FOR some, the number 13 is an unluckiest number. But when it comes to cash transfers, it seems 13 is a winner, especially for recipients.

Thirteen years ago, then Socioeconomic Planning Secretary Felipe M. Medalla floated the idea of giving cash to both rural and urban poor to bring about pro-poor growth. Medalla urged the Arroyo administration to adopt Brazil’sBolsa Familia program, which provides up to 95 reais (about $44 that time) a month to families who can keep their children in school and take them to clinics for health check-ups.

According to Medalla, doing so would ensure that the country’s economic growth would benefit not just college graduates who work in business process outsourcing or call centers. He projected that the government will only spend P20 million to P30 million a year for a cash-incentive program.

“It is not cheap but it’s not expensive either,” he said.

Thus, the Pantawid Pamilyang Pilipino Program, or 4Ps, was born. The 4Ps allowed millions of Filipino children to go to school and thousands of mothers to seek healthcare services.

Health crisis

THIRTEEN years later, the 4Ps, also referred to as the conditional cash transfer (CCT) program, was put to the test as the Philippines battled a “once in every 50 years” pandemic.

Authorities locked down borders between cities and restricted movements; effectively shutting down businesses and constricting food supply. While these actions probably saved lives by preventing the spread of the coronavirus disease of 2019, these also caused millions to lose their jobs and sources of income.

Leveraging the success of the 4Ps, the government extended more doles in cash and in kind to allow Filipinos to cope with the worst health crisis the country experienced in recent memory. The lifeline, called ayuda in Tagalog, allowed affected Filipinos to survive.

Overall, the pandemic has put to the test not only government’s ability to implement cash transfers and other social protection services, but also forced it to re-examine its social protection efforts.

National Economic and Development Authority (Neda) Undersecretary Rosemarie G. Edillon told the BusinessMirror in an email the government is finalizing the social protection framework that defines the social protection floor (SPF), among others.”

Assuring all

“SOCIAL protection means that every person has a right to full social and economic guarantees,” Rene E. Ofreneo, former Dean of the University of the Philippines School of Labor and Industrial Relations, said in a 2019 study.

He further wrote that social protection “consists of all elements and measures that would assure that every member of society is able to live a life of dignity from infancy to old age.”

Ofreneo, also a columnist of the BusinessMirror, said this means a person will be protected against accidents, illnesses, disability and unemployment, among others. It also means protecting victims “of disasters, economic shocks, dislocations and similar tragic events,” he wrote.

But for social protection to work, Ofreneo said the program must be reflected in the law and budgets of the state.

Ofreneo said that even before a law was passed to institutionalize the 4Ps, the 1987 Philippine Constitution already mandated the development of “a comprehensive and fully-operational social protection program.”

He added that social protection must be universal.

It must cover not just a section or segment of the population. It should also be enjoyed by indigenous peoples, migrants and refugees, according to Ofreneo.

“Social protection must also be transformative; that is, it should lead to the empowerment of the people as the principal actors—and not passive objects—of development,” Ofreneo said. “Finally, social protection must be redistributive, meaning that it should help address economic and social justice issues; in particular, the root causes of poverty and marginalization, which put people in precarious and disadvantaged situations.”

Protection interventions

THE government considers social protection as a “macroeconomic stabilizer” that can fuel demand and enable “people to better overcome poverty and social exclusion.”

According to Edillon, the government embraces the “universality of social protection” as a basic human right and that universal coverage means shocks or risks affecting all Filipinos would be covered by a “menu of social protection interventions.”

And government’s efforts in improving social protection are under way, she said.

The Neda said, however, that given budget limitations, the government aims to implement a social protection floor (SPF).

Edillon explained that an SPF is a minimum set of social protection programs, which includes several interventions like cash transfers, social insurance, safety nets and labor market interventions, among others.

With this, the Neda said the SPF is broader and more encompassing and is not the same as Universal Basic Income (UBI) or Basic Income Guarantee (BIG), which is essentially an unconditional cash transfer that ensures basic needs of households are covered.

Programs, services

DATA from the Department of Social Welfare and Development (DSWD) revealed a list of social protection services, particularly in relation to the pandemic. These services were: the Abot Kamay ang Pagtulong (Akap) program of the Department of Labor and Employment (Dole); the Social Amelioration Program (SAP) emergency cash subsidy; the 4Ps; and, the distribution of food and non-food items to households.

The services included assistance to individuals in crisis situation; supplementary feeding program; social pension for indigent senior citizens; efforts to prevent and respond to women and child abuse cases; and, monitoring theBahay Pag-Asa and other youth care facilities of the government.

The DSWD data showed government specifically provided the following during the course of its battle against the pandemic: livelihood assistance grant to 45,010 beneficiaries and boosted production of personal protective equipment and face masks through the 4Ps and the sustainable livelihood program, respectively, among others. The data also showed government agencies were able to serve 909,699 beneficiaries through the assistance to individuals in crisis situation, provided P291.36 million worth of food and non-food items and serve 2,413 women and child abuse cases.

According to the DSWD data, the government also served 1.76 million children through the supplementary feeding program; provided Akap 1-time financial assistance of P10,000 each to 244,605 displaced land-based and sea-based overseas Filipino workers; and, released 973 children in conflict with the law from the Rehabilitation Center for the Youth, Bahay Pag-Asa and other detention facilities.

Yet too little

JOSE Enrique A. Africa, executive director of nongovernment Ibon Foundation Inc., said the SAP and Small Business Wage Subsidy (SBWS) helped those that they reached, if only for just a little while.

However, Africa said the cash support was not very much.

He explained that the 17.7 million recipients of the first tranche of SAP only received an average of P5,636 equivalent to just P7 per person per day for a family of five since the lockdowns started in mid-March. Not everyone got a second tranche and the 13.9 million who did only got an average of P5,978 each, according to Africa. The 3.1 million SBWS beneficiaries received a bit more at an average of P7,441 for two months, he added.

Given this, Africa said putting in place a “universal social protection is long overdue.” The current system is “fragmented” and those outside of the 4Ps are “underfunded,” according to him.

He said it is important for the Philippines to have a “universal” SPF, which would include basic income security and “essential health care and minimum education and nutrition for children.”

“The SAP and SBWS were short-lived, though. While momentarily alleviating things for recipients, the pandemic-driven and lockdown-driven economic shock is so large it’s certain that many have been permanently pushed to a lower level of welfare with many even below the official poverty line,” Africa said.

Average incomes

IN other parts of the world, social protection is now being discussed in the context of universal basic income, or UBI, and temporary basic income, or TBI.

A UBI is seen as a long-term solution to shield the poor from economic shocks. The UBI was implemented in Finland, which gives its unemployed citizens aged 25 years old to 58 years old a monthly stipend of 560 euros a month. This two-year experiment is envisioned to cut red tape, poverty and unemployment.

A TBI is a minimum guaranteed income above the poverty line for vulnerable people in developing countries, according to a United Nations Development Program working paper released in July. The UNDP estimated that developing countries can extend TBIs of between 0.27 and 0.63 percent of their combined gross domestic product (GDP).

These could be made as top-ups on existing average incomes in each country up to a vulnerability threshold; lump-sum transfers that are sensitive to cross-country differences in the median standard of living; and lump-sum transfers that are uniform regardless of the country where people live.

Needs being met

Ateneo de Manila University School of Social Sciences Dean Fernando T. Aldaba wrote in a column for the BusinessMirror that “UBI grants all citizens of a country or a selected geographic area with a fixed sum of money, regardless of their income, resources or employment status, the purpose of which is to basically provide income security to meet basic needs.”

“BIG [basic income guarantee] also involves cash transfers designed with a similar purpose but targets only low income or poor individuals,” Aldaba said. (See “Basic income guarantee, anyone?” here:https://businessmirror.com.ph/2020/01/31/basic-income-guarantee-anyone/).

Aldaba wrote that BIG could help the Philippines reduce poverty and provide financial security among vulnerable groups and “population and may also decrease inequality across sectors of society.”

If the country will implement a BIG, this can simplify the country’s social protection programs, he said.

However, Aldaba said a BIG can be inflationary and come with “moral hazard issues” given that beneficiaries could lack the motivation to look for better-quality jobs. This means, a BIG could be a disincentive for them to work and could increase their dependence on the government.

Not cheap

ALDABA added that a BIG, however, can “also be a source of corruption and may divert government resources from competing priorities.

The UBI, meanwhile, is simply out of reach by developing country governments like the Philippines because it will entail a very large expenditure.”

Aldaba estimated that for a cash grant of P2,500 per month for a poor household, the government needs P72.5 billion or 2.1 percent of total budget for 2019 and around 41 percent of GDP. For P5,000 per month per poor household, it is P145 billion, 4.2 percent of total budget and 0.82 percent of GDP.

Aldaba said if the government wants every Filipino to meet the food threshold, there should be around P7,500 per-month-transfer per family with a total cost of P217.5 billion, which is 6.3 percent of the total budget and around 1.23 percent of GDP.

Income differences

Africa said a TBI is “extremely appropriate” given the country’s socioeconomic conditions.

He pointed to the Philippine Institute for Development Studies (PIDS) whose data showed that around 11.3 million (48 percent or half of Filipino households) have monthly incomes of at most P22,000.

He said based on Ibon estimates, around 70 percent of total employment is in the informal sector who are most vulnerable to income shocks, which can be addressed by a temporary basic income scheme.

Having a basic income could help address inequality in the country. Africa said the top 500 income earners have an average monthly income of around P4 million, which is over 150 times the reported average family income in the country at P313,000 annually according to the 2018 Family Income and Expenditure Survey (FIES). He noted that around 0.1 percent of Filipinos have wealth of P50 million or more, with the net worth of just the 50 richest Filipinos totaling P4.1 trillion.

However, economists said in some countries where the UBI was implemented, the programs were discontinued after a year of implementation because of the high costs involved.

Very costly

DE La Salle University Economist Maria Ella C. Oplas told the BusinessMirror that cost is one of the biggest concerns for the Philippines when implementing basic incomes, especially given the erosion of government revenues after lockdown measures shut down major economic activities.

The Department of Finance (DOF) earlier noted that the combined revenues collected by the Bureau of Internal Revenue and Bureau of Customs remained down 12 percent year-on-year as businesses were adversely affected months after the lockdown. For January to August, the government collected P1.637 trillion, lower than the P1.864 trillion it did so in the same period last year.

“We don’t have an ample budget where we can get the fund for the universal basic income,” Oplas said. “Unless we Filipinos stop complaining about all the taxes that the government is getting from us, I don’t think we will be ready for such. If we push for that, then we have to be ready for more debt.”

The situation becomes even more complicated when the database to be used in implementing such programs suffer from problems. Economists earlier pointed out the issues surrounding the names of recipients of the ayuda remain a challenge.

Efficient tax use

AFRICA said one of the ways to cure the data gaps is to use the community-based monitoring system (CBMS), which recently became institutionalized and will be implemented by the PSA.

This would be particularly useful when implementing a TBI, which requires targeting mechanisms; unlike the UBI, which is a system that is designed for all Filipinos, regardless of income status, he explained.

“In itself the CBMS is just a tool for TBI and will only be as useful as the government is willing to provide the resources for a meaningful basic income for Filipinos as needed,” Africa said. “TBI in any form will only start to be real for Filipinos upon a genuine government commitment to raise and devote resources for this.”

Oplas said she’s “willing to give 60 percent of my hard-earned money [like in European economies] if and only if I know that it is going to public service delivery.” That is, only if the government will be able to come up with a way to address the issues on data and how the funds can better be used to benefit a greater number of Filipinos.”

Real concern

PHILIPPINE Institute for Development Studies (PIDS) Senior Research Fellow Jose Ramon G. Albert told the BusinessMirror that while financing is a real concern, the Philippines can experiment on UBI. However, Albert said it should be first done on a smaller scale in order to determine financial needs and implementation issues.

A UBI or an unconditional cash transfer can be good given that the country really doesn’t extend unemployment benefits, he explained. This is something that has become obvious with the ongoing lockdown as evidenced by hundreds of jeepney drivers begging along the streets of Metro Manila.

“Our policy note on the FIRe [Fourth Industrial Revolution] called for looking into expanding social protection, including experiments with UBI; but we don’t also have unemployment benefits. Government needs to progressively attain universal social protection but also study things carefully as haste makes waste,” Albert said.

“It’s not enough to have a good program, it is equally important to look at intended and unintended consequences. Further, how much this [will] cost and how would we bear this cost,” he added.

Security guarantees

WHILE cost may be one of government’s considerations as it finalizes a new social protection framework, the Neda is currently focused on the SPF’s four social security guarantees.

These include access to a nationally-defined set of goods and services as well as basic income for children to give them access to nutrition, education, care and other necessary goods and services. The social security guarantees also include basic income security for persons in active age who are unable to generate incomes due to sickness, unemployment, maternity and disability. The list also includes basic income security for older Filipinos.

“The Covid-19 pandemic brought to fore the importance of institutionalizing the SPF to immediately and efficiently identify and assist the most vulnerable population …as a major strategy of the PDP [Philippine Development Plan] Midterm Update under Chapter 11,” Edillon said.

“The SPF will be instrumental in guaranteeing the access of people to social protection services, rendering its institutionalization vital in the improvement of SP service delivery in the country,” she added.

Adopt, enumerate

THE Neda said it will propose to the Department of Labor and Employment two types of SPFs: one for “normal” situations and another during “emergencies” such as pandemic and disasters.

Once the SPF is finalized, Edillon said, the government will issue a policy directive to officially adopt and enumerate the components of the SPF, along with the roles of the concerned agencies, among others.

Edillon said Neda aims to come up with a Social Development Cluster (SDC) resolution to establish an SPF anytime within this month or in November.

The SDC is one of the seven interagency committees of the Neda Board. It advises the President and the Neda Board on matters concerning social development, including education, manpower, health and nutrition, population and family planning, housing, human settlements and the delivery of other social services.

The SDC is chaired by the Labor Secretary and co-chaired by the Neda Director-General.

Reckoning with costs

IN terms of costs, UN officials emphasized that SPFs are affordable.

UN High Commissioner for Human Rights Michelle Bachelet, UN Special Rapporteur on Extreme Poverty and Human Rights Olivier De Schutter and International Labour Organization (ILO) Director-General Guy Ryder said so in a joint statement issued recently.

The financing gap for all developing countries the difference between what these countries already invest in social protection and what a full SPF (including health) would cost is about $1.191 trillion in the current year, they said. The costs already include the impact of addressing Covid-19, the UN officials said.

But they said the gap for the low-income countries is only some $78 billion, a negligible amount compared to the GDP of industrialized countries. And yet, the authors said, the total official development assistance for social protection amounts to only 0.0047 percent of the gross national income of donor countries.

“We regularly hear pledges that we must, and will, ‘build back better’ from the current crisis,” Bachelet, De Schutter and Ryder said. “We can only do this if everybody has a minimum level of social protection, including the poorest and most marginalized.”

Yo-yo effect

OFRENEO said ideally, social protection should be extended by government until Filipinos get back on their feet, especially given the current health and economic crises.

He cited two ways this could be achieved: using social protection as disaster risk reduction and management framework and a cash-for-work program to provide income to the unemployed.

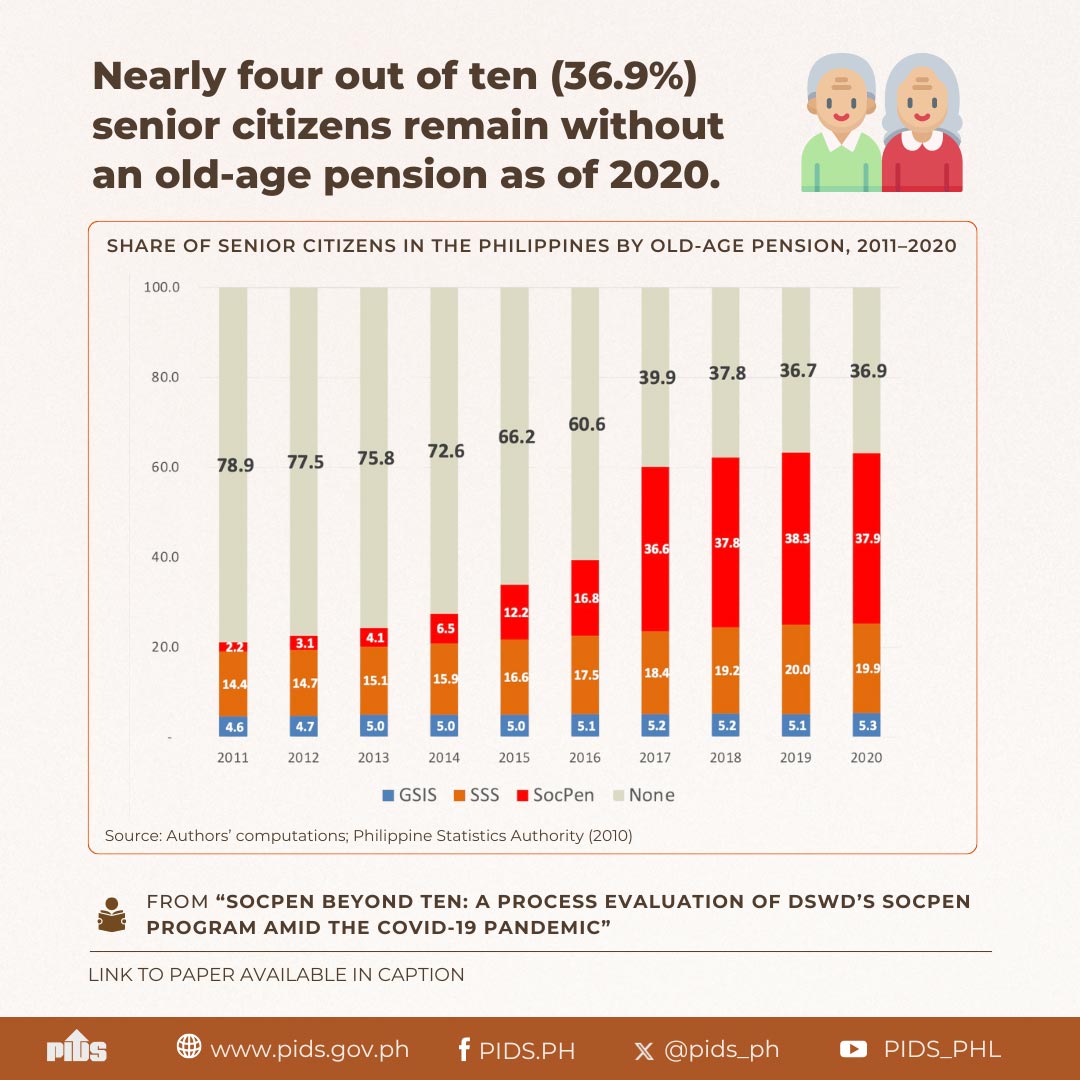

For former Socioeconomic Planning Secretary Dante B. Canlas, this requires the consolidation and strengthening of social protection institutions, particularly the Government Service Insurance System (GSIS), the Social Security System (SSS) and the Philippine Health Insurance Corp. (PhilHealth).

These efforts should also be accompanied by new social safety nets, the pressing need for which has been revealed by the outbreak of Covid-19. These new safety nets should include food assistance and unemployment insurance, Canlas added.

He said both social safety nets are targeted at the disadvantaged segment of the population and can be designed to avoid abuses and leakages.

Furthermore, Canlas said, the program designs must be sufficiently strong so that citizens experiencing temporary setbacks from unexpected shocks like the pandemic can bounce back or have a yo-yo effect.

Better preserve

CANLAS also said reforms are also needed at PhilHealth given the recent controversies in the agency. He said internal controls at PhilHealth must be tightened.

Those found guilty of corruption should be “meted out very severe penalties.” Further, those recruited in PhilHealth should be experts and must be competent administrators and staff.

The former Neda Chief said in order to save on costs and better preserve pension funds, the GSIS and SSS should be merged. This merger could be done by “carving out the retirement and disability funds” to be part of just one agency in charge of social security.

“To sustain the merged institution, it should be transformed into a pay-as-you go system, whereby contributions of active members finance the benefits going to retiring members. Over time, contributions and benefits need to be adjusted accordingly as a result of demographic changes,” Canlas explained in an email. “As for the current investible funds of both GSIS and SSS, they can be consolidated into a sovereign fund to be held in trust by the Bureau of Treasury.”

Making it happen

OFRENEO’S and Canlas’s recommendations build on the experience of the country on a program hatched in 2007, about 13 years ago.

That year could be considered fortuitous as the Philippines was lucky enough to have a government that listened to Medalla, one of the country’s leading economists, to roll-out the 4Ps.

Thirteen years later, if government could pull off its SPF tack, it could make the number 13 a lucky number for those advocating universal social protection.

Safety nets cushion pandemic fallout for poor Filipinos