Investing in women entrepreneurs means empowering generations. Charice was making and selling bead accessories to her classmates when she was in high school.

Teaching her the craftwork and the enterprise was her mother Noli, whose pastime was fashioning necklaces and bracelets from beads, strings and accessories bought wholesale in downtown Cebu.

Working with a people’s organization (PO), Noli had little to spare for trends as a single parent to two daughters. She made her own chokers, which caught the eye of co-workers and friends.

Older daughter Charice showed interest and joined Noli in making the handmade trinkets at home. In college, Charice set aside at first her school allowance and later her earnings from the handmade trinkets to go into buying and selling gold jewelry.

When Charice got married, she left the security of government employment and ventured into buying and selling on a smartphone- and web-based marketplace. She wanted the flexibility of time to balance family and enterprise.

For Grace, adversity opened opportunities. A recurring malady forced the single parent to leave the family she had worked for decades.

Moving in to live with a younger sister who had a sari-sari store in a Talamban neighborhood, Grace noted that among the store’s regular patrons were families whose young children left early to go to school.

Grace tried selling breakfast food that could be packed for school lunch. Encouraged by the earnings from the best-selling omelets and processed meat products, Grace went to Carbon market at dawn to buy fish and vegetables she and her sister turned into affordable, healthier meals for breakfast and lunch, which were bought by their neighbors and workers of a nearby company.

Grace pooled the separation pay she received from her former employer and a regular allowance her only son gave her every month. A sociable individual who enjoys cooking and mingling with people, Grace sees a “second life” in the cooking venture, which meets their basic needs and spares savings for the future.

While the Philippines ranks 17th in the World Economic Forum’s Global Gender Gap Report in 2021, there remains several significant “broken ladders” that hamper women from participating more and assuming leadership in business.

According to a March 24 article on bworldonline.com, the World Bank identified these institutional and cultural barriers to gender-inclusive growth: “skills, wage gap, homecare responsibilities and norms,” including biases and stereotypes that constrain women’s access to capital, investments and networks.

One of the proven mechanisms to overturning these gender gaps in work and economic participation is access to micro credit and micro entrepreneurship.

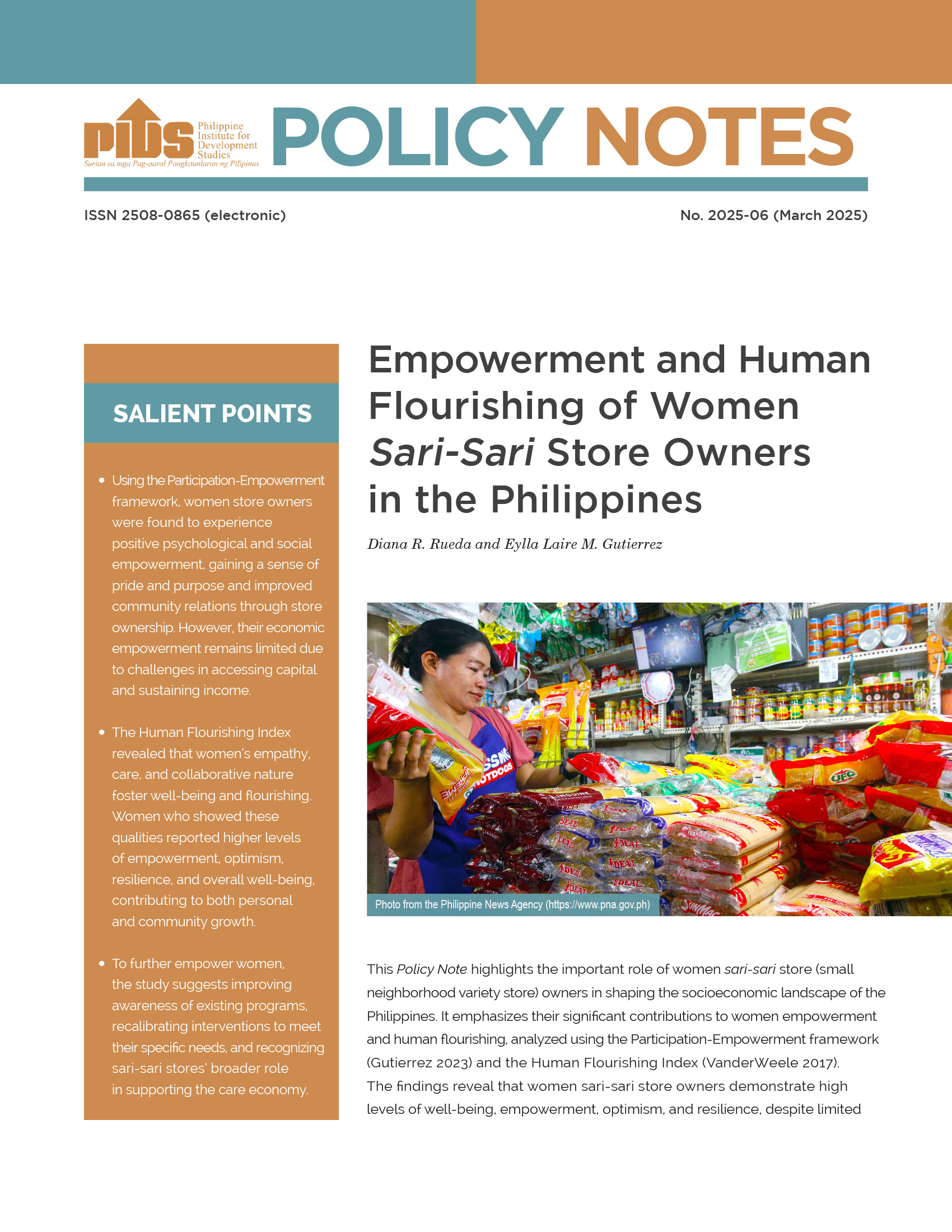

A 2006 study by Rosemary Dinio showed how 150 women owners of “sari-sari” stores used micro loans to achieve personal and family goals and contribute to their communities.

To supplement their families’ monthly family income of P5,001, the women tapped their personal savings, ranging from P1,000 to P5,000, to open a “sari-sari” store.

Through micro-financing, the women entrepreneurs increased their earnings from the stores, as well as their savings to as much as P1,000 a month.

According to the Dinio paper posted on the Philippine Institute for Development Studies, the 150 women and their families benefited from the sari-sari stores’ growth due to improvements of their houses, educational attainment and food consumption.

Other benefits cited by the women were the acquisition of new knowledge, improvement in borrowing capacity, better quality of life and improved status at home and in the community, with some women becoming leaders in their neighborhood.

It is worth pondering that while a thousand pesos seems to have diminished purchasing power, the value of this amount rises significantly when invested in a woman who activates micro funds’ transforming potential for empowerment and independence.