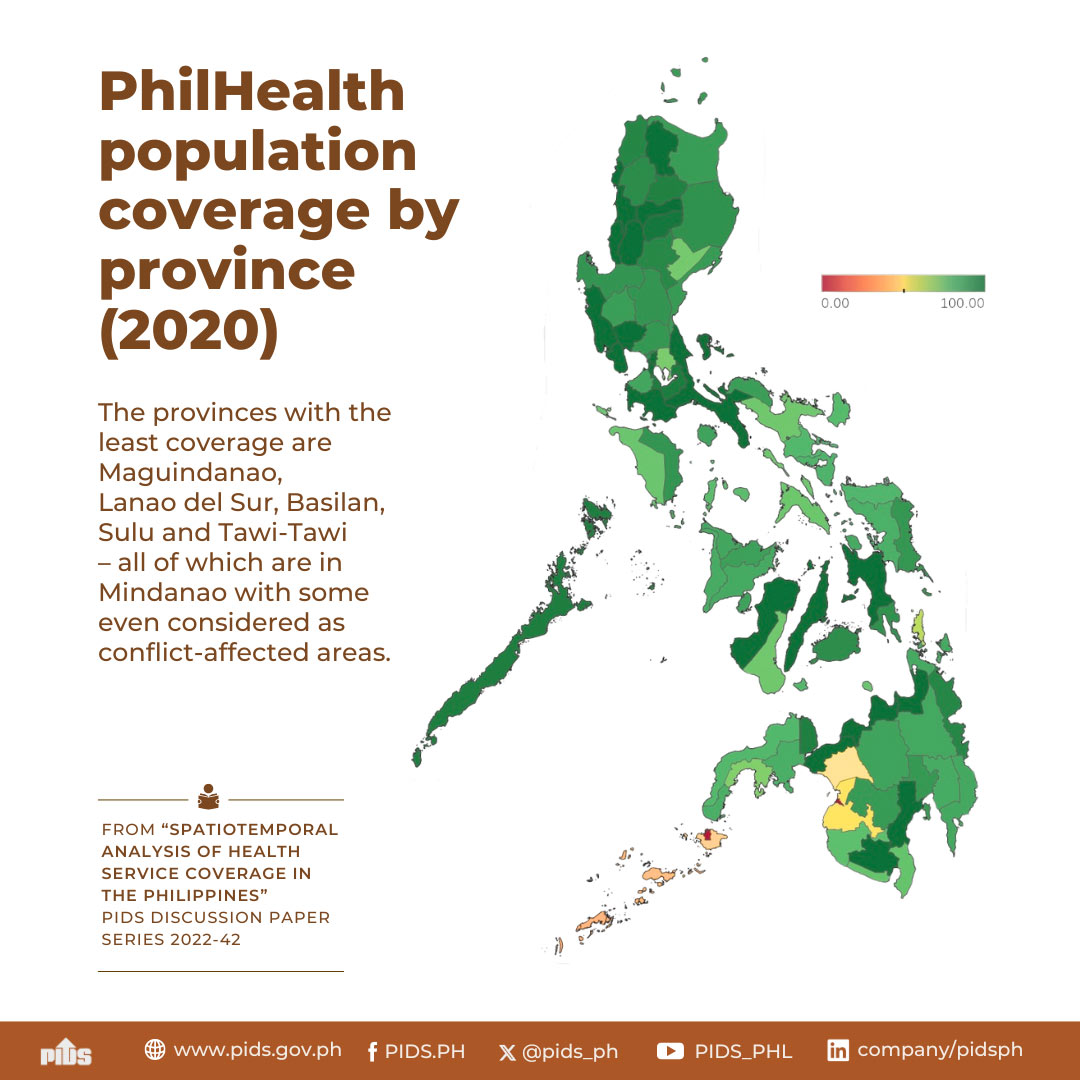

However, while the health outcomes of select public health programs have improved since the implementation of RA 10351, a recent study of state think tank Philippine Institute for Development Studies showed that the funds have not necessarily been efficiently and equitably utilized by the recipient programs.

In other words, DOH’s capability and accountability to utilize its annual budget effectively leave a lot to be desired. It needs to be more strategic in allocating and utilizing funds for its health programs to address gaps in government health services.

In terms of equitable budget allocation, according to the study, most of the funds from sin tax revenues are used to finance the membership of the disadvantaged sector in the national health insurance program. Therefore, poverty incidence must be consistently included among the criteria when allocating funds for health projects and activities. The poor must certainly benefit from sin taxes.

For the sake of transparency, the monitoring and evaluation of the outcomes achieved by the allocations provided by sin tax revenues must be continuously reported. Of course, people want to know if their sin taxes are really utilized for public health programs and are not lost to corruption, which is a graver sin.