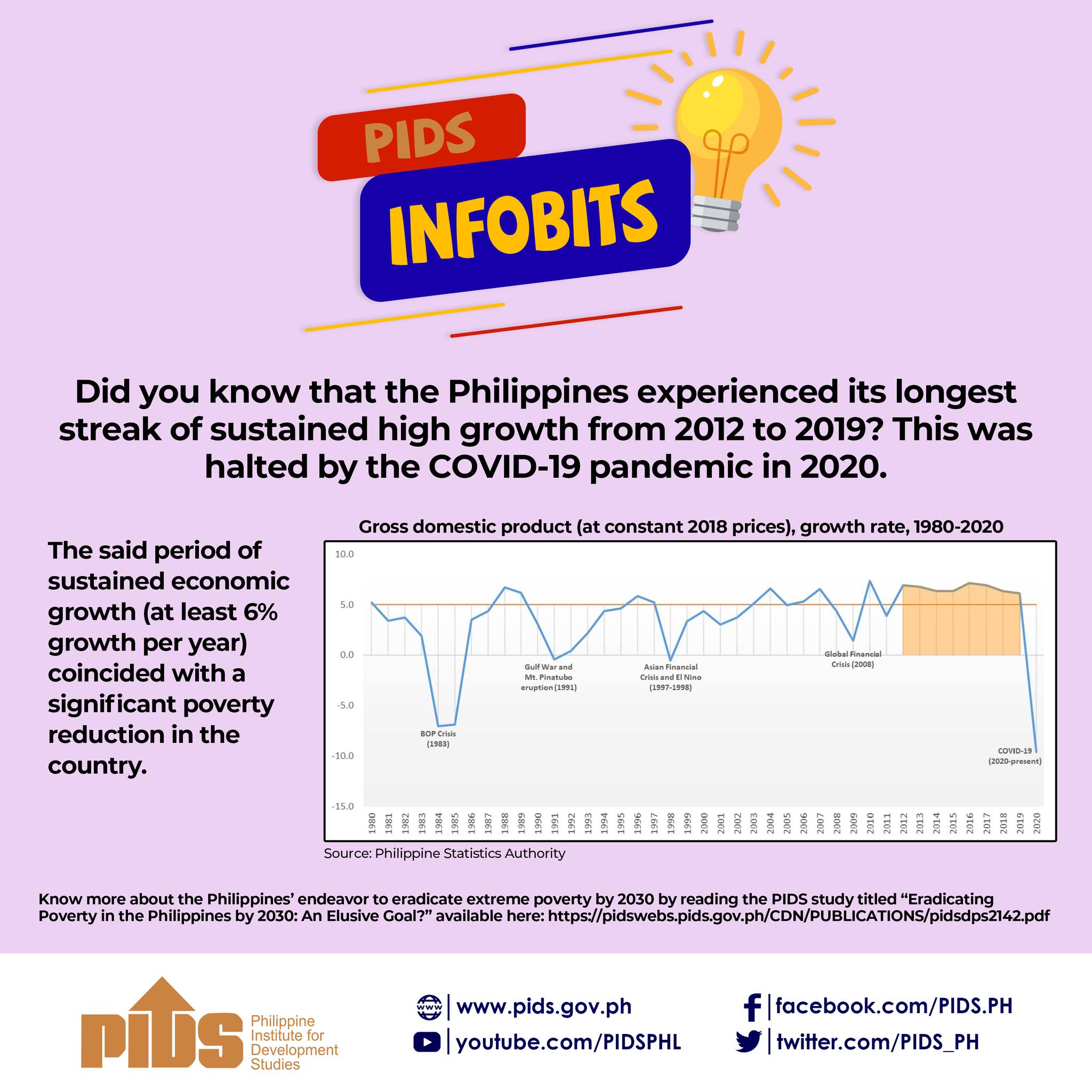

The 2023 Philippine national budget was drafted on the eve of the election of a new president. While aiming to sustain the recovery from the effects of the COVID-19 pandemic and address economic scarring, the new administration needs to manage the implementation of the Mandanas-Garcia Supreme Court Ruling (or Mandanas ruling, which broadens the base for intergovernmental fiscal transfers and fully devolves functions to local governments). Compounding this was the geopolitical tensions in Europe that shook the world in February 2022, disrupting global value chains and triggering the rise in oil and food prices. With the backdrop of these continuing challenges, the new administration has identified its key priorities that aim to address these short-term concerns while also seeking to lead the improvement of the country as it enters the medium to long term.

This paper examines the 2023 National Expenditure Program (NEP), which is also known as the President’s Budget, to see how it budgets for (a) the identified priorities of the new administration and (b) the effects of the pandemic and the Mandanas Ruling. Concerns regarding the pandemic are expected to be reflected not only with the prioritization of health and social protection programs but also efforts to improve the economy—especially given the projected 61.3 percent debt-to-GDP ratio in 2023.

With respect to the Mandanas Ruling, the phased absorption of devolved functions has been met by reduced support to richer local government units (LGUs) from national government programs. For poorer LGUs, policymakers introduced in 2022 the fiscal equalization program known as the Growth Equity Fund (GEF) to be a source of funds for LGUs that cannot absorb devolved functions immediately. The GEF is continued as a policy in 2023 but must be closely monitored.

The last section presents trends in Philippine fiscal deficits and discusses fiscal risks to debt sustainability. An exercise, estimating tax buoyancy, was also conducted to examine the current tax system. The results suggest that debt is sustainable and the current tax system is buoyant though it could still be improved to ensure a stable stream of revenues.

Comments to this paper are welcome within 60 days from the date of posting. Email publications@pids.gov.ph.

Citations

This publication has been cited 8 times

- DailyGuardian. 2022. Poor, lagging LGUs to receive devolution aid share. DailyGuardian.

- DailyGuardian. 2022. Lower debts and deficits, more revenues key to PH recovery. DailyGuardian.

- Domingo, Ronnel. 2022. Gov’t to borrow P135B from domestic market next month. BusinessWorld.

- Guinigundo, Diwa. 2023. Investing a mountain of debt?. BusinessWorld.

- Ordinario, Cai. 2022. ‘New taxes key to PHL fiscal sustainability’. Businessmirror.

- Ordinario, Cai. 2022. Tax allotment for LGUs cut due to Covid scars–DBM. BusinessMirror.

- Philippine Institute for Development Studies. 2022. Experts urge gov’t to tighten fiscal consolidation for PH economic recovery. Philippine Institute for Development Studies.

- RPN News. 2022. ‘New taxes key to PHL fiscal sustainability’. RPN News.