SENIOR CITIZENS accounted for more than a fifth of total health expenditures in 2018 and were out-of-pocket on 59% of their expenses, the Philippine Statistics Authority (PSA) reported Monday.

According to the PSA’s Philippine National Health Accounts, health spending for individuals aged 60 and above amounted to P171.55 billion, or 22% of the P779.22 billion in health expenditures in 2018.

Individuals aged 60-64 spent P66.94 billion, or 8.6% of total health spending. In the 65 and over age bracket, spending was P104.61 billion, or 13.4% — the largest of any age group.

Philippine Institute for Development Studies (PIDS) Senior Research Fellow Michael Ralph M. Abrigo said the elderly are the most likely to get sick, with expensive levels of care required.

“Medical afflictions towards the end of life are usually the most expensive,” Mr. Abrigo said in an e-mail.

Of the P171.55 billion in health spending for the elderly, around P44.45 billion were spent by the population segment with comorbidities — existing conditions that make them more vulnerable to illness.

Out-of-pocket payments by households in this segment amounted to P101.17 billion, or around 59% of the bill.

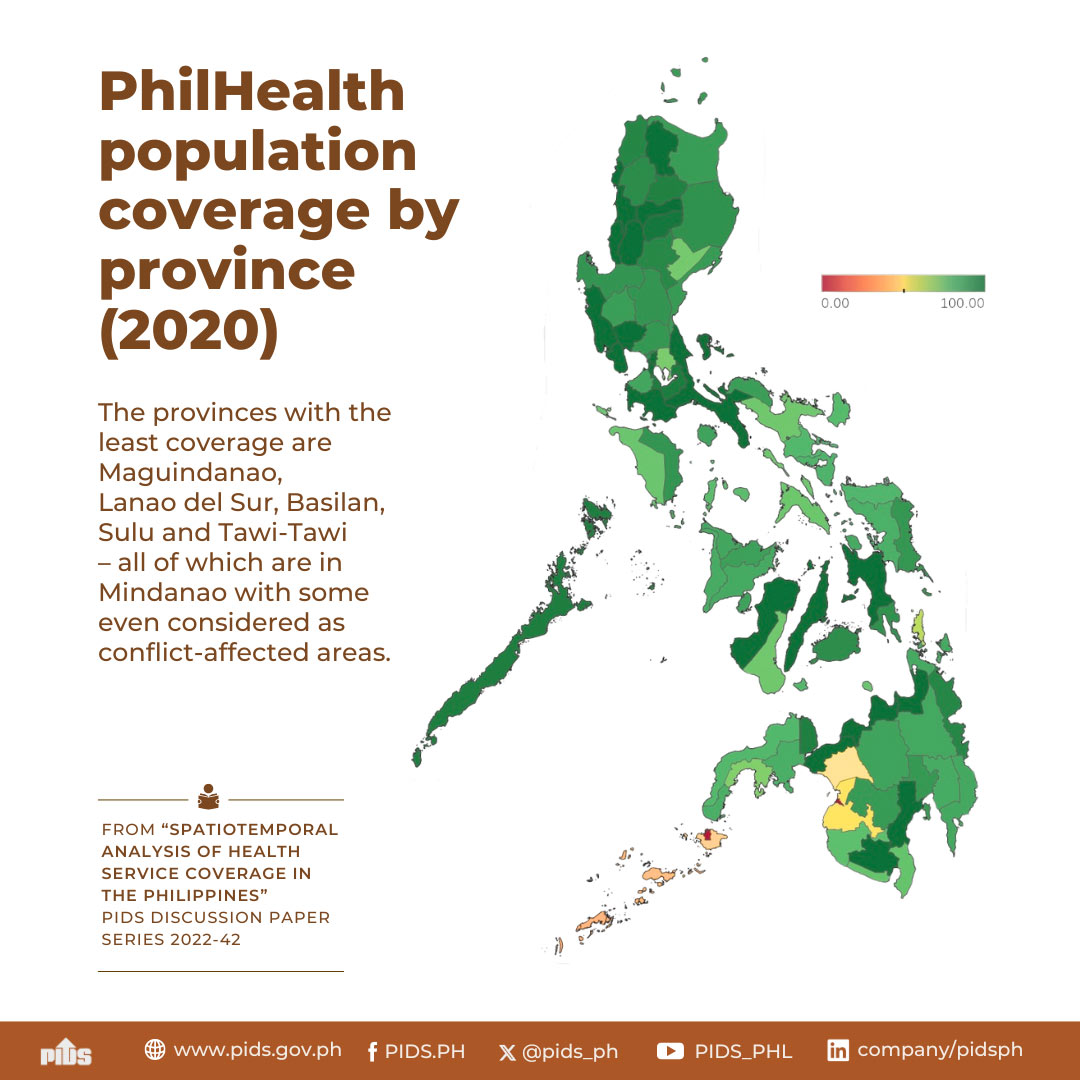

The remainder was financed by the Philippine Health Insurance Corp. or PhilHealth, which provided P32.51 billion (19% of the total). Also providing funds were “domestic revenue-based or central government schemes,” P16.33 billion (9.5%); “state/regional/local government schemes,” P10.06 billion (5.9%); health maintenance organizations, P8.05 billion (4.7%); insurance, P2.81 billion (1.6%); enterprise financing schemes, P359 million (0.2%); and government-based voluntary insurance, P250 million (0.1%).

University of Asia and the Pacific (UA&P) School of Economics Senior Economist Cid L. Terosa said in a separate email: “The fledgling state of our national health insurance system explains in part the higher share of out of pocket spending among senior citizens.”

“The health expenditure data clearly show the spending burden of most Filipinos for health. The data can be used to buttress the national social security and health insurance systems in ways that will ease the health spending burden of most Filipinos and improve their social protection and quality of life,” Mr. Terosa said.

PIDS’ Mr. Abrigo noted that private spending has been growing faster compared to public spending on healthcare over the past 25 years.

“This could be for a number of reasons, including improving purchasing power among households, increasing private health care costs (especially in-patient care), complementarities between private and public spending, and, sadly, limited social health insurance coverage,” he said.

“On complementarities between public and private spending, we have a number of papers at PIDS where we document that enrollment in PhilHealth increases total health expenditures, which is not necessarily a negative thing. It just means that people are demanding more health care because it is cheaper to access them with social health insurance,” he further explained.

Mr. Abrigo expects health spending for senior citizens to have increased in 2019 given the increasing number of the elderly and costs of hospital care, as well as stronger demand that arose from improving household purchasing power.

However, he noted expenditures for this year “would be difficult to predict.”

“(E)ven without COVID-19, the elderly are still more likely to get sick compared with the rest of the population so they will still require health care services. Also, the elderly population is still growing,” he said.

“But now the economy is on the downturn because of COVID-19, which may dampen household purchasing power. Also, it is quite difficult to access health care services with all the community quarantine being imposed and the restrictions on travel and public transportation. Add in risk aversion among the population who would rather wait out the pandemic instead of visiting health care providers… The final outcome depends on which effect is bigger,” he added.

UA&P’s Mr. Terosa said out-of-pocket spending may have gone higher this year due to “extreme pressure on the country’s finances during the pandemic.”

“Given the state of our social security and health insurance systems, it is possible that those receiving pensions have been spending more for health concerns,” Mr. Terosa said.

According to the PSA’s Philippine National Health Accounts, health spending for individuals aged 60 and above amounted to P171.55 billion, or 22% of the P779.22 billion in health expenditures in 2018.

Individuals aged 60-64 spent P66.94 billion, or 8.6% of total health spending. In the 65 and over age bracket, spending was P104.61 billion, or 13.4% — the largest of any age group.

Philippine Institute for Development Studies (PIDS) Senior Research Fellow Michael Ralph M. Abrigo said the elderly are the most likely to get sick, with expensive levels of care required.

“Medical afflictions towards the end of life are usually the most expensive,” Mr. Abrigo said in an e-mail.

Of the P171.55 billion in health spending for the elderly, around P44.45 billion were spent by the population segment with comorbidities — existing conditions that make them more vulnerable to illness.

Out-of-pocket payments by households in this segment amounted to P101.17 billion, or around 59% of the bill.

The remainder was financed by the Philippine Health Insurance Corp. or PhilHealth, which provided P32.51 billion (19% of the total). Also providing funds were “domestic revenue-based or central government schemes,” P16.33 billion (9.5%); “state/regional/local government schemes,” P10.06 billion (5.9%); health maintenance organizations, P8.05 billion (4.7%); insurance, P2.81 billion (1.6%); enterprise financing schemes, P359 million (0.2%); and government-based voluntary insurance, P250 million (0.1%).

University of Asia and the Pacific (UA&P) School of Economics Senior Economist Cid L. Terosa said in a separate email: “The fledgling state of our national health insurance system explains in part the higher share of out of pocket spending among senior citizens.”

“The health expenditure data clearly show the spending burden of most Filipinos for health. The data can be used to buttress the national social security and health insurance systems in ways that will ease the health spending burden of most Filipinos and improve their social protection and quality of life,” Mr. Terosa said.

PIDS’ Mr. Abrigo noted that private spending has been growing faster compared to public spending on healthcare over the past 25 years.

“This could be for a number of reasons, including improving purchasing power among households, increasing private health care costs (especially in-patient care), complementarities between private and public spending, and, sadly, limited social health insurance coverage,” he said.

“On complementarities between public and private spending, we have a number of papers at PIDS where we document that enrollment in PhilHealth increases total health expenditures, which is not necessarily a negative thing. It just means that people are demanding more health care because it is cheaper to access them with social health insurance,” he further explained.

Mr. Abrigo expects health spending for senior citizens to have increased in 2019 given the increasing number of the elderly and costs of hospital care, as well as stronger demand that arose from improving household purchasing power.

However, he noted expenditures for this year “would be difficult to predict.”

“(E)ven without COVID-19, the elderly are still more likely to get sick compared with the rest of the population so they will still require health care services. Also, the elderly population is still growing,” he said.

“But now the economy is on the downturn because of COVID-19, which may dampen household purchasing power. Also, it is quite difficult to access health care services with all the community quarantine being imposed and the restrictions on travel and public transportation. Add in risk aversion among the population who would rather wait out the pandemic instead of visiting health care providers… The final outcome depends on which effect is bigger,” he added.

UA&P’s Mr. Terosa said out-of-pocket spending may have gone higher this year due to “extreme pressure on the country’s finances during the pandemic.”

“Given the state of our social security and health insurance systems, it is possible that those receiving pensions have been spending more for health concerns,” Mr. Terosa said.