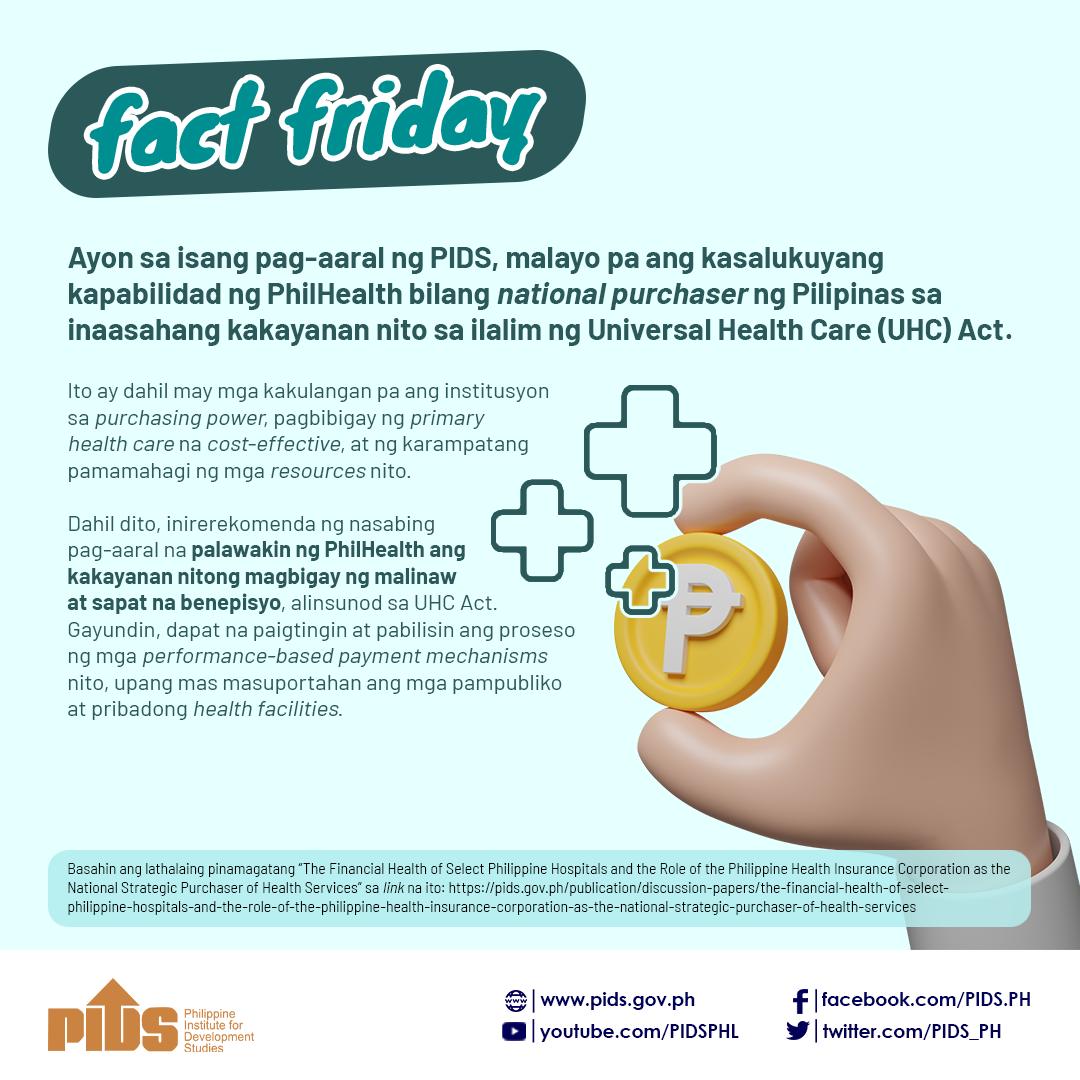

A study by the state think tank Philippine Institute for Development Studies (PIDS) is calling for the expansion of the Philippine Health Insurance Corporation`s (PhilHealth) health coverage for catastrophic illnesses through private supplemental insurance.

According to the PIDS study, titled `Exploring private supplemental insurance for catastrophic illnesses`, authored by Noel Juban and Benito R. Reverente, the PhilHealth `Z` package, designed to address catastrophic cases, has limited funding and covers only certain types of diseases, with a few selected government hospitals providing these benefits. Also, there are certain criteria that have to be met before a patient can be eligible to avail of the Z benefits such as age and severity of disease. Thus, having a supplemental fund could increase the scope of this program.

Launched in June 2012, the PhilHealth `Z` Benefits program provides financial coverage of Php100,000 to Php300,000 for catastrophic cases such as breast cancer, prostate cancer, cervical cancer, acute lymphocytic leukemia, kidney transplant, limb prosthesis, coronary artery bypass graft surgery, surgery for tetralogy of Fallot, and surgery for ventricular septal defect.

Based on the definition of the World Health Organization, out-of-pocket expenditure in health can be considered `catastrophic` if it exceeds 40 percent of a household`s nonfood expenses.

The Z benefits cover all diagnosis and treatment expenses, such as hospital fees, professional fees, medicines, and mandatory laboratory examinations.

Protection from catastrophic health expenditures is an essential component of the government`s Kalusugan Pangkalahatan (Health for All) program. Juban and Reverente argued that catastrophic illnesses can push a family into poverty. They explained that the frequent, prolonged hospitalization and very expensive treatments associated with these illnesses could result in high out-of-pocket (OOP) payments, depleting the financial resources of a household, especially the poor.

`Hence, without adequate financial risk protection, any health condition may cause catastrophic expenditures and impoverishment, depending on the income of the affected household and the cost of the management for the condition,` the authors stated.

According to the WHO, up to 11 percent of the population in some countries experience severe financial hardship each year due to health expenses, with up to 5 percent forced into poverty. In Asia, the Philippines has one of the lowest percentages and intensities of catastrophic payments. It is estimated that 4.6 percent of Philippine households incur catastrophic payments at threshold OOP of 10 percent of the total expenditures on health care.

The study, an output of the PIDS-DOH health system research management project, noted that a supplemental fund from the private sector for catastrophic illness financing is currently not feasible. However, the study suggests that PhilHealth could tap the private sector in providing financial protection for catastrophic illnesses.

`Utilizing the private sector to address the limitations of the current Z benefits packages will enable the government to provide financial protection to more Filipinos and come closer to providing quality health care for all,` the study noted.

The study suggested for Philhealth to set up a supplemental fund that can operate like a private insurance. It will be a voluntary insurance scheme that PhilHealth members can avail of for themselves to obtain additional benefits. It however cautioned that this would require additional manpower, infrastructure, information technology, and capacity building for the management of a fund.

Another avenue is for PhilHealth to outsource the management of supplemental funds to HMOs. In either scenario, the premiums can either be contributed by the private sector or paid for by the government through taxes.

`Since the private health maintenance organization (HMO) market is driven by competition and profit, PhilHealth should cover individuals who are likely to be rejected by HMO coverage, such as the poor and high-risk patients. Likewise, PhilHealth should conduct actuarial studies to provide accurate costing and incidence data, to be used in the formulation of the Z benefit packages to ensure that the funds remain viable,' it further recommended.

The study also called for the enhancement of the existing setup where the private sector provides supplemental insurance through HMOs, insurance companies, and self-insured companies. The government could give tax incentives to companies that provide catastrophic illness coverage for employees, either through HMOs or self-insurance.

It further pointed the need to regulate HMOs through the Insurance Commission (IC), the government agency that regulates and supervises the insurance and preneed industries. The IC, it noted, should be able to review the premiums of HMOs and examine their financial viability.

`There is no single body responsible or appropriate for the regulation of HMOs. The DOH can partially regulate the health aspect of HMOs through licensing. The Securities and Exchange Commission (SEC), on the other hand, registers, but does not regulate, HMOs. Neither the DOH nor the SEC is able to assess the financial sustainability of HMOs,` the study noted.

According to the PIDS study, titled `Exploring private supplemental insurance for catastrophic illnesses`, authored by Noel Juban and Benito R. Reverente, the PhilHealth `Z` package, designed to address catastrophic cases, has limited funding and covers only certain types of diseases, with a few selected government hospitals providing these benefits. Also, there are certain criteria that have to be met before a patient can be eligible to avail of the Z benefits such as age and severity of disease. Thus, having a supplemental fund could increase the scope of this program.

Launched in June 2012, the PhilHealth `Z` Benefits program provides financial coverage of Php100,000 to Php300,000 for catastrophic cases such as breast cancer, prostate cancer, cervical cancer, acute lymphocytic leukemia, kidney transplant, limb prosthesis, coronary artery bypass graft surgery, surgery for tetralogy of Fallot, and surgery for ventricular septal defect.

Based on the definition of the World Health Organization, out-of-pocket expenditure in health can be considered `catastrophic` if it exceeds 40 percent of a household`s nonfood expenses.

The Z benefits cover all diagnosis and treatment expenses, such as hospital fees, professional fees, medicines, and mandatory laboratory examinations.

Protection from catastrophic health expenditures is an essential component of the government`s Kalusugan Pangkalahatan (Health for All) program. Juban and Reverente argued that catastrophic illnesses can push a family into poverty. They explained that the frequent, prolonged hospitalization and very expensive treatments associated with these illnesses could result in high out-of-pocket (OOP) payments, depleting the financial resources of a household, especially the poor.

`Hence, without adequate financial risk protection, any health condition may cause catastrophic expenditures and impoverishment, depending on the income of the affected household and the cost of the management for the condition,` the authors stated.

According to the WHO, up to 11 percent of the population in some countries experience severe financial hardship each year due to health expenses, with up to 5 percent forced into poverty. In Asia, the Philippines has one of the lowest percentages and intensities of catastrophic payments. It is estimated that 4.6 percent of Philippine households incur catastrophic payments at threshold OOP of 10 percent of the total expenditures on health care.

The study, an output of the PIDS-DOH health system research management project, noted that a supplemental fund from the private sector for catastrophic illness financing is currently not feasible. However, the study suggests that PhilHealth could tap the private sector in providing financial protection for catastrophic illnesses.

`Utilizing the private sector to address the limitations of the current Z benefits packages will enable the government to provide financial protection to more Filipinos and come closer to providing quality health care for all,` the study noted.

The study suggested for Philhealth to set up a supplemental fund that can operate like a private insurance. It will be a voluntary insurance scheme that PhilHealth members can avail of for themselves to obtain additional benefits. It however cautioned that this would require additional manpower, infrastructure, information technology, and capacity building for the management of a fund.

Another avenue is for PhilHealth to outsource the management of supplemental funds to HMOs. In either scenario, the premiums can either be contributed by the private sector or paid for by the government through taxes.

`Since the private health maintenance organization (HMO) market is driven by competition and profit, PhilHealth should cover individuals who are likely to be rejected by HMO coverage, such as the poor and high-risk patients. Likewise, PhilHealth should conduct actuarial studies to provide accurate costing and incidence data, to be used in the formulation of the Z benefit packages to ensure that the funds remain viable,' it further recommended.

The study also called for the enhancement of the existing setup where the private sector provides supplemental insurance through HMOs, insurance companies, and self-insured companies. The government could give tax incentives to companies that provide catastrophic illness coverage for employees, either through HMOs or self-insurance.

It further pointed the need to regulate HMOs through the Insurance Commission (IC), the government agency that regulates and supervises the insurance and preneed industries. The IC, it noted, should be able to review the premiums of HMOs and examine their financial viability.

`There is no single body responsible or appropriate for the regulation of HMOs. The DOH can partially regulate the health aspect of HMOs through licensing. The Securities and Exchange Commission (SEC), on the other hand, registers, but does not regulate, HMOs. Neither the DOH nor the SEC is able to assess the financial sustainability of HMOs,` the study noted.