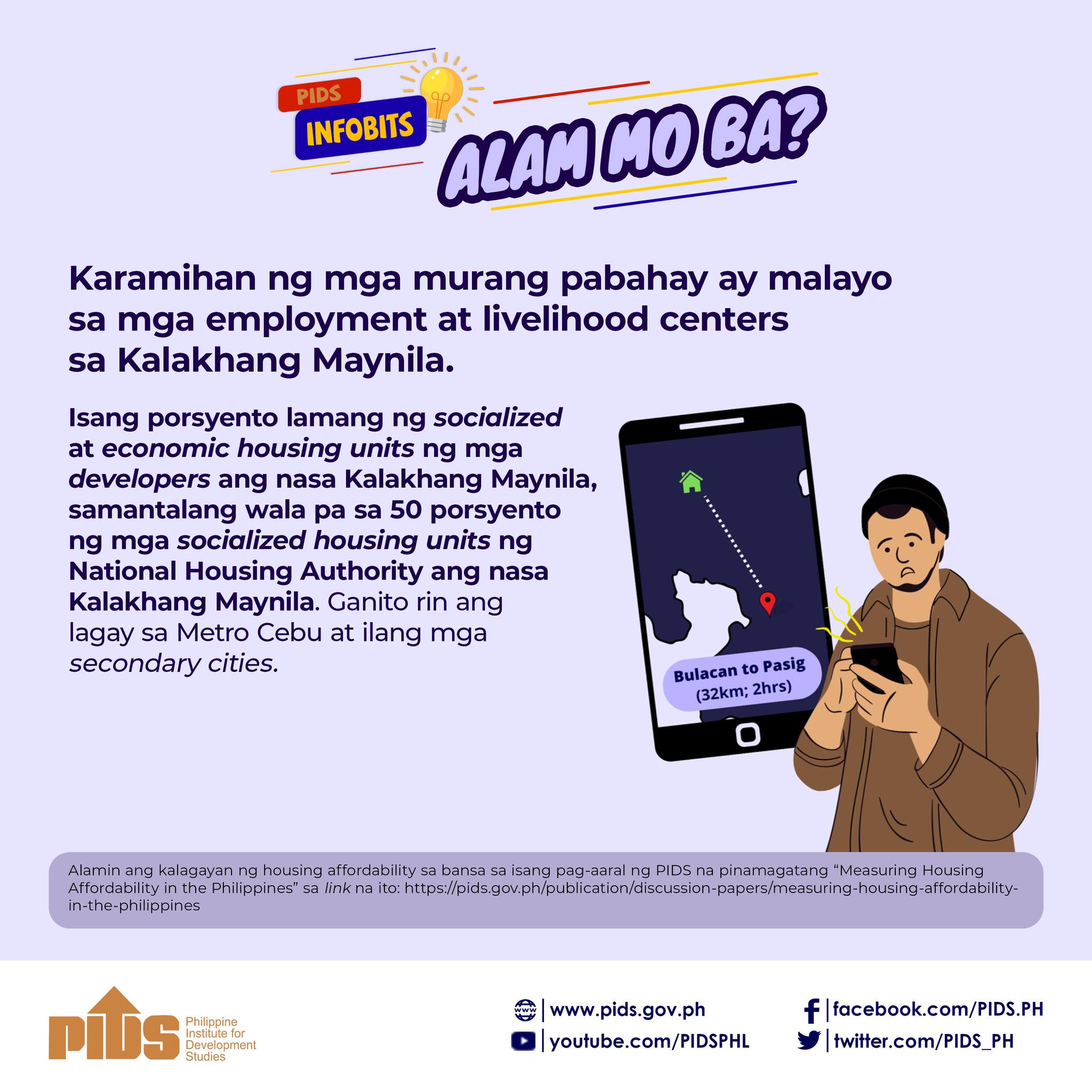

This study evaluates housing affordability using other methods beyond the standard 30 percent income benchmark. By employing the Housing Affordability Index, which considers median family income and average housing prices, the authors find that most Filipino households are income-constrained in purchasing homes. Using the residual income method alongside the 30 percent income standard reveals that the latter overestimates affordability for poorer households, with housing stress particularly evident among low-income groups. The study highlights that socialized and economic housing projects are increasingly situated on the urban fringes, limiting housing options for low- and middle-income households in cities. With residential prices outpacing income growth, the government faces two key objectives: improving housing conditions for poor and vulnerable households and curbing speculative increases in property prices. Proposed solutions include innovative housing interventions and regulatory measures to control property market speculation and ensure affordability.