Back in 2022, government launched the Pambansang Pabahay Para sa Pilipinas (4PH) program or the country’s national flagship housing project with the goal of having zero informal settlers by 2028.

Housing loan borrowers who will avail themselves of units under the 4PH program, through a Pag-IBIG housing loan, are supposed to enjoy lower interest rates than what Pag-IBIG Fund currently provides. The Department of Human Settlements and Urban Development (DHSUD) will subsidize up to five percent of the loan’s outstanding interest rate, allowing borrowers to pay an even reduced interest rate on their loans.

The 4PH program aims to build 6.5 million housing units through government-led housing initiatives and address the country’s current housing backlog by building one million housing units yearly until 2028. It prioritizes low-income groups and first-time homeowners and requires local government unit nomination.

A report by UN Habitat estimates that housing need in the Philippines will increase from 6.5 million to 22 million units by 2040.

Can government catch up given the rapid population growth?

Nathaniel von Einsiedel, former president of the Chamber of Real Estate Builders’ Association (CREBA), has called on the government to rethink its 4PH program.

In a paper submitted to DHSUD, he pointed out that although government has raised the price ceilings for socialized housing units in the hope of enticing more private sector participation in the 4PH program, the fact remains that over 50 percent of the population cannot afford even the lowest price ceiling.

The new price ceilings, he emphasized, made it even more unaffordable to the majority of Filipinos. These new ceilings are: for a four-story socialized condominium building, P933,320 for a 22-square-meter unit; P1.06 million for a 25-sqm unit; and P1.145 million for a 27-sqm unit. The unit prices are higher in taller buildings with the highest being P1.62 million for a 27- sqm unit, but these prices do not include land acquisition cost.

Von Einsiedel stressed that studies have shown that even before the 4PH program, up to 70 percent of the population could not afford the government price ceilings.

The problem, he said, is that people’s incomes have not risen commensurately with the escalating prices of land and construction costs, while the government policy continues to insist on addressing the housing problem through the traditional “housing as a commodity of trade” approach instead of the more realistic and proven “human settlements” approach. “The problem of low-income housing is not housing; it is low income,” he added.

According to the Philippine Statistics Authority, a family of five requires a minimum of P13,873 a month to meet basic food and non-food expenses. Of this amount, government prescribes that the maximum monthly housing expenditure should not exceed 30 percent or P4,162 a month.

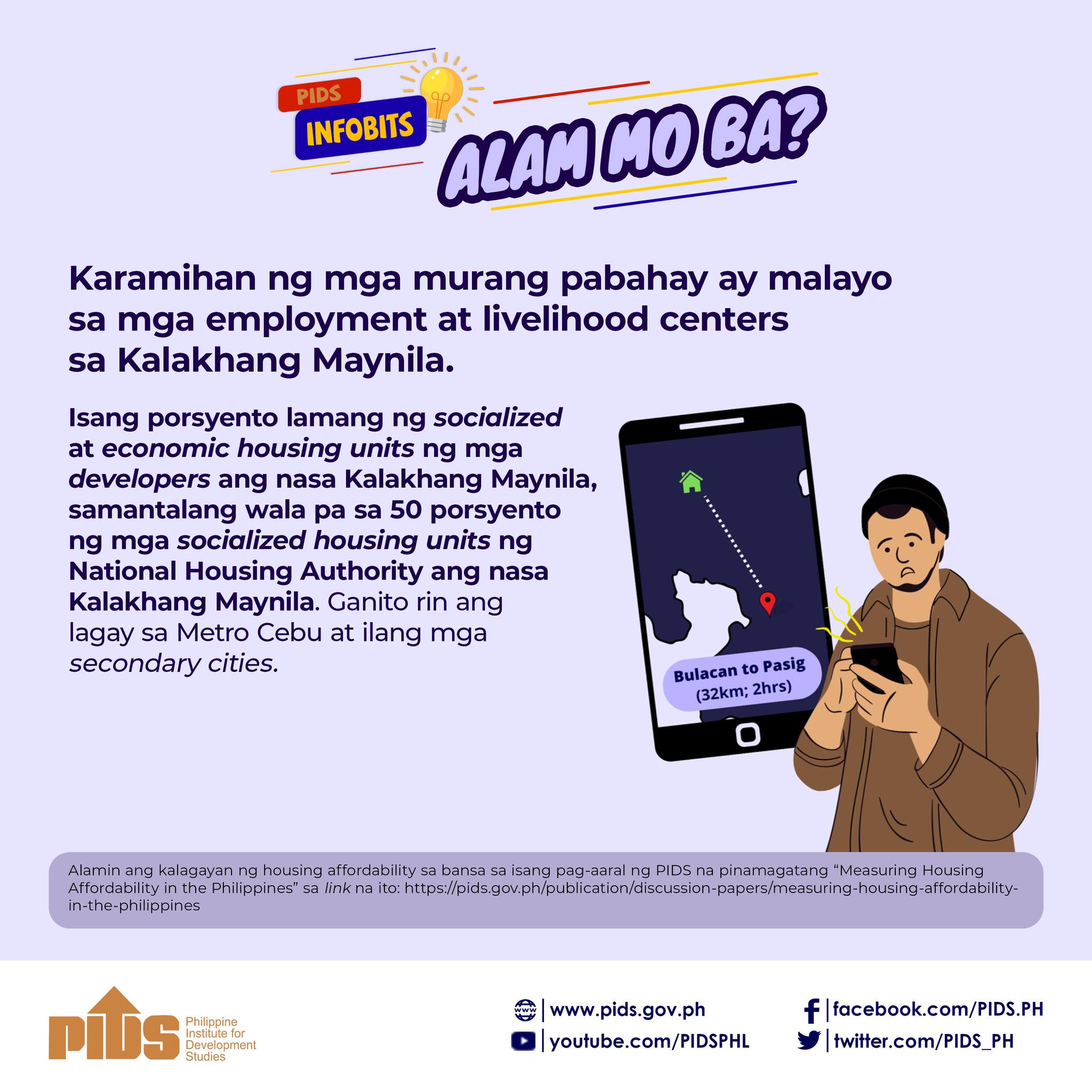

Meanwhile, a 2022 study by the Philippine institute for Development Studies (PIDS) revealed that the poor and low-income households are not able to afford the price of housing at 30 percent of their income. The same study emphasized that the development of affordable housing should be government-led and not private sector-led.

The PIDS study concluded that for the poor and low-income households, interest subsidies and tax incentives to housing developers will not work. It added that an ownership-focused program implies that government needs to subsidize at least 70 percent of the housing cost per household, which covers land cost and site development.

“The problem with ownership is that the assets of government and the returns to investment are mainly captured by the beneficiaries and government loses control over property rights on these assets and the rights to reclaim and transfer to another eligible household when the beneficiary had acquired properties of its own. In contrast, a land lease and rental housing arrangement will enable government to maximize the use of assets and reduce over time the cost of financing housing for the poor,” the study explained.

Von Einsiedel asked the DHSUD to consider the adoption of the community land trust (CLT) so as to provide an opportunity for low-income households to experience the benefits of homeownership.

He explained that a CLT provides affordable housing in perpetuity through long-term land leasing and homeownership.

A CLT organization owns the land while leasing the latter to the homeowners who will own the houses built on the property. The leases can be as long as 99 years, renewable and inheritable. If the owner decides to sell his home, the CLT organization will have the right to purchase it.

He explained that the separation of ownership of the land and house is one of the strategies CLTs apply to keep homes affordable to future buyers.

Von Einsiedel said that more than 260 CLTs operate in the United States, and more exist in Canada, Kenya, New Zealand, Australia, and the United Kingdom, many of which have been very successful.

CLTs can be adopted by LGUs to develop affordable housing.

The former CREBA chief pointed out that although the Local Government Code and the Urban Development and Housing Act empower LGUs to take direct responsibility in providing affordable housing within their jurisdictions, only a handful have actually done so. These include Valenzuela City, Cebu City, Quezon City, Makati, Manila, and Puerto Princesa.

He is proposing that LGUs establish a combined community land bank and land trust specifically for the purpose of making housing permanently affordable and available to low-income households within their territories. A land bank is a public entity with power to put vacant, abandoned, and deteriorated properties back to productive use according to community goals.

A local government ordinance, he explained, can give a community land bank the power to acquire tax-foreclosed property cost effectively, sell property to buyers or developers driven not by the highest price but by the outcome that aligns with community goals (i.e. affordable housing), extinguish liens and clear title, hold property that are tax-exempt, and generate and collect revenue from delinquent property.

Von Einsiedel said that some LGUs, such as Cagayan de Oro, have an ongoing land banking program to provide resettlement sites for households relocated from disaster-prone areas. Other LGUs like Valenzuela City use the power of eminent domain to acquire land for low-income housing. Valenzuela City created and manages the Disiplina Village whose units are on long-term leases at a monthly rate of P300.

He emphasized that LGUs are empowered to acquire land for public purposes including for housing of low-income households and to purchase properties that have not paid real property taxes. This, he pointed out, can be used to kick-off a land banking program and eventually a land bank (LB) linked with a CLT.

He added that an LB-CLT offers a solution to the housing backlog and that by ensuring a continuing supply of land and separating ownership of a house from the land beneath it, government can assure home buyers that the home remains affordable permanently.