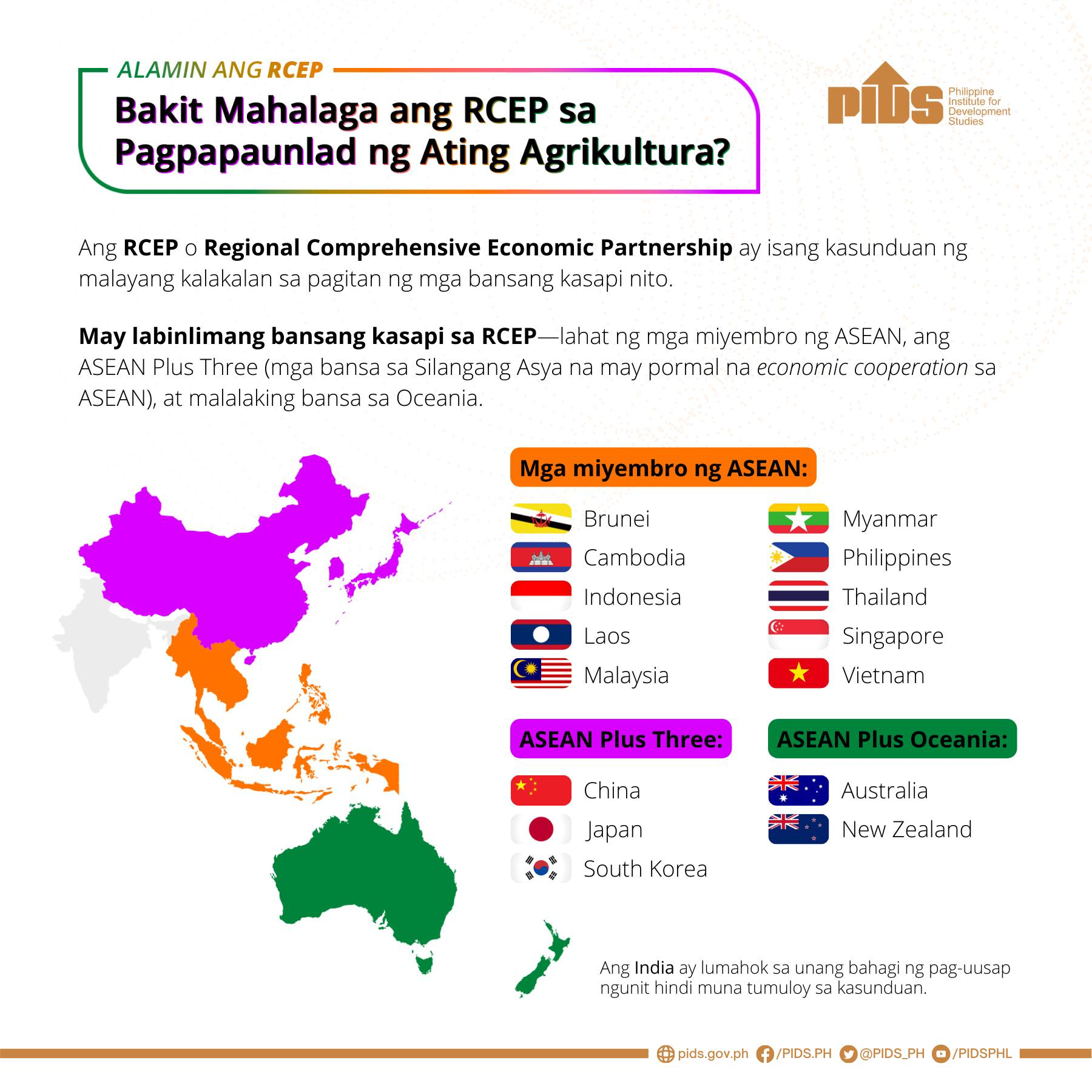

The Regional Comprehensive Economic Partnership agreement entered into force for some countries on January 1, 2022, paving the way for the creation of the world’s largest free trade area.

The RCEP took effect for countries which have ratified the agreement: Australia, Brunei Darussalam, Cambodia, China, Japan, Laos, New Zealand, Singapore, Thailand, and Vietnam.

The RCEP will enter into force on February 1, 2022 for South Korea

As for the remaining signatory states—Indonesia, Malaysia, Myanmar, and the Philippines—the agreement will take effect 60 days after the deposit of their respective instrument of ratification, acceptance, or approval with the Secretary-General of the Association of Southeast Asian Nations (ASEAN) as the Depositary of the RCEP Agreement.

After years of negotiation, ASEAN, Australia, China, Japan, South Korea, and New Zealand in November 2020 signed the RCEP.

According to data by the World Bank, the agreement will cover 2.3 billion people or 30% of the world’s population, contribute US$25.8 trillion or about 30% of global gross domestic product, account for $12.7 trillion or over a quarter of global trade in goods and services, and account for 31% of global foreign direct investment inflows.

The agreement encompasses several areas of cooperation and aims to achieve trade liberalization by eliminating 90% of tariffs within the bloc. While many tariffs will be abolished immediately, others will be reduced gradually during a 20-year period.

Delays equate to opportunities lost

In the Philippines, the Department of Trade and Industry (DTI) has been requesting Senate to concur with the ratification of the RCEP, saying the country’s non-participation or delay in participation “will cause disruption” in the country’s economic growth momentum.

DTI, in an earlier statement, said many economists and international organizations have stressed the importance of the RCEP agreement to the Philippines and to the region.

Economist Dr. Francis Quimba of the Philippine Institute for Development Studies (PIDS) said non-participation in RCEP will cause the Philippines to miss out on this opportunity to facilitate much-needed economic growth and recovery. He said the delay or non-participation to RCEP will lead to a 0.26% decline in real GDP for the Philippines.

Initial estimates by Quimba showed that while East Asian countries stand to benefit the most in terms of increase in exports as RCEP will be the first free trade agreement (FTA) among the three, the Philippines and Vietnam will gain the most in terms of real GDP due to lower trade costs and higher factory gate prices.

In the same vein, a study conducted by Dr. Caesar Cororaton, a research fellow at the Virginia Polytechnic Institute and State University and a visiting scholar at the De La Salle University, noted that the RCEP is estimated to improve the country’s trade balance by as much as $128.2 million, increase overall welfare by $541.2 million, contribute to a 1.93% real GDP growth, and lower poverty incidence by 3.62% in 2031.

An Asian Development Bank (ADB) study recognized that RCEP has a strong potential to mold regional trade and investment patterns well into the future and to influence the direction of global economic cooperation at a challenging time. RCEP effects on the region’s trade will also significantly deepen regional production networks and raise productivity. At the sectoral level, exports and imports of nondurable and durable manufactures will experience the most growth.

Better in than out

Some stakeholders, however, pointed out that the ADB study indicates marginal gains for the Philippines, with the country only seeing an incremental increase in real income of $3 billion by 2030 (or 0.39% growth) compared to China, Japan, and South Korea.

Trade Secretary Ramon Lopez explained it is understandable that East Asian countries see the largest increase in incomes as this will be the first time these three countries will have an FTA among each other.

“Prior to RCEP, there had been no FTA between China, Japan, and Korea which means there is no pre-existing preferential treatment on traded goods among them, and MFN [most-favored nations] rates are applied. The same can also be said with trade in services and investment where these countries do not accord special treatment to services and investments coming from the other two countries,” Lopez said.

Lopez added, “While the ADB study cited in the article states that the Philippines will see a small incremental increase in real income valued at only $3 billion by 2030, again this must be viewed in proper context. Note that Singapore has zero incremental income in the study with a growth rate of 0.05%; Brunei has 0.46% change in income but it has zero incremental income; Indonesia has 0.18% change in income yet it has $4 billion incremental income; and Vietnam has 0.97% change in income yet it has only $4 billion incremental income.”

Similarly, the United Nations Conference on Trade and Development (UNCTAD) in a recent study recognized that the “large potential of the RCEP agreement in creating trade for the member economies also implies that even for members that may initially be negatively affected by trade diversion effects, it is better to be in than out the RCEP agreement. Not only because being part of the deal creates additional trade that may offset the losses, but because it strengthens economic integration and the benefits that may come with it, such as foreign direct investment, technology sharing, structural transformations, among others.”

According to the UNCTAD study, RCEP tariff concessions may result in lower exports for Cambodia, Indonesia, Philippines, and Vietnam due to negative trade diversion effects, as some exports of these economies are expected to be diverted to the advantage of other RCEP members because of differences in the magnitude of tariff concessions.

Trade Assistant Secretary Allan Gepty, the Philippines’ lead negotiator for the RCEP agreement, explained that while the assumptions and estimates on the benefits of RCEP to the Philippines vary, studies consistently show the Philippines will indeed benefit from the RCEP.

“Figures may be higher or lower depending on the assumptions and models used, but an improvement in real GDP, no matter how small, is always a welcome development, especially as we seek to reverse the economic slump we’ve experienced due to the pandemic,” said Gepty.

PH remains on sidelines as RCEP takes effect in 10 countries