The challenge toward achieving universal health care coverage in the Philippines is how to extend health care coverage to the informal sector.

Under the National Health Insurance Program, the formal sector is mandatorily enrolled in the social health insurance program, while those in the informal sector, mostly self-employed and the near poor, have to enroll voluntarily. Coverage of the informal sector is still slow, according to a research of the UPecon Foundation – Health Equity and Financial Protection in Asia Project (UPecon-HEFPA).

University of the Philippines School of Economics (UPSE) Associate Professor Joseph Capuno said insurance subsidies in the form of premium vouchers, information kits, and assistance to complete and submit enrollment forms can increase insurance uptake by the informal sector. Capuno stressed this in a symposium on “Towards Universal SHI Coverage in the Philippines: Setting the Subsidies Right for the Informal Sector”, held last September 27, at the UPSE. The forum was cosponsored by the Philippine Institute for Development Studies (PIDS) and part of the observance of the 11th Development Policy Research Month.

Through the PhilHealth Prepaid Premium (3P) study of the UPecon-HEFPA team, it was found that premium subsidies bundled with information drives (information kit and SMS messages) could help increase the enrollment in social health insurance (SHI). However, financial burdens placed on families by the enrollment process must be addressed. The identified Individually Paying Program (IPP) members of the 3P study were given 3P certificates worth six hundred pesos each, which they can use to enroll in PhilHealth. They were all also given information packets about the IP program, its requirements and procedures. Very few 3P certificate recipients enrolled, however, and it was found out that this was due to the lack of funds to cover the transaction costs of their enrollment (like transportation fares).

“Premium subsidies may be less effective than measures that reduce the burden placed on families by the enrollment process,” said Capuno.

Moreover, the PhilHealth benefit delivery rate (BDR) for inpatient care for the informal sector in 2010 was only 10.51 percent, according to UPSE Associate Professor Stella Luz Quimbo. The BDR is a summary measure of social health insurance performance that reflects the enrollment of the target population (coverage rate), its accessibility to beneficiaries (claim rate), and the magnitude of social health insurance benefits relative to medical expenditures (reimbursement rate).

“To improve the BDR of the informal sector, efforts should be directed toward expanding the coverage rate (50%) and the reimbursement rate (currently at 37.34%),” Quimbo said.

Highlighting the importance of health insurance to the poor and vulnerable groups, in particular to the informal sector, UPSE Associate Professor Aleli Kraft said improving financial protection through health insurance will help poor households avoid cutting down their basic food and nonfood expenditures, especially those for medical care and education.

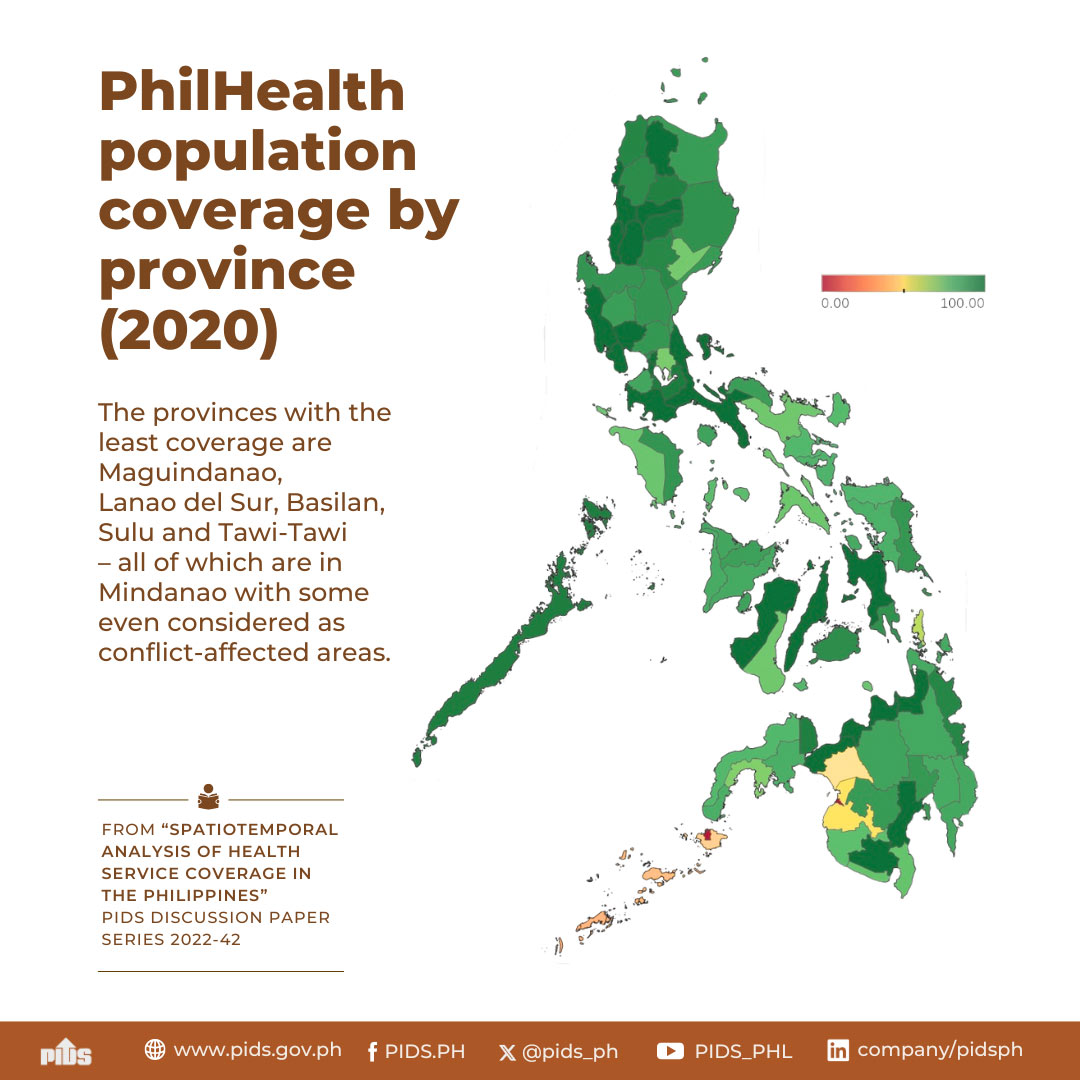

PhilHealth coverage as of 2011 is 82 percent of the population or about 74 million. Nevertheless, huge challenges remain on how to effectively and rationally utilize insurance benefits for beneficiaries and how to keep beneficiaries enrolled, particularly those in the informal sector.

Under the National Health Insurance Program, the formal sector is mandatorily enrolled in the social health insurance program, while those in the informal sector, mostly self-employed and the near poor, have to enroll voluntarily. Coverage of the informal sector is still slow, according to a research of the UPecon Foundation – Health Equity and Financial Protection in Asia Project (UPecon-HEFPA).

University of the Philippines School of Economics (UPSE) Associate Professor Joseph Capuno said insurance subsidies in the form of premium vouchers, information kits, and assistance to complete and submit enrollment forms can increase insurance uptake by the informal sector. Capuno stressed this in a symposium on “Towards Universal SHI Coverage in the Philippines: Setting the Subsidies Right for the Informal Sector”, held last September 27, at the UPSE. The forum was cosponsored by the Philippine Institute for Development Studies (PIDS) and part of the observance of the 11th Development Policy Research Month.

Through the PhilHealth Prepaid Premium (3P) study of the UPecon-HEFPA team, it was found that premium subsidies bundled with information drives (information kit and SMS messages) could help increase the enrollment in social health insurance (SHI). However, financial burdens placed on families by the enrollment process must be addressed. The identified Individually Paying Program (IPP) members of the 3P study were given 3P certificates worth six hundred pesos each, which they can use to enroll in PhilHealth. They were all also given information packets about the IP program, its requirements and procedures. Very few 3P certificate recipients enrolled, however, and it was found out that this was due to the lack of funds to cover the transaction costs of their enrollment (like transportation fares).

“Premium subsidies may be less effective than measures that reduce the burden placed on families by the enrollment process,” said Capuno.

Moreover, the PhilHealth benefit delivery rate (BDR) for inpatient care for the informal sector in 2010 was only 10.51 percent, according to UPSE Associate Professor Stella Luz Quimbo. The BDR is a summary measure of social health insurance performance that reflects the enrollment of the target population (coverage rate), its accessibility to beneficiaries (claim rate), and the magnitude of social health insurance benefits relative to medical expenditures (reimbursement rate).

“To improve the BDR of the informal sector, efforts should be directed toward expanding the coverage rate (50%) and the reimbursement rate (currently at 37.34%),” Quimbo said.

Highlighting the importance of health insurance to the poor and vulnerable groups, in particular to the informal sector, UPSE Associate Professor Aleli Kraft said improving financial protection through health insurance will help poor households avoid cutting down their basic food and nonfood expenditures, especially those for medical care and education.

PhilHealth coverage as of 2011 is 82 percent of the population or about 74 million. Nevertheless, huge challenges remain on how to effectively and rationally utilize insurance benefits for beneficiaries and how to keep beneficiaries enrolled, particularly those in the informal sector.