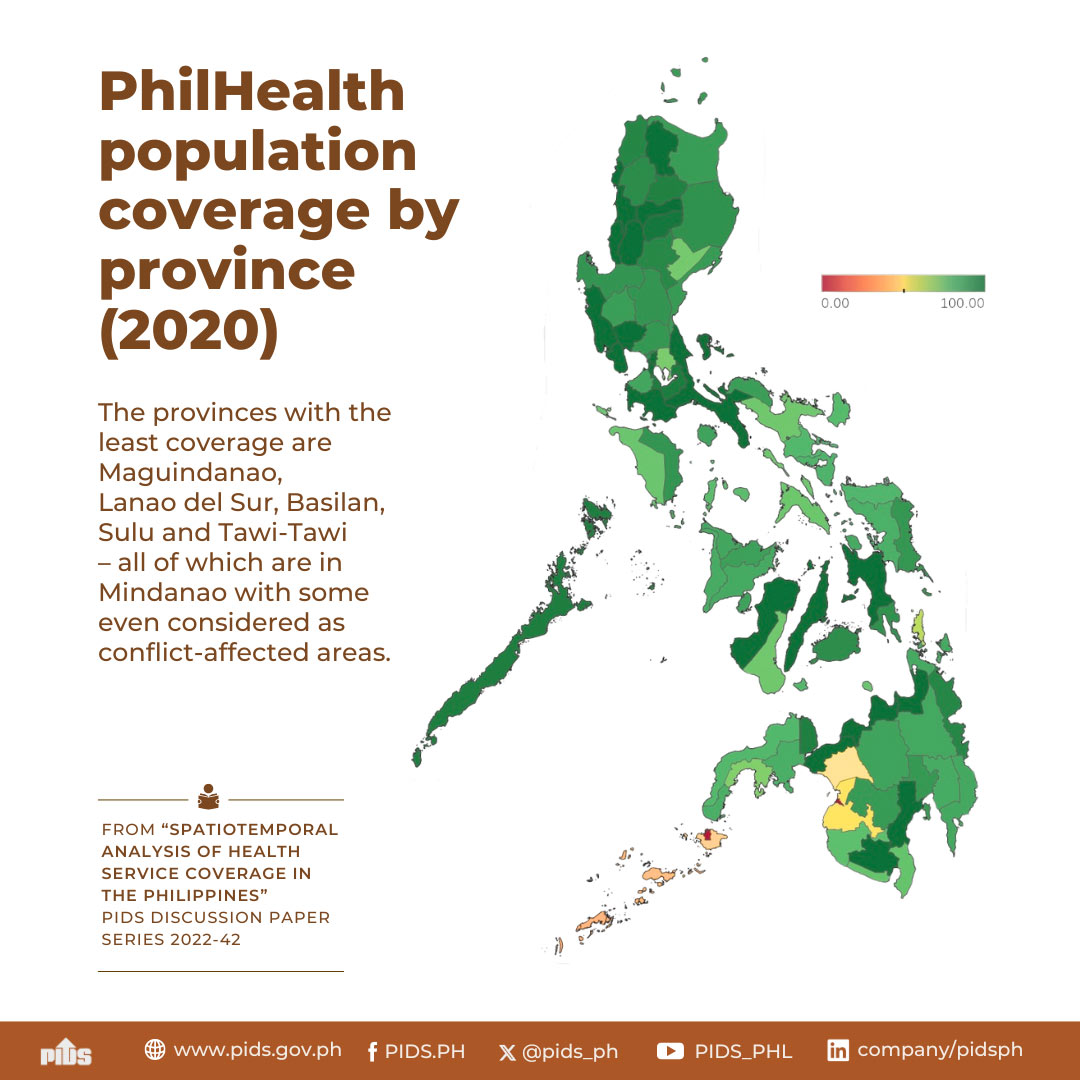

IMPROVING the taxing power of local government units (LGUs) and revising the Internal Revenue Allotment (IRA) formula will help local governments support the country’s devolved health system, according to the Philippine Institute for Development Studies (PIDS).

In a statement, PIDS Supervising Research Specialist Janet Cuenca said the provinces currently have “weak taxing power” and low IRA funds making it difficult for them to maintain and operate hospitals.

Relatedly, private think tank IBON pointed out that apart from LGUs, households also do not have enough funds to pay for their medical and health needs, especially in the time of the coronavirus 2019 (Covid-19).

Cuenca said the health spending of LGUs from IRA are too low to be able to support the operation of hospitals, pay the salaries of health workers and buy hospital beds and other medical supplies.

“Given their limited funds, LGUs tend to spend less on maintaining hospitals and rely more on the national government’s financial assistance such as the Health Facilities Enhancement Program [HFEP] of the Department of the Health,” Cuenca said.

PIDS explained that the HFEP is intended to support the upgrade of barangay health

stations, rural health units, government hospitals and health facilities in provinces. The program also finances the training of health professionals.

The DOH also subsidizes vertical programs such as the Expanded Program in Immunization, the control of infectious or communicable diseases, and the deployment of human resources for health in the LGUs. All of these are allowed under Section 17(f) of the Local Government Code.

“Increasing [the] share of DOH spending at the provincial level certainly diminishes the health expenditure decentralization ratio, and in practical terms, it weakens health devolution,” Cuenca, however, said.

Out of pocket

To illustrate the current financial dilemma of households with Covid-19 patients. Maricar R. Piedad of Ibon Foundation Inc. cited the bill of a recovered patient that reached P1.312 million for a 15-day confinement for Covid-19.

Piedad said bulk of the medical bill came from charges for laboratory tests, doctors’ professional fees, intubation, and the ventilator and respirator used throughout the patient’s admission.

She said the patient was lucky that all the funds were covered by PhilHealth at that time. Since April 15, PhilHealth no longer covered the entire amount of the bill of Covid-19 patients.

According to PhilHealth Circular 2020-0009, Piedad said patients with mild pneumonia can get a maximum coverage of P43,997, while moderate and severe pneumonia patients can have a maximum amount coverage of P143,267 and P333,519, respectively. Critical patients, on the other hand, can access benefits of up to P786,384.

“If the patient with the P1.312-million medical bill for example had been confined after April 15, PhilHealth would have just paid the P333,519 maximum coverage for severe pneumonia patients. The remaining P978,481 or almost 75 percent of the patient’s total medical bill would have to be paid out-of-pocket,” Piedad said.

This is a major concern, especially now that millions are jobless or have experienced a significant reduction in their income. She added that given the situation, many Filipinos no longer consult doctors despite experiencing Covid-19 symptoms, in order to save money.

Piedad said the government should speed up efforts to broaden and build up testing and hospital capacity. She said it is high time that government make health care accessible and affordable for every Filipino.

She said the government can start by making Covid-19 testing and treatment free for all. Piedad said the pandemic will continue as long as infected Filipinos are not isolated and treated.

In a statement, PIDS Supervising Research Specialist Janet Cuenca said the provinces currently have “weak taxing power” and low IRA funds making it difficult for them to maintain and operate hospitals.

Relatedly, private think tank IBON pointed out that apart from LGUs, households also do not have enough funds to pay for their medical and health needs, especially in the time of the coronavirus 2019 (Covid-19).

Cuenca said the health spending of LGUs from IRA are too low to be able to support the operation of hospitals, pay the salaries of health workers and buy hospital beds and other medical supplies.

“Given their limited funds, LGUs tend to spend less on maintaining hospitals and rely more on the national government’s financial assistance such as the Health Facilities Enhancement Program [HFEP] of the Department of the Health,” Cuenca said.

PIDS explained that the HFEP is intended to support the upgrade of barangay health

stations, rural health units, government hospitals and health facilities in provinces. The program also finances the training of health professionals.

The DOH also subsidizes vertical programs such as the Expanded Program in Immunization, the control of infectious or communicable diseases, and the deployment of human resources for health in the LGUs. All of these are allowed under Section 17(f) of the Local Government Code.

“Increasing [the] share of DOH spending at the provincial level certainly diminishes the health expenditure decentralization ratio, and in practical terms, it weakens health devolution,” Cuenca, however, said.

Out of pocket

To illustrate the current financial dilemma of households with Covid-19 patients. Maricar R. Piedad of Ibon Foundation Inc. cited the bill of a recovered patient that reached P1.312 million for a 15-day confinement for Covid-19.

Piedad said bulk of the medical bill came from charges for laboratory tests, doctors’ professional fees, intubation, and the ventilator and respirator used throughout the patient’s admission.

She said the patient was lucky that all the funds were covered by PhilHealth at that time. Since April 15, PhilHealth no longer covered the entire amount of the bill of Covid-19 patients.

According to PhilHealth Circular 2020-0009, Piedad said patients with mild pneumonia can get a maximum coverage of P43,997, while moderate and severe pneumonia patients can have a maximum amount coverage of P143,267 and P333,519, respectively. Critical patients, on the other hand, can access benefits of up to P786,384.

“If the patient with the P1.312-million medical bill for example had been confined after April 15, PhilHealth would have just paid the P333,519 maximum coverage for severe pneumonia patients. The remaining P978,481 or almost 75 percent of the patient’s total medical bill would have to be paid out-of-pocket,” Piedad said.

This is a major concern, especially now that millions are jobless or have experienced a significant reduction in their income. She added that given the situation, many Filipinos no longer consult doctors despite experiencing Covid-19 symptoms, in order to save money.

Piedad said the government should speed up efforts to broaden and build up testing and hospital capacity. She said it is high time that government make health care accessible and affordable for every Filipino.

She said the government can start by making Covid-19 testing and treatment free for all. Piedad said the pandemic will continue as long as infected Filipinos are not isolated and treated.