The Philippines has finally reached "investment grade" status. Fitch Ratings` decision to upgrade the country`s sovereign credit rating to "BBB-" from "BB+" last March 27, 2013 grabbed news headlines. What does this mean for the government, the economy, and business? More importantly, what is in store for the ordinary Filipino struggling to make a living?

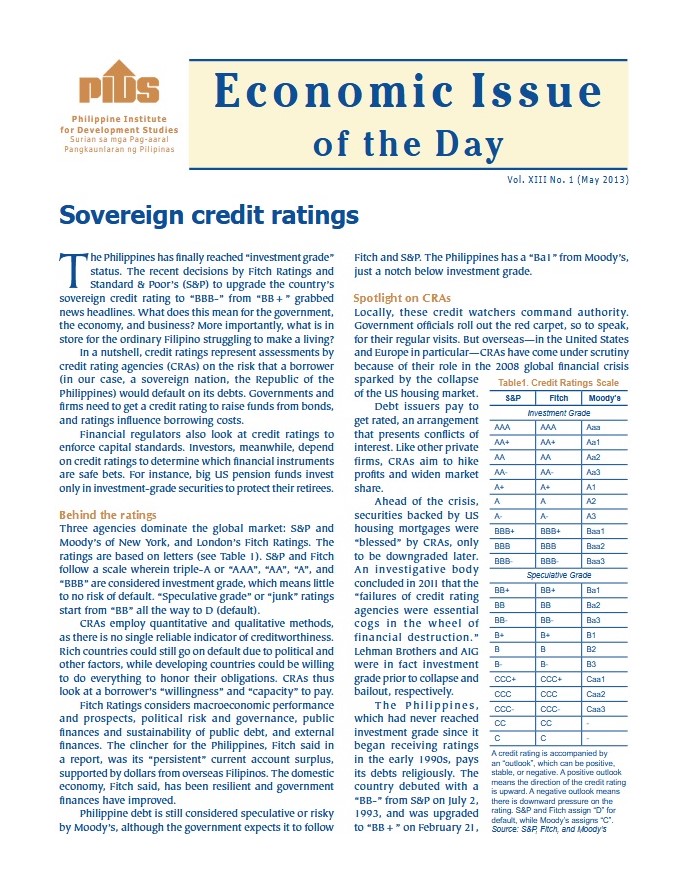

In a nutshell, credit ratings represent assessments by credit rating agencies on the risk that a borrower (in our case, a sovereign nation, the Republic of the Philippines) would default on its debts. Governments and firms need to get a credit rating to raise funds from bonds, and ratings influence borrowing costs. Credit ratings are not to be taken as "buy" or "sell" recommendations, as they are merely "opinions" about credit risk. At most, an investment-grade rating can be regarded as a "seal of good housekeeping" as far as the government`s financial stability is concerned.