The government should review the provision of the Pantawid Pamilyang Pilipino Program (4Ps) cash grants to make it more effective and responsive to the needs of its beneficiaries.

This was underscored during a webinar recently organized by state think tank Philippine Institute for Development Studies (PIDS) on “Evaluating the Pantawid Pamilyang Pilipino Program's Payment System”. The webinar featured a PIDS study that examined the program’s payment system in terms of the amount, frequency, and mode of payment delivery of cash transfers.

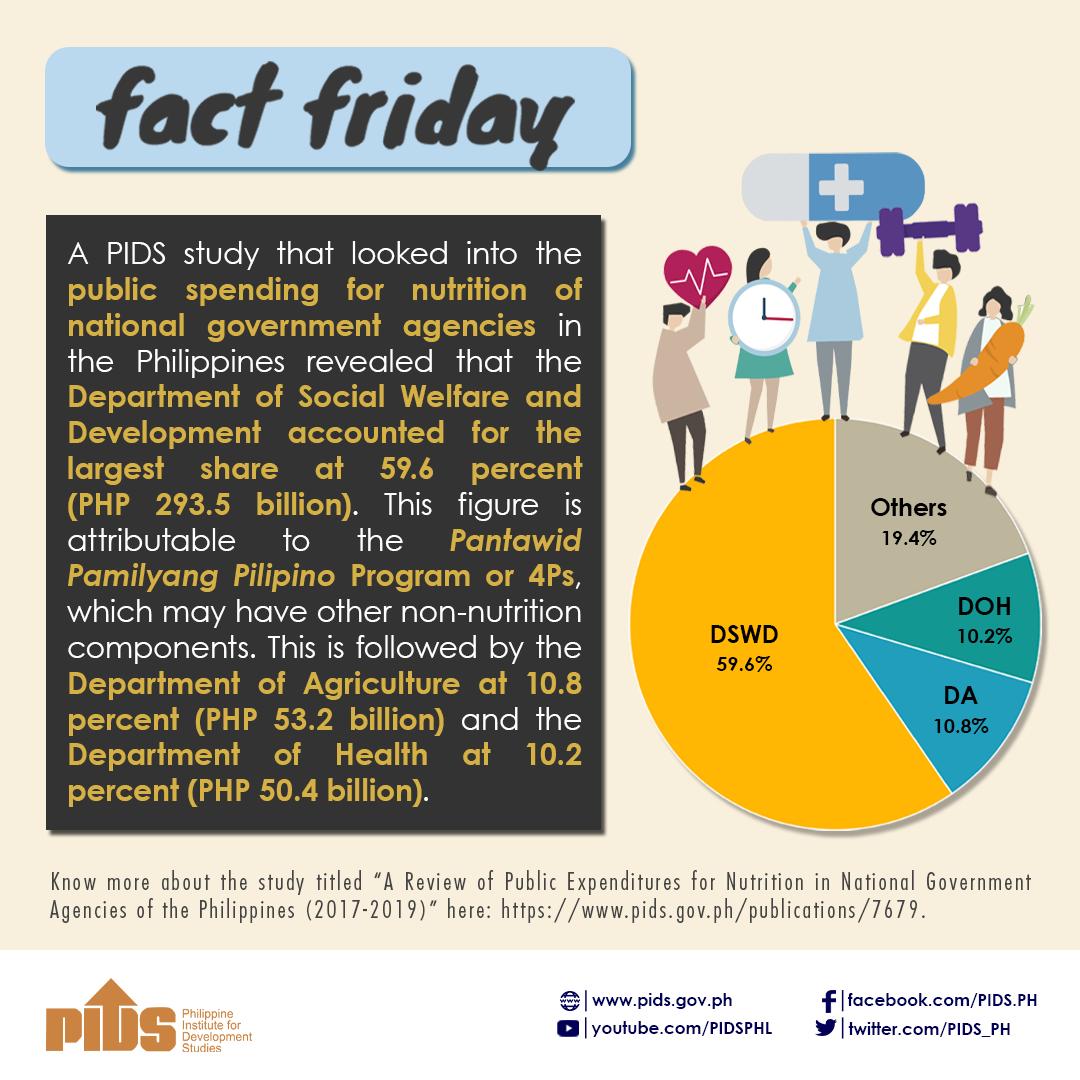

The 4Ps is the government’s flagship social protection program implemented by the Department of Social Welfare and Development (DSWD).

According to PIDS Supervising Research Specialist and coauthor of the study Kris Ann Melad, the amounts of the cash transfers “have remained at their nominal levels from 2008 to 2016, even though their real value has already decreased due to inflation”. She noted that significant increases happened only in 2017 and 2020.

Citing a 2017 study that compared the Philippines with other countries also providing conditional cash transfers, Melad pointed out that “the generosity of the [4Ps] program is actually [at] the bottom 20 percent”.

In terms of frequency of payment, which is currently every two months, the study noted that “there is no strong demand for more frequent payments among the beneficiaries,” with some saying that this would entail additional travel expenses for those who will go to other barangays to access their cash grants. Similarly, program implementers are concerned about the costs that come with increasing the 4Ps’ payment frequency, particularly on operations for compliance monitoring and bank service fees.

In terms of mode of payment, Melad noted that the 4Ps’ payment delivery system has improved over the years, with about 92.6 percent of beneficiaries receiving their cash grants through cash cards as of the second quarter of 2021. While both beneficiaries and program implementers think that cash cards are more convenient than the over-the-counter payment mode, the former still faces challenges concerning the accessibility of automated teller machines (ATMs) and banks in rural areas, the long process of card replacement, and gaps in feedback loop among staff.

To address the challenges faced by the 4Ps beneficiaries, the PIDS study provided some recommendations.

For the grant amount, Melad said there is a need to establish a principle for adjusting the grant amount to make it more responsive, especially when the country enters the recovery phase post-COVID-19 pandemic. Another option is to provide supplementary interventions in the form of other cash assistance or programs.

For the payment frequency, the study emphasized the importance of reliability and predictability of payment schedules more than increasing the frequency of payouts. For reliability, program implementers should ensure that ATMs have enough cash and are not offline or malfunctioning often.

“[The government should ensure] that the payouts are [given on time] and [it should reduce] the barriers in accessing the grants. We also suggest improvements in the processes and [information technology] infrastructure of the DSWD and Land Bank of the Philippines (LBP),” Melad said.

For payment modes, the study called on the LBP and other authorized government depository banks involved in the payment system to “expand the network of ATM and local bank branches in the country to reach all areas”. Moreover, the LBP should find alternative points of cash withdrawal to cover areas without ATMs. ###

Watch the video of this seminar at https://www.facebook.com/PIDS.PH/videos/1260015987759939 or https://www.youtube.com/watch?v=QhW3qtYP4aY.

For more videos of PIDS events, go to https://www.pids.gov.ph/videos.

This was underscored during a webinar recently organized by state think tank Philippine Institute for Development Studies (PIDS) on “Evaluating the Pantawid Pamilyang Pilipino Program's Payment System”. The webinar featured a PIDS study that examined the program’s payment system in terms of the amount, frequency, and mode of payment delivery of cash transfers.

The 4Ps is the government’s flagship social protection program implemented by the Department of Social Welfare and Development (DSWD).

According to PIDS Supervising Research Specialist and coauthor of the study Kris Ann Melad, the amounts of the cash transfers “have remained at their nominal levels from 2008 to 2016, even though their real value has already decreased due to inflation”. She noted that significant increases happened only in 2017 and 2020.

Citing a 2017 study that compared the Philippines with other countries also providing conditional cash transfers, Melad pointed out that “the generosity of the [4Ps] program is actually [at] the bottom 20 percent”.

In terms of frequency of payment, which is currently every two months, the study noted that “there is no strong demand for more frequent payments among the beneficiaries,” with some saying that this would entail additional travel expenses for those who will go to other barangays to access their cash grants. Similarly, program implementers are concerned about the costs that come with increasing the 4Ps’ payment frequency, particularly on operations for compliance monitoring and bank service fees.

In terms of mode of payment, Melad noted that the 4Ps’ payment delivery system has improved over the years, with about 92.6 percent of beneficiaries receiving their cash grants through cash cards as of the second quarter of 2021. While both beneficiaries and program implementers think that cash cards are more convenient than the over-the-counter payment mode, the former still faces challenges concerning the accessibility of automated teller machines (ATMs) and banks in rural areas, the long process of card replacement, and gaps in feedback loop among staff.

To address the challenges faced by the 4Ps beneficiaries, the PIDS study provided some recommendations.

For the grant amount, Melad said there is a need to establish a principle for adjusting the grant amount to make it more responsive, especially when the country enters the recovery phase post-COVID-19 pandemic. Another option is to provide supplementary interventions in the form of other cash assistance or programs.

For the payment frequency, the study emphasized the importance of reliability and predictability of payment schedules more than increasing the frequency of payouts. For reliability, program implementers should ensure that ATMs have enough cash and are not offline or malfunctioning often.

“[The government should ensure] that the payouts are [given on time] and [it should reduce] the barriers in accessing the grants. We also suggest improvements in the processes and [information technology] infrastructure of the DSWD and Land Bank of the Philippines (LBP),” Melad said.

For payment modes, the study called on the LBP and other authorized government depository banks involved in the payment system to “expand the network of ATM and local bank branches in the country to reach all areas”. Moreover, the LBP should find alternative points of cash withdrawal to cover areas without ATMs. ###

Watch the video of this seminar at https://www.facebook.com/PIDS.PH/videos/1260015987759939 or https://www.youtube.com/watch?v=QhW3qtYP4aY.

For more videos of PIDS events, go to https://www.pids.gov.ph/videos.