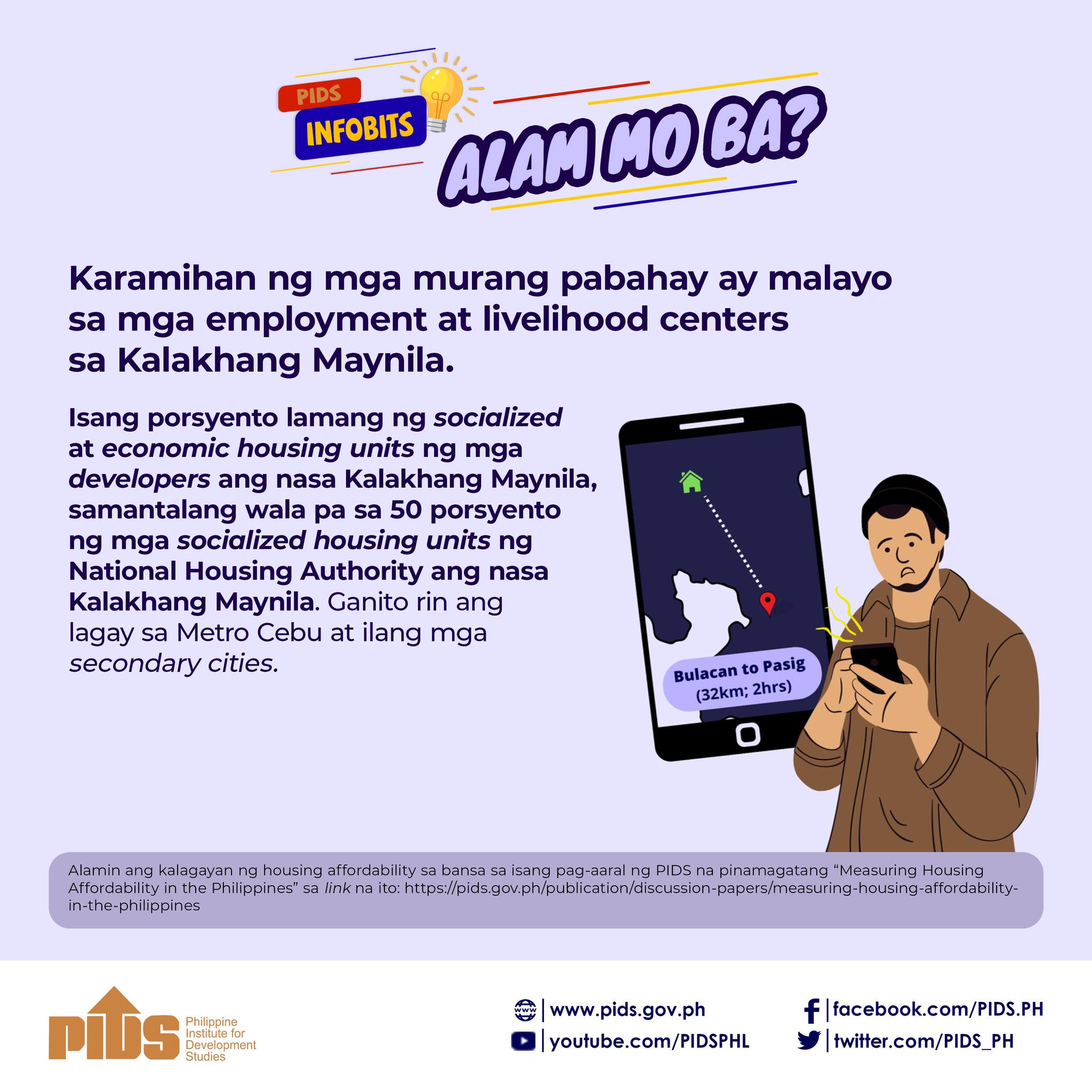

Understanding housing affordability is key to addressing the housing problem. This study evaluates housing affordability in the Philippines using conventional approaches. It compares Residual Income Method estimates with those from the 30 percent of income standard that is commonly used as a measure of housing affordability in the country. The authors note that the 30 percent of income standard overestimates housing affordability among the poor and underestimates among those in the upper income levels relative to the Residual Income Method. In other words, the poor and low-income households are not able to afford housing priced at 30% of their income, while the middle income to rich are able to afford housing priced at more than 30% of their income. The study also shows that the structure of family (i.e., size and presence of children) affects housing affordability. A comparison of household affordability levels with the available housing supply in the formal market shows that a typical household in the Philippines experiences housing stress due to inadequate affordable housing specifically near places of work or livelihood and the low capacity to qualify for mortgage financing. This situation tends to worsen over time as the growth of residential prices surpasses the growth of incomes. Given the housing affordability problem in the country, the government must undertake reforms to prevent speculative increases in land and residential prices and to reexamine the role of the public sector in the delivery of affordable housing. The former would involve adopting a standard valuation of land and real estate properties; the effective implementation of idle land tax by all LGUs and regulation on borrowings such as financial ceilings on household debt to income ratio and other anti-speculative measures. On the other hand, government provision of affordable housing would require an overhaul of the housing subsidy programs and creation of a public housing fund to finance direct subsidies to households, public sector construction of affordable housing (for rent or ownership); and housing support in times of disaster. At the town or city level, Community Development Funds (CDFs) anchored to municipal councils should be established to support housing projects arising from urban renewal or upgrading or other urbanization challenges.

Comments to this paper are welcome within 60 days from the date of posting. Email publications@pids.gov.ph

Citations

This publication has been cited 15 times

- DailyGuardian. 2022. 30% housing price-to-income rule not fit for PH–PIDS study. DailyGuardian.

- DailyGuardian. 2022. LGU-private sector partnership, key to curbing PH’s housing shortage. DailyGuardian.

- Jocson, Luisa Maria Jacinta. 2022. Philippine government told to cut red tape in housing development. BusinessWorld.

- Mary Ann LL. Reyes . 2025. A new approach to socialized housing. Philippine Star .

- Ordinario, Cai. 2022. PIDS: Most Filipinos can’t afford a house near jobs. BusinessMirror.

- Ordinario, Cai. 2022. PIDS study presents alternatives to address PHL housing backlog. Businessmirror.

- Panay News. 2022. Housing. Panay News.

- Philippine Institute for Development Studies. 2022. Government urged to adopt more integrative approach to affordable housing . Philippine Institute for Development Studies.

- Philippine Institute for Development Studies. 2022. LGU-private sector partnership, key to curbing PH’s housing shortage. Philippine Institute for Development Studies.

- Philippine Institute for Development Studies. 2022. 30% housing price-to-income rule not fit for PH–PIDS study. Philippine Institute for Development Studies.

- Reyes, Mary Ann. 2025. Phl’s worsening housing backlog. Philippine Star.

- Reyes, Rizal Raoul. 2023. CLI aims to be more active in socialized housing program. BusinessMirror.

- Rizal Raoul Reyes . 2025. NHA rolls out game-changing initiatives; PIDS cites need for reforms to address housing problems. BusinessMirror.

- Rizal Raoul Reyes . 2025. NHA rolls out game-changing initiatives; PIDS cites need for reforms to address housing problems. BusinessMirror.

- The Philippine Star. 2022. Policy reforms needed vs land price hikes – PIDS. Louella Desiderio .