The self employed and professionals, or SEPs, will get no benefit from the government’s tax reform program which is now under considation by the Senate. Indeed, PIDS, the government economic think tank says SEPs are better off under the current tax law.

A PIDS paper suggest that the tax-reform program could fall short of expectations due to the lack of incentives for SEPs to pay taxes. Why should SEPs, who have managed to stay underground unknown to the BIR, surface now for no good reason?

The much awaited tax reform program is expected to generate additional revenues of P51.3 billion in 2018, P96.5 billion in 2019, and P99.9 billion from 2020 onward.

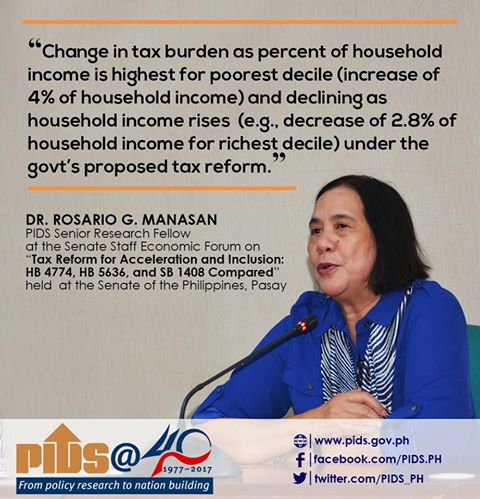

But PIDS senior research fellow Rosario G. Manasan thinks “the high estimates are unlikely to be achieved because of an increased risk of noncompliance among SEPs who are expected to face higher effective tax rates under all three bills, in comparison to those under the current system.”

Manasan said additional revenues could even be lower if tax collection is inefficient (in other words, corrupt). A five-percentage-point reduction in tax-collection efficiency could cut estimates by more than half.

How does the tax reform proposal affect the self-employed and professionals?

HB 4774, HB 5636 and SB 1408 all propose to divide SEPs into two groups depending on the size of their gross sales or gross receipts, i.e., (i) SEPs with gross sales/receipts below the VAT threshold (under the three bills, the VAT threshold will be raised from P1.5 million to P3 million). and (ii) SEPs with gross sales/ receipts above the VAT threshold.

On the one hand, SEPs with gross sales/ receipts below the VAT threshold will be taxed at eight percent of gross sales/ receipts in lieu of the VAT and other percentage taxes. On the other hand, SEPs with gross sales/receipts above P3 million will face a tax rate of 30 percent based on their net income, i.e., they will be taxed in the same manner as corporations under HB 4774 and HB 5636.

SB 1408 proposes to tax SEPs with gross sales/ receipts above P3 million using the tax rate schedule that will be applicable to CIEs (compensation income earners). All three bills propose to reduce the optional standard deduction to 20 percent from the current 40 percent of gross income.

What do all these mean?

According to Manasan, under the proposed bills, “SEPs with annual net income between P3 million and P8.95 million will be taxed more heavily than compensation income earners with comparable income levels from 2020 onwards. The opposite will be true for SEPs with annual net income above P8.95 million.

“Second, the proposed tax treatment of SEPs with gross sales/receipts below P3 million under HB 4774, HB 5636 and SB 1408 introduces severe horizontal inequity in the PIT (personal income tax) system.

“Under these bills, the effective tax rates (i.e., the ratio of tax liability to net income) faced by SEPs with gross sales/receipts below P3 million depends on their “profit margin,” i.e., the ratio of their net income to their gross sales/receipts.

“SEPs with lower profit margins (e.g., small store owners, food service providers, public transport operators, small contractors, and small/ medium scale entrepreneurs, in general) will have higher ETRs or effective tax rate than SEPs with higher profit margins (e.g., lawyers, doctors, accountants, and consultants).

“In other words, SEPs with higher profit margins will be given more favorable tax treatment than those with lower profit margins. Moreover, SEPs with profit margins greater than 27 percent will have ETRs lower than 30 percent, placing them in a favorable situation tax-wise compared to SEPs with yearly gross sales/ receipts above P3 million.

Also, Manasan pointed out, SEPs with gross sales/receipts between P1.5 million and P3 million and with profit margins higher than 60 percent will get better tax treatment than wage income earners with comparable income as well as SEPs with gross sales/receipts greater than P3 million.

There are other interesting technical points raised in the PIDS paper than can be accommodated in this column. Those interested can refer to: https://pidswebs.pids.gov.ph/CDN/PUBLICATIONS/pidsdps1727.pdf

I just want to reiterate points I have consistently raised in this space and voiced in conversations with policy makers. First is the need to think of how the new tax rules will be implemented. It is not enough to tinker with mathematical tax models without regard to how corrupt tax examiners will collect from tax payers. Preventing corruption must be a concern.

In other words, we need a very simple tax return of no more than two pages rather than the forbidding forms they have now. If the Singaporeans can manage world class tax collection effort with a simple tax return form, maybe that’s the route to take.<

Simplicity also means the number of tax returns a self employed or professional must file must be cut to one. Right now, SEPs must file a VAT return every month, an income tax return every quarter and a final tax return every April.

Then give SEPs good options other than having to present an itemized return which is subject to corruption. The 40 percent standard optional deduction is something I have always used, even if I know I may be paying more than I should. It is simple and not subject to any fund raising effort by the tax examiner.

It is sad they are reducing it to 20 percent. But at least it is still there. I understand, DOF wanted it removed outright. What would be ideal is for a personal income tax rate for SEPs that incorporates what they now collect from us on VAT.

Then again, why should we even pay VAT when there is hardly any input VAT we can claim in a one man business run from the home? VAT works for a manufacturing business. For SEPs, it is just an excuse to charge another tax.

The simpler the better. A self employed retiree should be able to do his own tax return without help from an accountant.

I share the anxiety many in the business sector have for the health of our economy that now hangs on the passage of the tax reform bill. I don’t want to think of how badly the international banks and investors will react, if the bill fails to pass the Senate and subsequently, the bicameral conference committee. It won’t be good.

But since we are reforming the tax system anyway, let us do it right. And by right, it shouldn’t be just from the perspective of what is good or convenient for government. They must also consider what is fair and convenient for the taxpayer.

Our policy makers must not forget that after all, it is the taxpayer that must part with hard earned income to pay the prescribed tax rates. Simplify. Simplify. Simplify. That cannot be emphasized enough.

Self employed and professionals should also speak up. Divided, the tax planners can do as they please. But SEPs can be a formidable group… there are so many of us, more so than the soft drink manufacturers and the cooperatives whose views are being heard.

Accountants and lawyers, in particular, should make their voices heard now. Let us avoid the crying and gnashing of teeth once the bill becomes law as presently written in a way that’s not to our interest.

A PIDS paper suggest that the tax-reform program could fall short of expectations due to the lack of incentives for SEPs to pay taxes. Why should SEPs, who have managed to stay underground unknown to the BIR, surface now for no good reason?

The much awaited tax reform program is expected to generate additional revenues of P51.3 billion in 2018, P96.5 billion in 2019, and P99.9 billion from 2020 onward.

But PIDS senior research fellow Rosario G. Manasan thinks “the high estimates are unlikely to be achieved because of an increased risk of noncompliance among SEPs who are expected to face higher effective tax rates under all three bills, in comparison to those under the current system.”

Manasan said additional revenues could even be lower if tax collection is inefficient (in other words, corrupt). A five-percentage-point reduction in tax-collection efficiency could cut estimates by more than half.

How does the tax reform proposal affect the self-employed and professionals?

HB 4774, HB 5636 and SB 1408 all propose to divide SEPs into two groups depending on the size of their gross sales or gross receipts, i.e., (i) SEPs with gross sales/receipts below the VAT threshold (under the three bills, the VAT threshold will be raised from P1.5 million to P3 million). and (ii) SEPs with gross sales/ receipts above the VAT threshold.

On the one hand, SEPs with gross sales/ receipts below the VAT threshold will be taxed at eight percent of gross sales/ receipts in lieu of the VAT and other percentage taxes. On the other hand, SEPs with gross sales/receipts above P3 million will face a tax rate of 30 percent based on their net income, i.e., they will be taxed in the same manner as corporations under HB 4774 and HB 5636.

SB 1408 proposes to tax SEPs with gross sales/ receipts above P3 million using the tax rate schedule that will be applicable to CIEs (compensation income earners). All three bills propose to reduce the optional standard deduction to 20 percent from the current 40 percent of gross income.

What do all these mean?

According to Manasan, under the proposed bills, “SEPs with annual net income between P3 million and P8.95 million will be taxed more heavily than compensation income earners with comparable income levels from 2020 onwards. The opposite will be true for SEPs with annual net income above P8.95 million.

“Second, the proposed tax treatment of SEPs with gross sales/receipts below P3 million under HB 4774, HB 5636 and SB 1408 introduces severe horizontal inequity in the PIT (personal income tax) system.

“Under these bills, the effective tax rates (i.e., the ratio of tax liability to net income) faced by SEPs with gross sales/receipts below P3 million depends on their “profit margin,” i.e., the ratio of their net income to their gross sales/receipts.

“SEPs with lower profit margins (e.g., small store owners, food service providers, public transport operators, small contractors, and small/ medium scale entrepreneurs, in general) will have higher ETRs or effective tax rate than SEPs with higher profit margins (e.g., lawyers, doctors, accountants, and consultants).

“In other words, SEPs with higher profit margins will be given more favorable tax treatment than those with lower profit margins. Moreover, SEPs with profit margins greater than 27 percent will have ETRs lower than 30 percent, placing them in a favorable situation tax-wise compared to SEPs with yearly gross sales/ receipts above P3 million.

Also, Manasan pointed out, SEPs with gross sales/receipts between P1.5 million and P3 million and with profit margins higher than 60 percent will get better tax treatment than wage income earners with comparable income as well as SEPs with gross sales/receipts greater than P3 million.

There are other interesting technical points raised in the PIDS paper than can be accommodated in this column. Those interested can refer to: https://pidswebs.pids.gov.ph/CDN/PUBLICATIONS/pidsdps1727.pdf

I just want to reiterate points I have consistently raised in this space and voiced in conversations with policy makers. First is the need to think of how the new tax rules will be implemented. It is not enough to tinker with mathematical tax models without regard to how corrupt tax examiners will collect from tax payers. Preventing corruption must be a concern.

In other words, we need a very simple tax return of no more than two pages rather than the forbidding forms they have now. If the Singaporeans can manage world class tax collection effort with a simple tax return form, maybe that’s the route to take.<

Simplicity also means the number of tax returns a self employed or professional must file must be cut to one. Right now, SEPs must file a VAT return every month, an income tax return every quarter and a final tax return every April.

Then give SEPs good options other than having to present an itemized return which is subject to corruption. The 40 percent standard optional deduction is something I have always used, even if I know I may be paying more than I should. It is simple and not subject to any fund raising effort by the tax examiner.

It is sad they are reducing it to 20 percent. But at least it is still there. I understand, DOF wanted it removed outright. What would be ideal is for a personal income tax rate for SEPs that incorporates what they now collect from us on VAT.

Then again, why should we even pay VAT when there is hardly any input VAT we can claim in a one man business run from the home? VAT works for a manufacturing business. For SEPs, it is just an excuse to charge another tax.

The simpler the better. A self employed retiree should be able to do his own tax return without help from an accountant.

I share the anxiety many in the business sector have for the health of our economy that now hangs on the passage of the tax reform bill. I don’t want to think of how badly the international banks and investors will react, if the bill fails to pass the Senate and subsequently, the bicameral conference committee. It won’t be good.

But since we are reforming the tax system anyway, let us do it right. And by right, it shouldn’t be just from the perspective of what is good or convenient for government. They must also consider what is fair and convenient for the taxpayer.

Our policy makers must not forget that after all, it is the taxpayer that must part with hard earned income to pay the prescribed tax rates. Simplify. Simplify. Simplify. That cannot be emphasized enough.

Self employed and professionals should also speak up. Divided, the tax planners can do as they please. But SEPs can be a formidable group… there are so many of us, more so than the soft drink manufacturers and the cooperatives whose views are being heard.

Accountants and lawyers, in particular, should make their voices heard now. Let us avoid the crying and gnashing of teeth once the bill becomes law as presently written in a way that’s not to our interest.