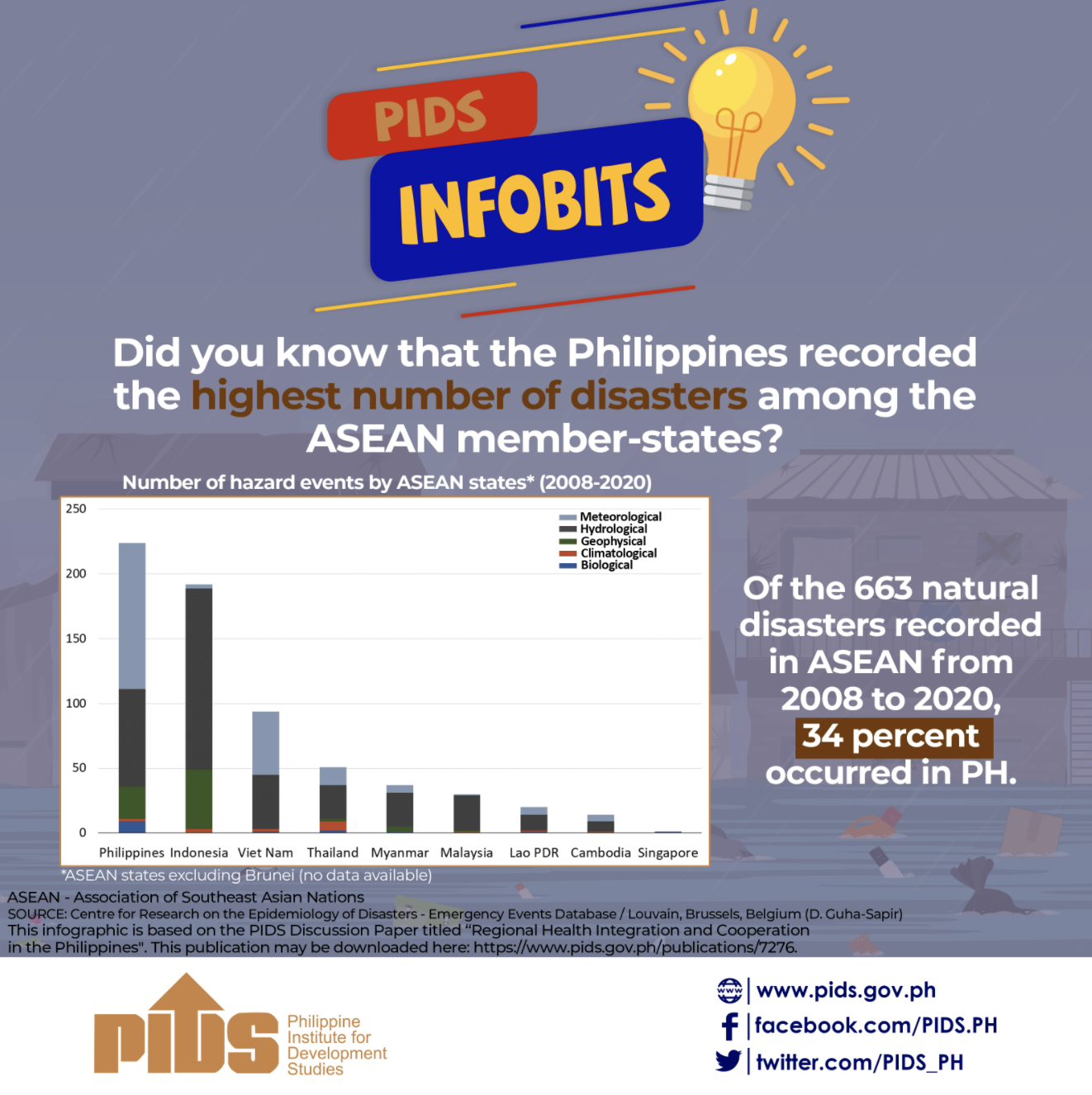

Studies find increasing frequency, intensity, and impacts of natural disasters, especially as they interplay with the negative effects of climate change, environmental degradation, and rapid urbanization. The financial implications could be massive, especially in terms of damages on private assets, public infrastructure, and on the productive agents of the economy. Various estimates show that the magnitude of damages and losses on economies could hover around a fraction of one percent to a tenth of GDP, depending on the degree of exposure.It is quite common that individual governments bear most of the cost of disasters, especially in emerging economies where the private sector and the capital markets are not fully developed. The available resources within governments are mostly insufficient to address the cost of response, rehabilitation, and reconstruction, which could result in adverse impacts on the overall fiscal and macroeconomic condition of the particular economy. On top of that, the burden on the society, particularly the poor, is prolonged by the inability to deliver services due to the financial constraints resulting from a disaster.As such, there is a need to improve the current system of financing the cost of disasters in a manner that would enhance the roles of the domestic private sector and international financial market. In addition, in this age of globalization and close interconnectedness, disasters tend to carry risks that cross borders, calling for a greater and more concerted global/regional effort. The paper proposes to expand the prevailing regional cooperation within APEC toward improving access to finance for disaster recovery and reconstruction and taking a more proactive approach to risk financing. Regional cooperation is seen as a mechanism to promote the development of financial systems and products to effectively reduce the fiscal burden arising from disasters, as can be gleaned by looking at the experiences of other economies in this regard.